For anybody who’s been watching the markets a while, it’s odd to think of Apple as a laggard. And yet, since the Cupertino, Calif., megalith reported earnings on Oct. 25, this is what we’ve seen. (Chart starts with the closing price the day before Apple reported.):

Granted, that’s just over the last couple weeks, and Apple is still far outpacing the broader S&P 500 stock index this year. (It’s up 47%, vs. the S&P’s 12%.)

But with its giant market capitalization—more than $563 billion—Apple has an outsized influence on broad stock market indexes such as the S&P, which are weighted by market cap. That means bigger companies have a much larger impact in those broad benchmarks than smaller companies.

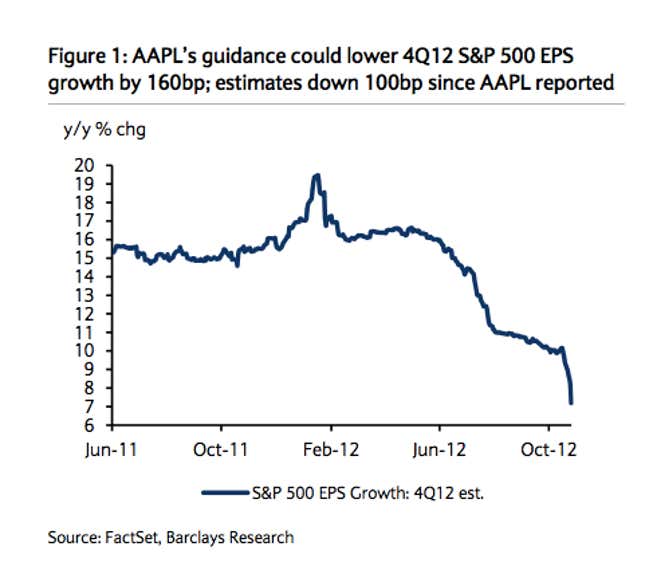

Case in point: Apple currently accounts for about 5% of the S&P 500’s earnings per share, according to Barclays analysts. So when Cupertino disappointed stock market analysts by announcing lower-than-expected guidance for next quarter, it forced a massive rethinking of the earnings profile for the entire index. Here’s a great chart showing the phenomenon, courtesy of Barclays:

So what does this mean? It means that even if the economy shows signs of traction and a lot of small companies are doing better than expected, much of that improvement—at least from the perspective of stock market performance—is going to get swamped out if Apple shares continue to be weak. (Quartz’s Christopher Mims thinks that’s likely.)

Should you care? If you own a plain-vanilla S&P index fund, you definitely should. Managers of those funds have to be careful to make sure that the stocks they own match the makeup of the index. As a result, as Apple’s market value has been exploding higher in recent years, becoming a bigger share of the index, those fund managers have been forced to buy more and more of the stock—with your money.

This is the big criticism of the index funds that everyone is encouraged to buy. Owning an index fund essentially means that you are buying more and more of a stock as it gets more and more expensive. That is the very opposite of what “value investors” like Warren Buffett would do.