Bring on the regulatory scrutiny. That’s the message that CIT Group’s CEO, John Thain, has sent to the US government. CIT Group just bought itself much closer oversight by US regulators as a result of its planned $3.4-billion merger with the parent company of the California regional bank OneWest Bank.

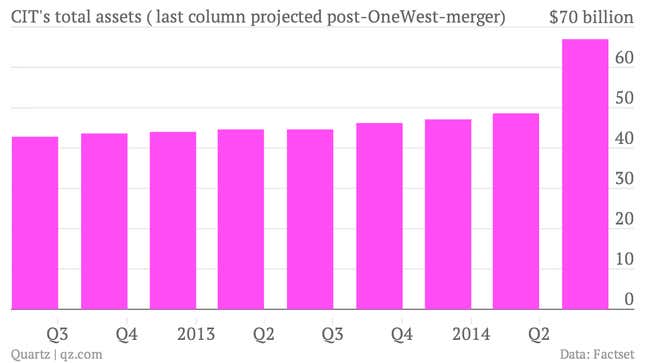

The acquisition, announced today, catapults the lender, which filed for bankruptcy in 2009 in the aftermath of financial crisis, into a new realm. It will go from being a lender to small and mid-sized companies that held about $48 billion in assets at the end of the first quarter this year, to a much bigger bank with total assets of roughly $67 billion.

That jump in total assets brings with it the burden of greater scrutiny from regulators, because any US bank maintaining at least $50 billion in assets is considered a “systemically important financial institution” (SIFI) and therefore has to subject itself to a host of tougher regulatory requirements, including bank stress testing by the Federal Reserve. CIT has until now hovered below that threshold.

The CIT merger comes as the lender reported solid second-quarter earnings of $246.9 million, up 34% compared to the same period last year.

Merger activity among US banks has been scarce lately for precisely this reason: Financial institutions in the wake of the 2008 financial crisis have been loath to trigger more regulator oversight, which some bank officials have argued translates into greater compliance costs.

Bank officials have complained about the 50-billion threshold, which was established as a part of the Dodd-Frank regulatory reforms which had their four-year anniversary yesterday. Here’s what one bank official told the Wall Street Journal about the cut-off:

“Fifty billion dollars is almost ridiculously low to be subject to these regulations,” said Camden Fine, CEO of the Independent Community Bankers of America. “A $50 billion or even a $70 billion bank should not have to jump through those hoops.”

Regulators also have appeared reluctant to approve multi-billion dollar bank deals. For example, the $3.7-billion merger of the regional banks Hudson City Bancorp and M&T Bank has been under review for the past two years. It’s unclear if CIT executives will find an easier path toward closing, but CIT executives have said they hope to get the green light for the deal by the middle of next year.

Part of the motivation for the OneWest merger is Thain’s plan to diversify CIT Group’s lending by giving it more access to a retail deposits (it will grow to $28 billion in deposits once the merger is complete, from $23 billion in the first quarter).

Thain, who was the CEO of then-troubled Merrill Lynch until it was acquired by Bank of America during the height of the financial credit storm, was named the top boss of CIT Group four years ago. He has been vocal about wanting to grow CIT’s assets and deposits in one fell swoop, even if that means tougher regulations.

On Wall Street, however, it’s wise to be careful what you wish for.