In the run-up to the referendum on Scottish independence, big businesses were wary of expressing any official preference either way, for fear of upsetting customers on both sides of the debate. But with a week to go before the vote, and the polls predicting an extremely close result, some of the largest companies in Scotland are speaking out.

For the “Yes” (to independence) camp, the news isn’t good. In financial services, one of Scotland’s largest industries, major players now say that if Scotland becomes independent they will up sticks and move south. The main reason? A fear that Scotland couldn’t effectively backstop its financial system.The size of Scotland’s banking industry in relation to its economy is far larger than even Iceland or Cyprus. At a parliamentary hearing yesterday, Bank of England governor Mark Carney said that if an independent Scotland adopted the pound as its currency without a formal currency union, it would need to build up reserves worth 25% to 100% of its GDP—and the British government insists that a union is out of the question.

Today, the Royal Bank of Scotland confirmed that it would move its headquarters—based in Edinburgh since 1727— to England (almost certainly London) in the event of a vote for independence:

… there are a number of material uncertainties arising from the Scottish referendum vote which could have a bearing on the Bank’s credit ratings, and the fiscal, monetary, legal and regulatory landscape to which it is subject. For this reason, RBS has undertaken contingency planning for the possible business implications of a ‘Yes’ vote. RBS believes that this is the responsible and prudent thing to do and something that its customers, staff and shareholders would expect it to do.

Lloyds Banking Group, which owns Bank of Scotland (established in 1695), released a statement late yesterday, which it said was in response to the increasing volume of questions it’s getting from customers, staff, and other partners:

While the scale of potential change is currently unclear, we have contingency plans in place which include the establishment of new legal entities in England. This is a legal procedure and there would be no immediate changes or issues which could affect our business or our customers.

Clydesdale Bank, founded in Glasgow in 1838, is also eyeing a move south in the event of independence, it said today (pdf):

Clydesdale Bank can confirm that its contingency plans for a ‘Yes’ vote in the forthcoming Independence Referendum include re-registering the Bank as an English company in order to mitigate risks and provide increased certainty for customers during the independence negotiations and beyond.

The Edinburgh-based insurer and asset manager Standard Life is also planning to transfer parts of its business, which began in Scotland in 1825, to “new regulated companies in England” if Scots vote to leave the UK. It cited the “uncertainty around a range of issues material to Scotland’s future” for the move. Those issues:

* The currency that an independent Scotland would use

* Whether agreement and ratification of an independent Scotland’s membership to the European Union would be achieved by the assumed target date (currently 24 March 2016)

* The shape and role of the monetary system going forward

* The arrangements for financial services regulation and consumer protection in an independent Scotland

* The approach to individual taxation, especially around savings and pensions

It’s not just financial firms. Energy giants such as BP and Shell, crucial investors in Scotland’s North Sea oil and gas blocks, have also been speaking up against independence. BP boss Bob Dudley prefers the “stability and certainty” of Scotland remaining in the UK. And retailers like John Lewis and B&Q have been warning of price hikes in an independent Scotland.

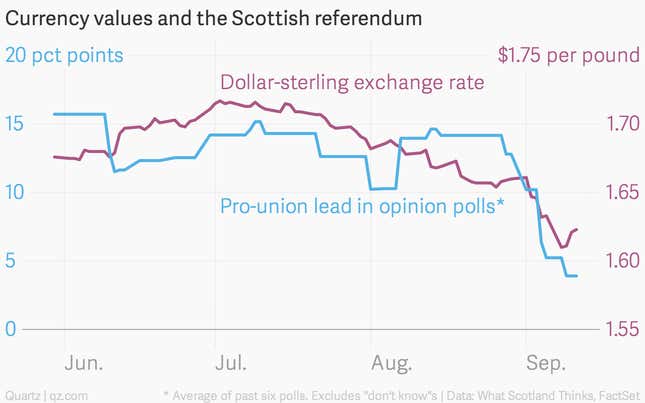

Despite the latest flurry of announcements, the “Yes” camp says that plenty of businesses are on its side—it recently published a list of 100 executives who back independence. Not to be outdone, today the “No” campaign put out is own slate of 100 business leaders who support their position. Whether business bigwigs can sway voters remains to be seen, but with stocks and the pound falling every time the pro-independence camp makes gains in the polls, the financial markets have shown a preference for the UK to remain united. That’s a view that Scotland’s biggest financial firms share, they now admit.