Australia’s ‘miracle’ economy now looks much less miraculous

Australia hasn’t had a recession since the early 1990s, thanks to an economy ever-more focused on digging stuff out of the ground and selling it to the industrial behemoth that is China.

Australia hasn’t had a recession since the early 1990s, thanks to an economy ever-more focused on digging stuff out of the ground and selling it to the industrial behemoth that is China.

Still, all is not perfect in the land of Oz.

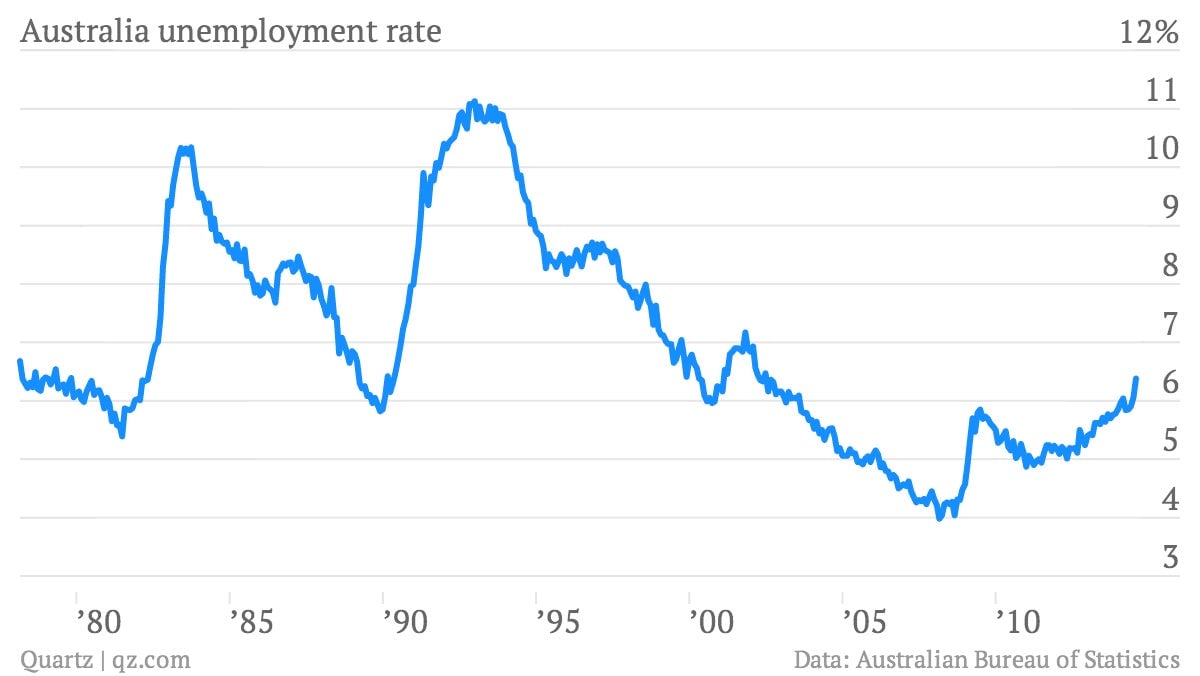

To wit, unemployment shot up to 6.4% in July, the highest level since 2002.

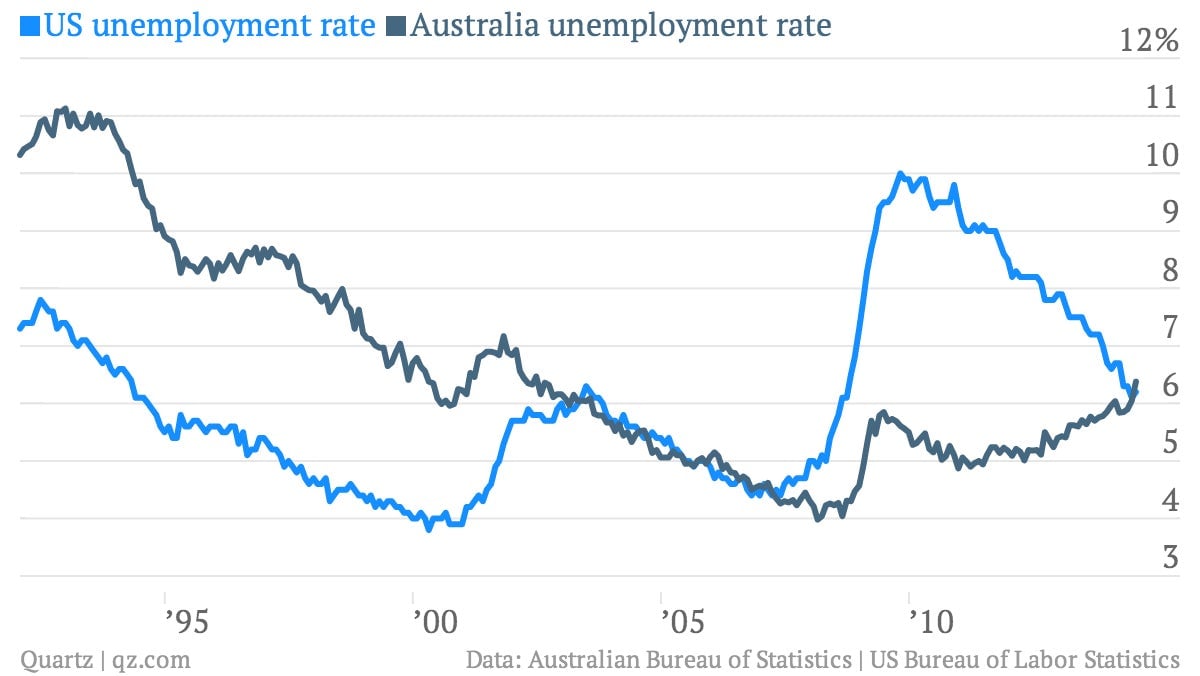

Some have been pointing out the fact that Australia’s unemployment rate has risen above that of the US. (Though it’s generally a no-no to compare unemployment rates from different countries, as they often have wildly different methodologies.)

At any rate—pun intended!—the reason for the uptick in joblessness is fairly clear: a slowdown in China has dampened activity in Australia’s crucial commodities sector. With some ups and downs, iron ore exports have gone roughly nowhere since late 2011. (That’s a huge change from the explosive growth the mining sector experienced the previous decade.)

On the domestic front, a spending cuts and tax increases introduced by Prime Minister Tony Abbott in a tough May budget hurt consumer confidence for a bit, but things seem to have stabilized.

And the help seems to be on the way, amid what amounts to a broad-based push by Chinese policymakers to get the economy moving again. A mini-stimulus centering on railroad construction will require plenty of steel, of which Australia supplies the main ingredient. Giant miner Rio Tinto spot-lighted record iron ore sales in Australia’s Pilbara region in its earnings today and a has generally robust outlook for Chinese demand, premised on Beijing getting its debt-based economic engine running strong. “We are seeing an easing of credit in the first half of this year,” Rio Tinto executives today analysts on a conference call today.

In other words, it looks like Australia’s economy will be able to ride the dragon a bit longer.