The billionaires set to get even richer on the dollar-store mega-merger

The American discount retailers known as “dollar stores” help many working families stretch their paychecks for household supplies. And they may be an even better deal, it turns out, for billionaire activist investors.

The American discount retailers known as “dollar stores” help many working families stretch their paychecks for household supplies. And they may be an even better deal, it turns out, for billionaire activist investors.

That appears to be the case in the planned $9.2-billion merger of the discount retailers Dollar Tree and Family Dollar, announced today. The merger would create a $18-billion giant selling to mostly low-income customers, offering them everything from knickknacks to home cleaning products to foods and beverages. The deal is likely to line the pockets of a bevy of well-heeled activist investors, who have been campaigning for the sale of Family Dollar for the past several years.

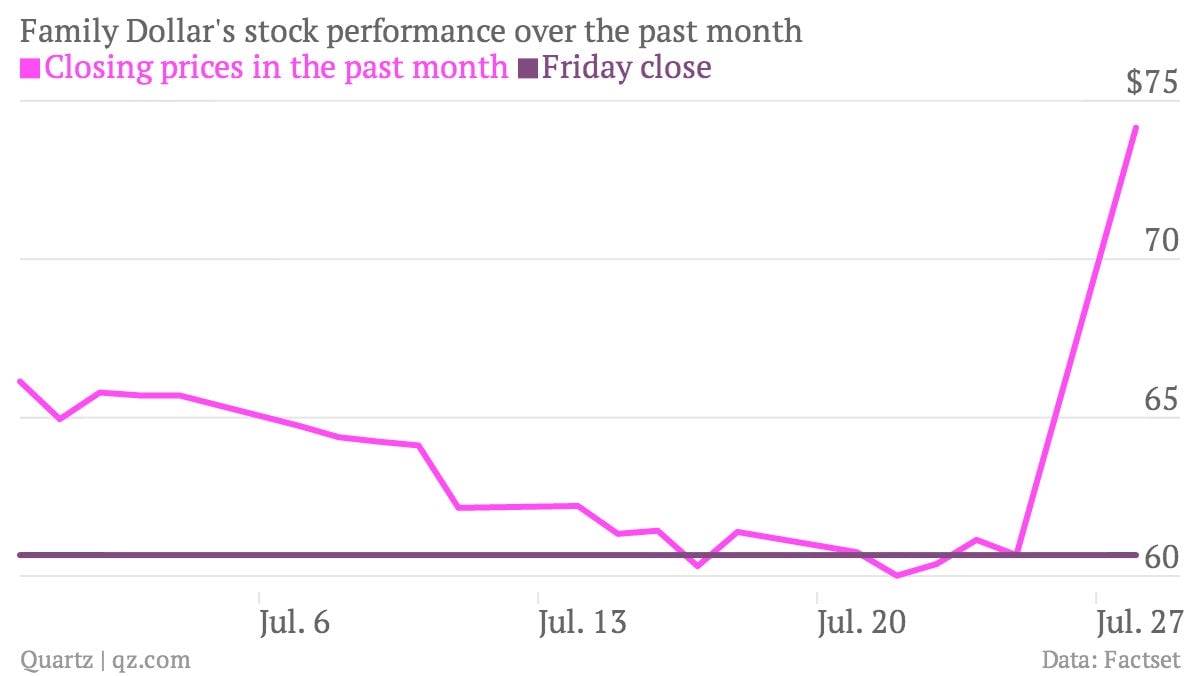

At $74.50 a share, Dollar Tree’s offer to purchase Family Dollar represents a 23% premium on Family Dollar’s $60.66 closing price on Friday.

Most of Family Dollar’s largest shareholders are deep-pocketed billionaires–three out of the four, in fact. One of the most prominent of those is the billionaire Carl Icahn, who has reported accumulating a 9.4% stake in the discounter, and has been pushing for a sale of the company since last month (paywall).

Typically these sophisticated investors accumulate stocks via options, so it’s hard to know exactly what sorts of returns they may garner, but based on the stock price, Icahn would be looking at making roughly $150 million from his stake if the deal goes through. The activist investor Nelson Peltz, who owns Family Dollar shares via his investment fund Trian Fund Management, is in line to make about $116 million from his 7.4% stake, while another billionaire investor, John Paulson of Paulson & Co., may score about $100 million from the deal.

Peltz’s interest in Family Dollar has been a fairly long-running one. Peltz has been trying to force the company’s sale since back in 2010, when his fund Trian made its own unsolicited offer for Family Dollar in an effort to spur competing bids. Peltz would later rescind that $7.7-billion bid, in exchange for a seat on Family Dollar’s board.

Icahn’s activism may have garnered him the biggest relative bang for his buck, given that he has only been invested in the company for a little over a month.