Line’s IPO will finally put a real value on messaging apps

It’s been hard for investors and other tech players to put a firm value on one of the fastest-growing area of the consumer internet, social-messaging apps like WhatsApp and Line. In February, Facebook said it was paying $19 billion for WhatsApp, a price many found risibly high. Japanese e-commerce giant Rakuten bought Viber—a similar app— around the same time for $900 million. The other top social messaging apps are either owned by a huge listed parent company such as Tencent or in private hands.

It’s been hard for investors and other tech players to put a firm value on one of the fastest-growing area of the consumer internet, social-messaging apps like WhatsApp and Line. In February, Facebook said it was paying $19 billion for WhatsApp, a price many found risibly high. Japanese e-commerce giant Rakuten bought Viber—a similar app— around the same time for $900 million. The other top social messaging apps are either owned by a huge listed parent company such as Tencent or in private hands.

The market is finally going to have a say, though. Line has now reportedly filed for an IPO on the Tokyo stock exchange.

With analysts estimating Line’s market valuation at more than ¥1 trillion ($9.84 billion), its public debut is expected to be one of Japan’s biggest offerings this year. A person familiar with the matter, according to the Wall Street Journal, says it will likely also file a listing in the New York Stock Exchange as early as this fall. Line is based in Japan but owned by Naver Corp, the South Korean search portal company.

While Line hasn’t disclosed its profits, the company has said that first-quarter revenue was ¥14.6 billion yen ($144 million), more than three times what it had a year ago. Line derives a large portion of its revenue from in-app games. It also makes money when users purchase virtual items like cartoon stickers in the app and charges companies and celebrities who want to send out messages to users, much like promotional advertising.

This chart, from Line’s most recent published revenue figures, provides a sense of how rapidly it has been growing:

How does that stack up against its competitors? Line reported full-year revenue of $338 million in 2013, compared to $203 million for KakaoTalk and $243 million for Twitter. WeChat said its fourth-quarter 2013 earnings were between $32 and $48 million, which compares to $120 million for Line.

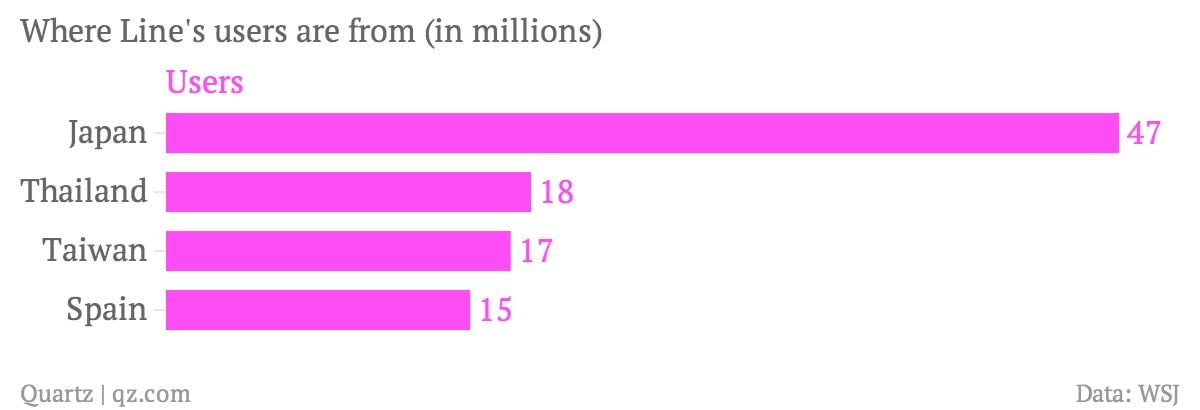

Although Line is based in Japan, a huge chunk—80% of its 480 million registered users—comes from overseas.