The result of years of relentless Fed money creation: a strengthening dollar

It’s funny. For years folks have been screaming that the Federal Reserve’s effort to support the American economy in the wake of the Great Recession would be the death of the US dollar, ending in hyperinflation and prompting global investors to dump US government debt. They been wrong. Inflation remains quite low. Investors are still paying incredibly high prices for US government bonds. And, in fact, the US greenback remains a bastion of strength.

It’s funny. For years folks have been screaming that the Federal Reserve’s effort to support the American economy in the wake of the Great Recession would be the death of the US dollar, ending in hyperinflation and prompting global investors to dump US government debt. They been wrong. Inflation remains quite low. Investors are still paying incredibly high prices for US government bonds. And, in fact, the US greenback remains a bastion of strength.

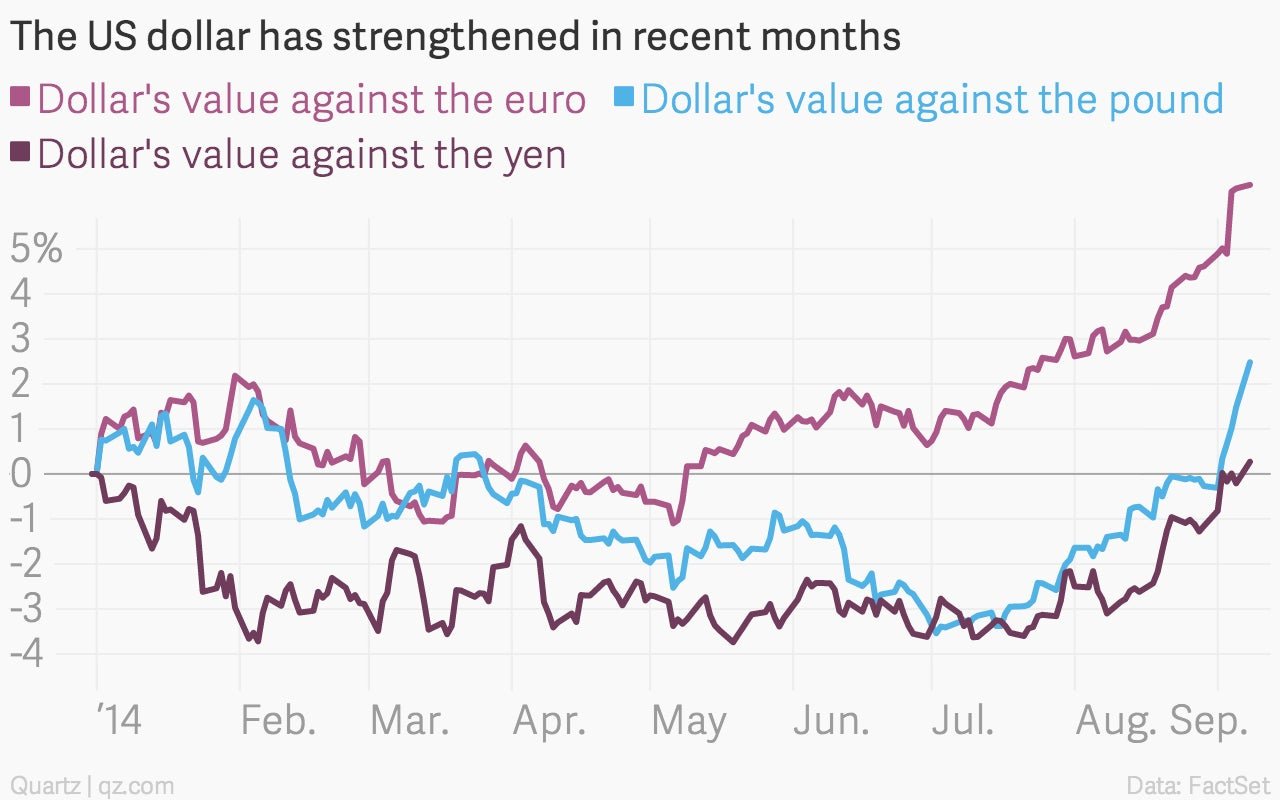

In fact, the American buck is getting even stronger.

Most recently, the British pound has taken a header against the dollar amid concerns that Scotland might go its own way in its looming independence referendum. (Scottish independence could have deep repercussions on the value of the pound.) Likewise the greenback has been rising steadily against the euro in recent months, with markets convinced that the European Central Bank would announce a bond-buying—or money-creation program—aimed at keeping the continent from slipping into a Japanese style deflation. (It did last week.)

And speaking of Japan, the Bank of Japan is engaged in a super-charged yen creation program as part of the fiscal and monetary effort—Abenomics—aimed at jolting Japan back into faster growth.

Now, the Fed continues its own money-creation program, too. But unlike Japan and Europe—which seem to be in the early stages of central bank monetary experimentation—the Fed seems to be nearing the end. The US central bank is on track to end its quantitative easing efforts later this year. And Wall Street expects it to actually start raising rates sometime in early 2015. Moreover, the US economy is by far the bright spot in the developed world economy at the moment, with second-quarter GDP running at a revised 4.2% annualized rate.

In other words, far from being concerned about the Fed’s bulbous balance sheet, the markets seem to be giving the Fed a pat on the back for a job well done in helping to keep the US growing. The trajectory of US growth is one of the reasons why the path of America’s debt-to-GDP ratio is projected to stabilize over the next few years. (Though longer-term financial concerns tied to the rapidly aging baby-boom generation remain important.) And at any rate, the fact that the dollar continues to have the confidence of global markets means the US will have no trouble continuing to borrow to finance its debts.

In other words, the Federal Reserve’s extraordinary efforts to push the American economy forward have helped the economy and done little harm to the financial reputation of US. In fact, they seem to have helped in demonstrating that US institutions—at least the monetary ones—are able to deliver appropriate policy.

That should give courage to Mario Draghi’s ECB as it belatedly follows in the Fed’s footsteps.