Hydraulic fracturing—the oil drilling technique that unlocks oil and gas tightly trapped in rock formations—has been a recent bonanza for the US, creating economic growth, cheap fossil fuels and even changing the way the earth looks from space. But is it going to last?

Critics looking at the money pouring into oil exploration, the growing political concern with greenhouse gasses and climate change, and the challenge of renewable energy are starting to wonder if this is really a sustainable development or a temporary bubble that, in a worst case scenario, could end in tears for companies with big investments in expensive oil drilling operations and exploration.

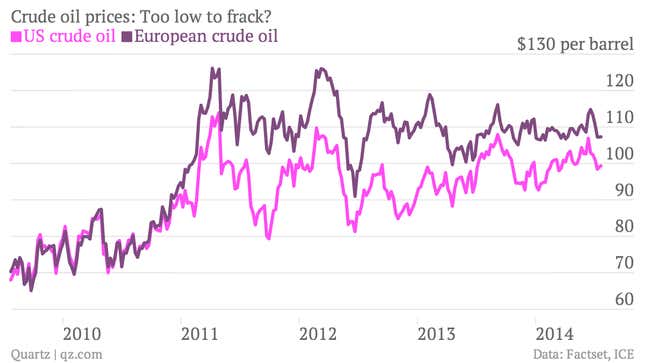

You can see in the chart below how, in 2011, the spread between future prices of West Texas Intermediate crude oil and Brent crude oil, the US and European price benchmarks, began to diverge as tight oil production in places like the Bakken Shelf in North Dakota and Eagle Ford in Texas ramped up:

But while the explosion of new productivity has kept average prices below the pre-recession in 2008, it hasn’t been enough to bring down the cost of oil to the $40-a-barrel costs of just a decade ago. That has Mark Lewis, an energy analyst at Kepler Chevereux, believing the market is tighter than many who think energy is abundant, and potentially vulnerable to shocks coming from several directions. Those vulnerabilities depend on the following:

Tight oil just gets tighter. Tight oil production requires constant investment in new drilling and equipment; the average well at Eagle Ford will produce 40% less oil in its second year of operation. To run on this “capex treadmill,” as Lewis puts it, companies have been relying on the cheap cost of capital, but that won’t last if the Federal Reserve tightens monetary policy soon. According to the International Energy Agency, North America provides about 18% of the world’s fossil fuels but 50% of upstream capital investment, a disparity that Lewis calls “staggering.” That means oil producers might not be able to sell their products at a profit, even when oil prices are high. The tribulations of Chesapeake Energy, which turned to fraud after a glut of natural gas made its investments unprofitable, could be a warning.

Governments shrink oil demand. It’s unlikely that the world’s nations will agree on a compact to reduce carbon emissions drastically enough to limit increases in the average global temperature to 2° Celsius. But governments may still take other actions that lower oil prices. Carbon pricing schemes, emissions limits and investments in renewable energy could all push oil prices down in future; if currently planned policies take effect, the IEA says oil will cost $128 a barrel in 2035, and could reach $100 if the strictest possible measures to enforce climate change goals are enacted. That rock bottom estimate isn’t likely, but the cheaper oil is, the less it makes sense for fracking—which breaks even at prices of $85 a barrel or more, depending on the specific geology at play.

Political uncertainties are resolved. As the Telegraph’s Ambrose Evans-Pritchard notes in a column on this topic, two major producers of cheap oil, Iran and Libya, are largely cut off from the oil markets, while two others, Iraq and Syria, are caught up in civil war. If the latter two find some kind of political accord or the former two come back into line with stability returning in North Africa or Iran making a nuclear deal, prices will fall.

High oil prices lead to other energy investments. The price debate is a double-edged sword for fossil fuel companies: While rising prices have made fracking profitable and convinced oil companies to explore expensive arctic and deep ocean reserves, they have also made investments in renewable solar and wind energy much more feasible.

While the boom in tight oil production has been a major factor in recent supply increases, he expects that production will drop as the economics of extraction change—and that drop off “could be very precipitous,” leaving big companies facing write-downs on bad assets.