Despite regulatory probing, banks’ “dark pool” trading venues are doing just fine

The dark waters are rising.

The dark waters are rising.

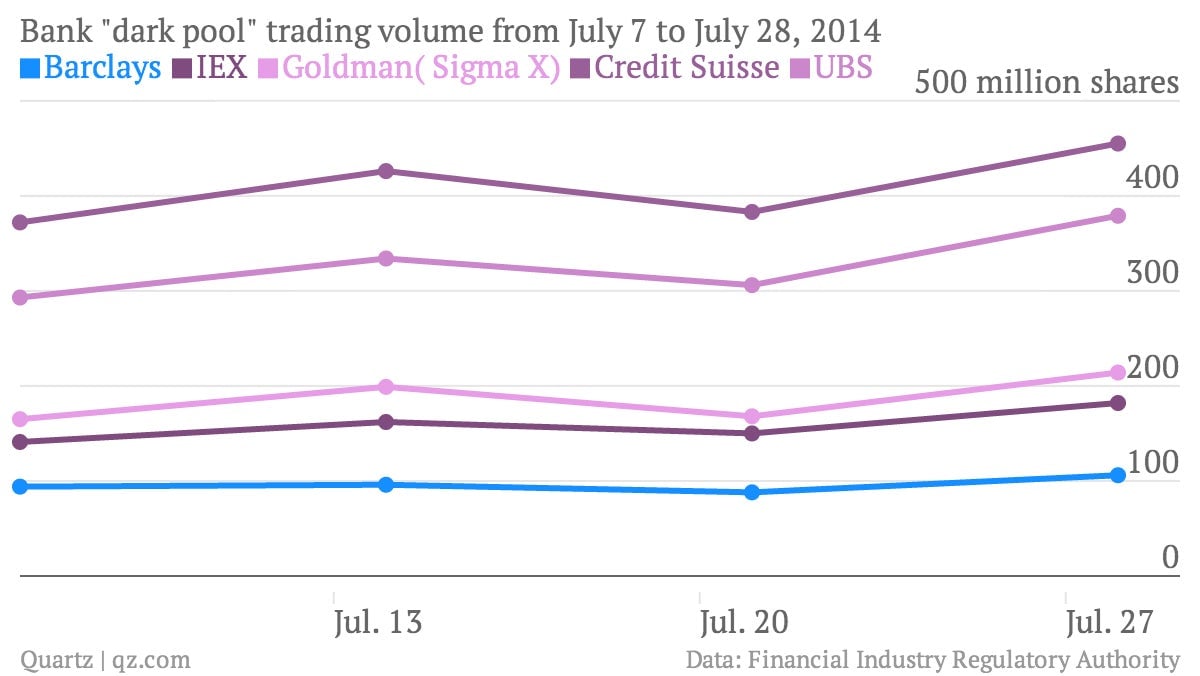

Trading volume in some banks’ secretive trading venues, known as “dark pools,” is seeing increased activity. That’s despite the fact that many of these so-called dark pools, which allow big investors to exchange large blocks of shares anonymously, are currently facing heightened scrutiny and legal challenges from financial watchdogs.

New York Attorney General Eric Schneiderman began ratcheting up the regulatory heat on bank-operated dark pools months ago. In late June, he filed a suit against Barclays’ dark pool, in which he alleged that the UK bank’s trading venue favored high-frequency trading clients, who employ lightening-quick computers to execute trades, over regular customers. Barclays has argued that the suit isn’t justified.

After an initial drop in trading volume following the news of the suit, Barclays’ dark pool appears to shrugging off any lingering fallout:

According to data from the Financial Industry Regulatory Authority, which began releasing select weekly trading data on dark pools last month, Barclays trading volume is up 20% at 106 million shares, compared to 88 million recorded on July 21. Barclays’s dark pool trading volume is up 13% since Finra began releasing data on these opaque trading platforms. But it’s not just Barclays. Goldman Sachs’ dark pool volume is up about 30% since July 7; Credit Suisse is up 22%; and IEX Group—made famous by Michael Lewis’s controversial book on trading, Flash Boys, and designed to thwart high-frequency trading algorithms—saw volume jump 30%.

Why dark pool trading volume is spiking despite mounting questions around the integrity of these platforms isn’t clear. Maybe secrecy in trading trumps security.