More money, more options.

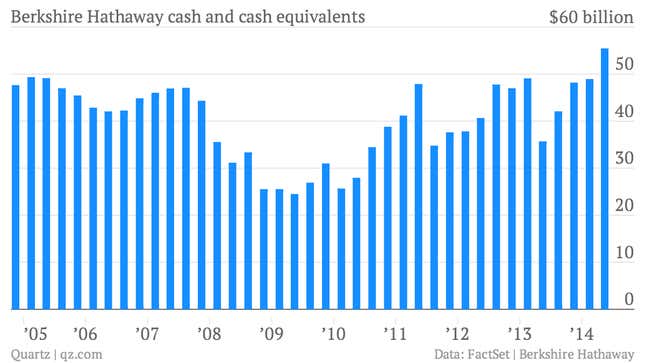

Warren Buffett’s Berkshire Hathaway has seen its cash pile grow to heretofore unseen heights in recent months, with cash and cash equivalents reaching more than $55 billion in the quarter that ended on June 30, the company reported on Friday. That’s up 55% compared to second quarter of 2013.

As we’ve noted before, during the global financial crisis and the market meltdown and recession that followed, Buffett was buying big, using cash to make a string of giant deals. He snatched up preferred shares in traditional rock-solid companies like Goldman Sachs and General Electric. (Though they looked anything but solid during the crisis.) He also made Berkshire’s largest ever acquisition, the $26.7 billion purchase of the Burlington Northern Santa Fe railroad.

Those deals were possible because Berkshire had an ample supply of “dry powder,” as investors call the cash that can easily be spent on big deals.

“It’s been an ideal period for investors: a climate of fear is their best friend,” Buffett wrote in his annual shareholder letter recounting the story of 2009, when the company’s cash balances fluttered around recent lows of around $26 billion.

A similar dip in Berkshire’s cash came in late 2011, as the company announced large investments in chemical maker Lubrizol and Bank of America. And the cash pile declined in 2013, as Berkshire invested in American ketchup giant Heinz.

But as the mood of the financial markets improved in recent years, it’s been tougher to find the deals that are the foundation of Buffett’s value investing strategy. (Value investors emphasize buying assets that are significantly undervalued because of market conditions, and then holding those investments for long periods of time.)

Buffett has said that the company will keep a cushion of about $20 billion in cash. The amount in excess of that level is available for deal-making. Buffett is merely rebuilding his supply of dry powder and waiting for the buying opportunity the market might offer.