For sale: One Portuguese bank—some solvency issues, fixer-upper opportunity

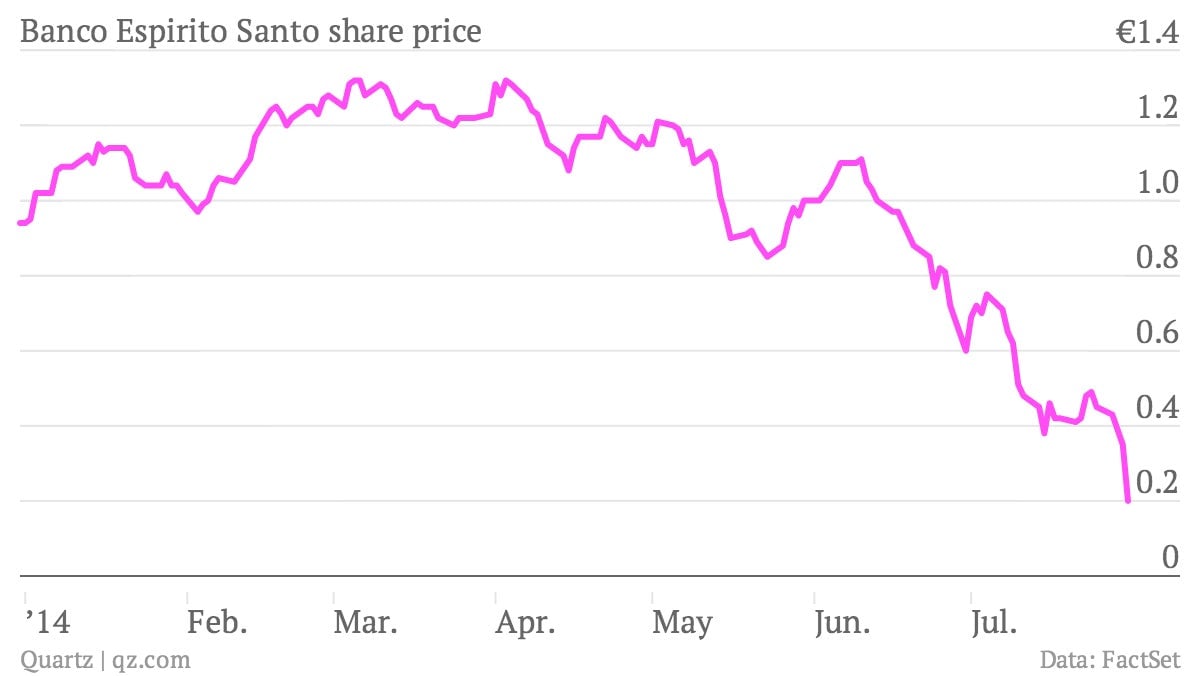

A piece of Banco Espírito Santo, Portugal’s largest listed bank, can be yours for the low, low price of just 20 euro cents per share (or best offer). That’s 80% off the price at the start of the year.

A piece of Banco Espírito Santo, Portugal’s largest listed bank, can be yours for the low, low price of just 20 euro cents per share (or best offer). That’s 80% off the price at the start of the year.

Price drop!

New and improved!

Now under new management, the bank is putting past unpleasantness behind it. Yes, it just reported a €3.6 billion ($4.8 billion) loss in the first half of the year, the largest in Portuguese corporate history. Yes, the loss destroyed the bank’s capital buffer, “jeopardizing the compliance with the minimum solvency ratios,” according to the central bank. Yes, there are problems at the bank’s Angolan unit and possible fraud by former managers, including unvetted letters of credit kept away from the bank’s normal accounting system and only recently discovered by the new regime.

But a new supervisory committee comprised of PricewaterhouseCoopers professionals is now keeping a close eye on things, and the voting rights held by the cash-strapped holding companies of the Espírito Santo family empire, from which the bulk of the bank’s loan losses derive, have been suspended. As far as the capital hole goes, it’s nothing that a few billion euros won’t fix (paywall).

That’s where you come in.

If the bank can’t raise enough capital from private sources, the government may need to bail it out with some of the €6.4 billion it has set aside for such contingencies. But Banco Espírito Santo boss Vitor Bento says “both shareholders and potential investors have shown interest in participating in a capitalization plan, some of them willing to take relevant stakes in the bank.”

Will you be one of those buyers?

Try to ignore that the investors who pumped €1 billion in fresh capital into the bank just last month are now sitting on 70% losses. Lightning never strikes twice, right?

Act now!

Behind every problem lies an opportunity. This is a 145-year-old institution with a 20% market share in an economy that is more or less on the mend. And who doesn’t like a sweet deal on a fixer-upper? This bank is priced to move!