General Electric got mired in the risky business of consumer credit cards and car and home loans—and now it’s steadily pursuing an exit.

The industrial conglomerate does the bulk of its lending through its finance arm GE Capital–a lending entity so formidable that US regulators deemed it systemically important. Back in 2008, GE Capital represented half of the company’s earnings.

CEO Jeff Immelt has lately been pushing to break GE’s dependence on its finance arm and beef up the component of its business that builds things like components for aircrafts, energy plants, and wind turbines as well as medical devices.

“We are boldly reshaping the company,” Immelt said during a call to discuss the company’s second-quarter results Friday. Immelt has said that he wants to reduce GE Capital’s share of the company’s overall revenue to somewhere around 25% or 30%, from the 43% currently. GE’s recent $17 billion agreement to buy Alstom’s energy business helps to that end by widening the company’s international energy footprint.

The planned spinoff of GE’s retail financing business, Synchrony Financial, by way of an initial public offering, is part of that grand plan. GE announced the IPO plan to unload the $20 billion retail finance business is on track as it disclosed second-quarter profits rose by 13% (paywall) driven by its oil and gas and jet engine businesses.

Synchrony Financial–the name for the retail-finance activities GE plans to list–is a profitable lending arm within GE Capital’s larger lending franchise, comprised mostly of credit-card receivables. GE plans on floating about $3.1 billion shares of Synchrony in the market starting late July.

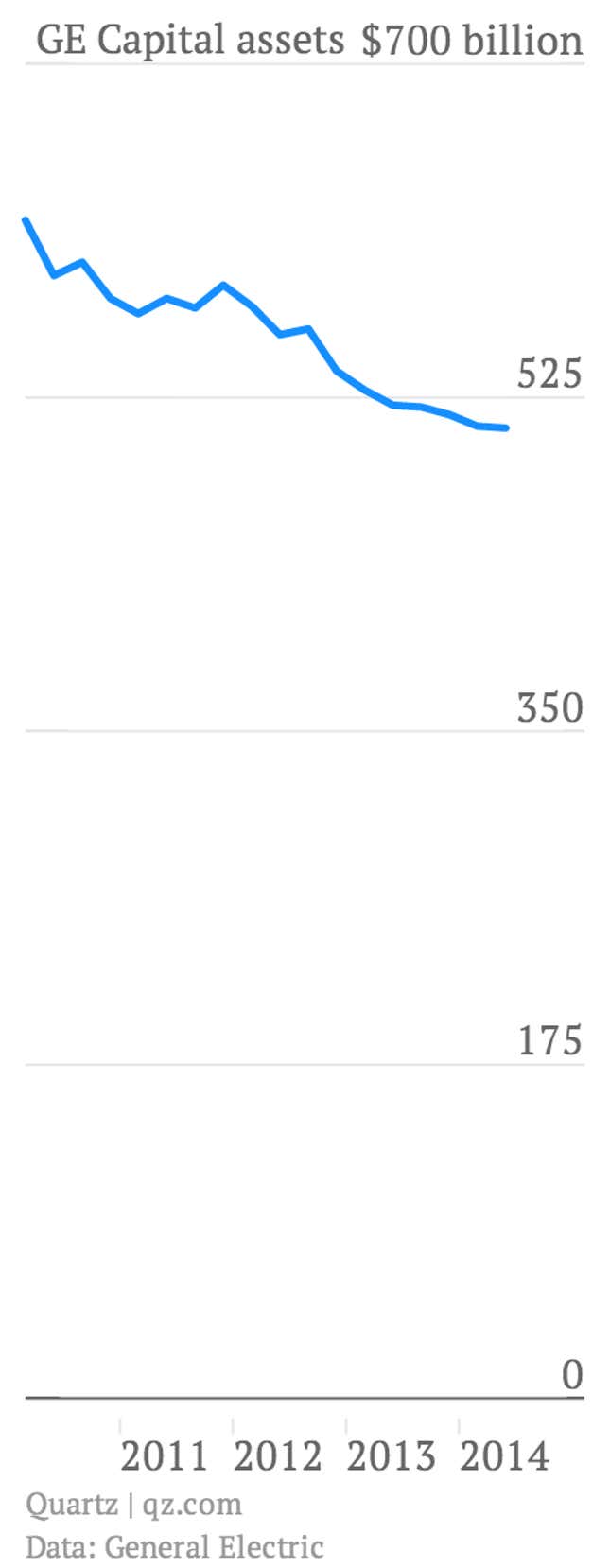

GE already has reduced its finance arm’s assets by about 18%, or $109 billion, over the past four years, and the spinoff will continue that steady shrinkage.