US regulators have bubbles on the brain.

No sooner has the US banking system emerged from the hair-raising 2008 credit bubble (mostly in funky mortgage-backed securities) than regulators are looking into others. This time financial overseers, primarily at the Office of the Comptroller of the Currency (OCC), are worried about risky car loans, according to a report released by the OCC yesterday (pdf). They’re also concerned about leveraged lending, which (as we recently explained) is basically loans to companies that already have a lot of debt.

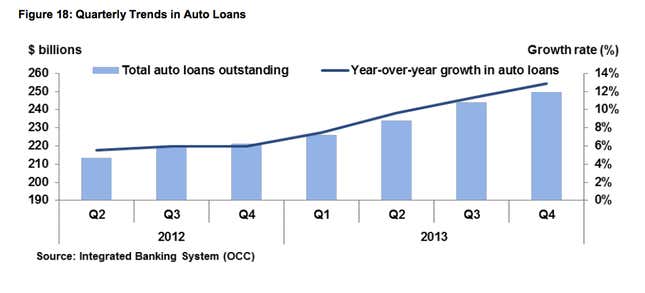

The growing risk in the banking system isn’t exactly a secret. But the OCC’s statements yesterday offered the most detailed explanation around why regulators are wringing their hands. One of their worries is a decline in underwriting standards by banks (something we’ve highlighted in small business lending), which means that the loans could be more prone to going bad. Here’s a chart the OCC used to highlight the rapid growth in auto lending since the start of last year:

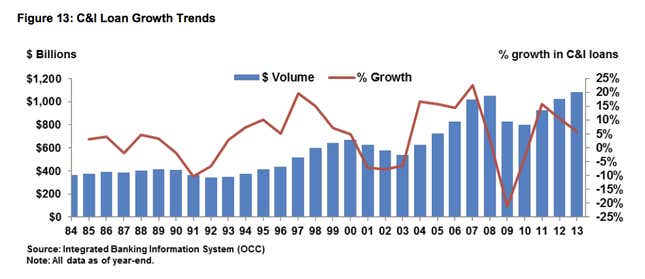

Meanwhile commercial and industrial (C&I) lending—the bulk of which is to small and medium-sized businesses—has also been on a relatively steady rise:

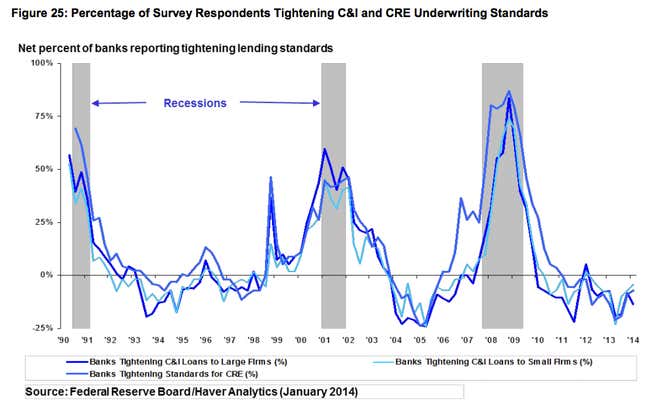

That’s as standards in underwriting have been dropping. As we can see in this OCC graphic, banks tend to make it harder for borrowers to obtain loans during weaker economic times, but loosen their standards in better times:

Part of the reason for this troubling set of trends is that banks are scrambling to offer loans that can deliver richer returns for them, especially as other areas of their businesses have been slumping, such as trading and mortgage underwriting. Banks also are facing greater competition from various kinds of non-bank entities that can offer loans but aren’t as tightly regulated—which is one of the things prompting banks to loosen their own lending standards. Here’s what the OCC had to say about competition:

Competition is resulting in eased underwriting across a variety of products. Weakening standards are particularly evident in indirect auto and leveraged lending; however, some easing in underwriting and increased risk layering are also occurring in other types of commercial loans.

There’s no reason to think that banks are in serious jeopardy yet. But the fact that regulators are pointing to these areas shows they’re either really concerned, or applying an overabundance of caution in order to avoid the next crisis. The latter explanation would make sense, given that the OCC and other regulators missed banks loading up on risky debt in the lead-up to the 2008 crash. But perhaps better safer than sorry.