Obama hints at more regulation to prevent US banks backsliding to their old risk-happy ways

US president Barack Obama sent a clear message to the US banking community today: I’ve got my eyes on you.

US president Barack Obama sent a clear message to the US banking community today: I’ve got my eyes on you.

Speaking during an interview which aired today on America Public Media’s “Marketplace,” Obama suggested that US financial watchdogs need to continue to rein in risk-taking in the banking sector. That’s despite the industry wading through a morass of new regulatory rules under the 2010 Dodd-Frank financial reforms, which are still being rolled out.

Obama expressed a worry that even after emerging from a crisis that rocked the global economy to its very core, banks have gone back to their old wheeling-and-dealing risk-taking ways:

Now, it’s a great strength of our economies that we’ve got the deepest, strongest capital markets in the world, but what has also happened is that as the financial sector has grown, more and more of the revenue generated on Wall Street is based on arbitrage—trading bets—as opposed to investing in companies that actually make something and hire people. And so, what I’ve said to my economic team, is that we have to continue to see how can we rebalance the economy sensibly, so that we have a banking system that is doing what it is supposed to be doing to grow the real economy, but not a situation in which we continue to see a lot of these banks take big risks because the profit incentive and the bonus incentive is there for them. That is an unfinished piece of business, but that doesn’t detract from the important stabilization functions that Dodd-Frank were designed to address.

A spokesman later tempered the president’s remarks, noting that no new bank rules are in the offing. However, the banking sector has plenty of reason to fret that there may be stiffer regulations afoot, or at least a stricter interpretation of some of the Dodd-Frank rules still to be implemented.

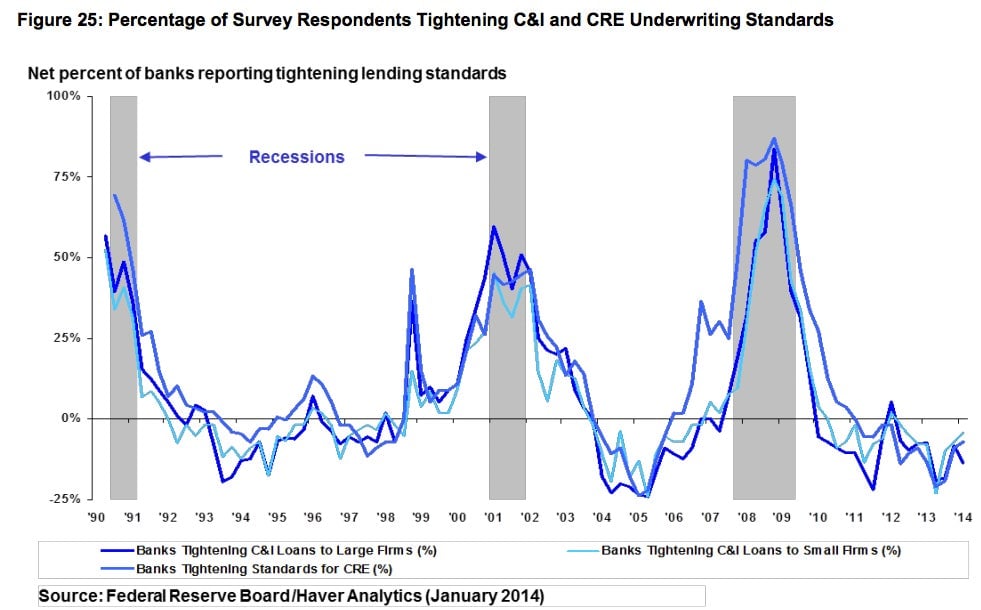

Obama’s tough talk is coming as other regulators also are expressing concerns that conservative lending practices adopted in the immediate fallout from the financial crisis are now slipping. The Office of the Comptroller of the Currency has said it is worried about flagging underwriting standards in the origination of car loans and other debt. Leveraged lending, in which banks lend to already heavily indebted companies, also is on the regulators’ radar.

Banks also have been ramping up their lending to small companies over the past several years in an area known as commercial and industrial lending. This kind of lending could actually be perceived as a good thing that contributes to building the overall economy, but lending standards there are sliding as well, as the below OCC chart highlights:

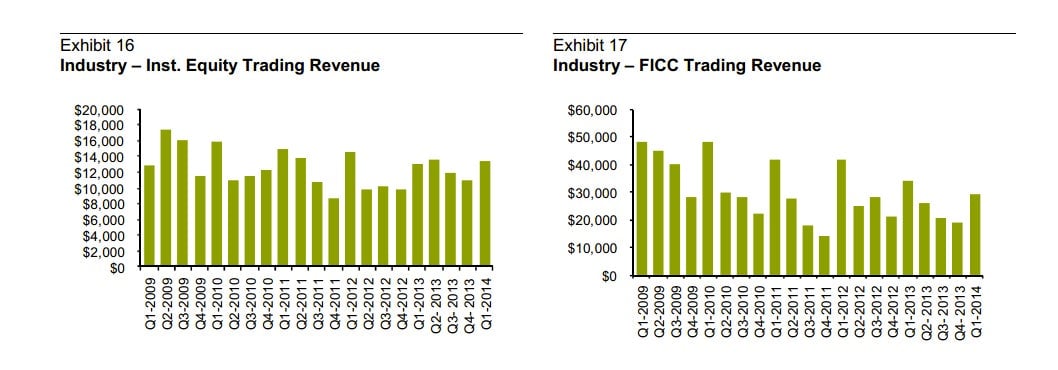

Obama’s comments specifically seemed to put a spotlight on bank trading practices. That may seem curious considering that the banking industry has lately bemoaned the slump in trading that has gripped the market for the past few years. Goldman Sachs, Citigroup, JPMorgan Chase, among others, have encountered double-digit shrinkage in trading revenues. And many of those dour results are a function of regulations limiting trading risk, including the Volcker rule, which is meant to bar certain kinds of speculative bank bets. The rules have resulted in a number of banks (and quite a few European financial institutions) opting to retrench in trading.

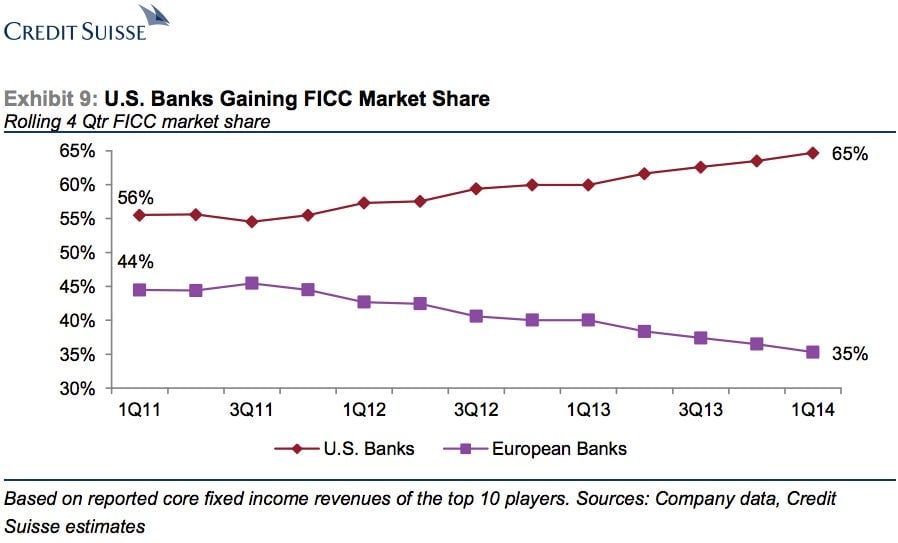

It’s unclear how long this trading slump will last. But US banks appear to be betting that it won’t be for long, because they are grabbing an even larger share of risky trading businesses, like fixed income, currencies, and commodities from their European rivals.

Times are rough now. But President Obama, and perhaps other regulators, may be worried that US banks are just biding their time until they can return to the risks and rewards of the halcyon days that preceded the crisis.