American household finances have recovered, it just doesn’t feel like it

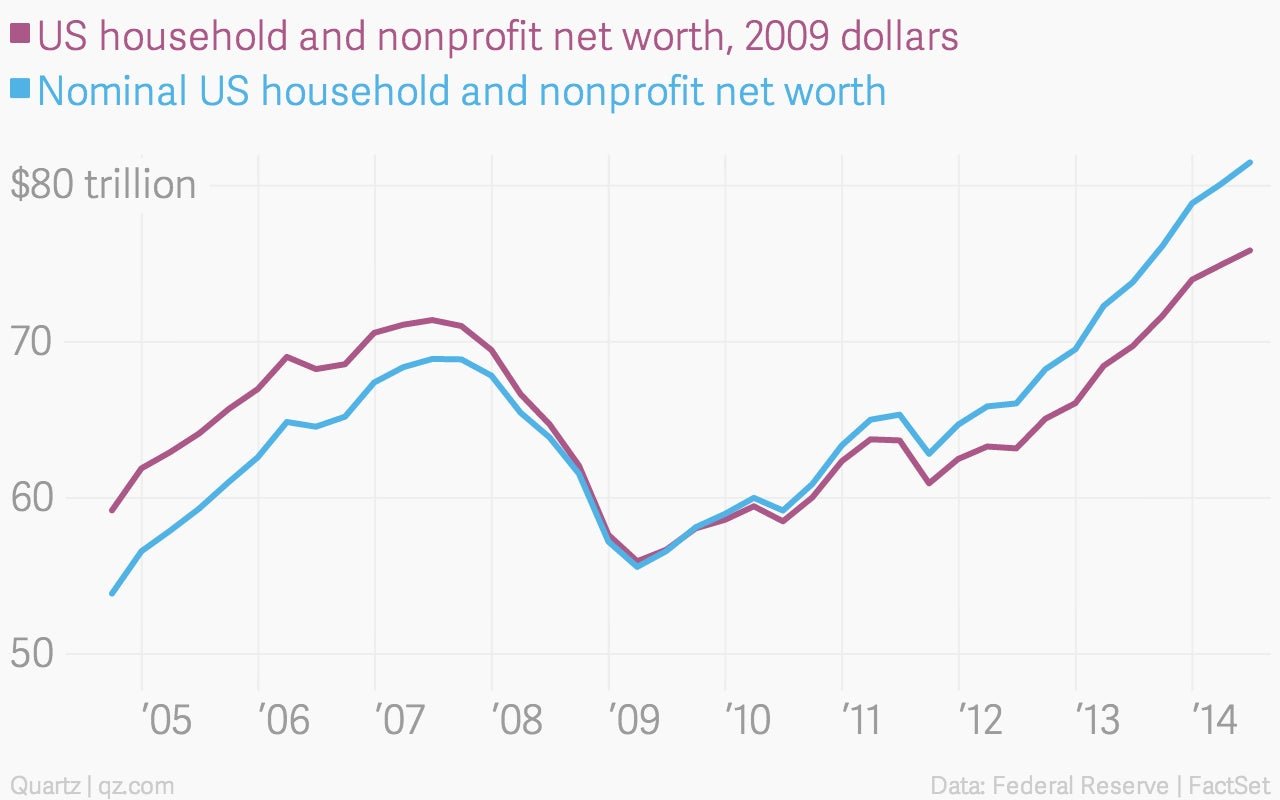

A nice rebound in asset prices has helped American households—at least in the aggregate—recover all of the wealth they lost during the Great Recession, according to the high-level quarterly statistics published by the Federal Reserve. The net worth of US households and nonprofit organizations rose to $81.49 trillion during the second quarter of 2014; that’s 18.3% higher than the pre-crisis peak $68.9 trillion in the second quarter of 2007.

A nice rebound in asset prices has helped American households—at least in the aggregate—recover all of the wealth they lost during the Great Recession, according to the high-level quarterly statistics published by the Federal Reserve. The net worth of US households and nonprofit organizations rose to $81.49 trillion during the second quarter of 2014; that’s 18.3% higher than the pre-crisis peak $68.9 trillion in the second quarter of 2007.

And that’s not just inflation. Even in inflation-adjusted terms—using the price deflator index included in monthly personal consumptions expenditures data—household net worth is up 6.2% from the pre-crisis peak.

That would be terrific news if the US consisted of just one large household. Instead there are more than 115 million households. Obviously the net worth of all of them hasn’t increased at the same rate. The surge in household net worth was driven, in large part, by the remarkable rally in the US stock market. The market value of US equity shares hit $24.49 trillion during the second quarter, which is 49% higher than where the value of equities was during the second quarter of 2012.

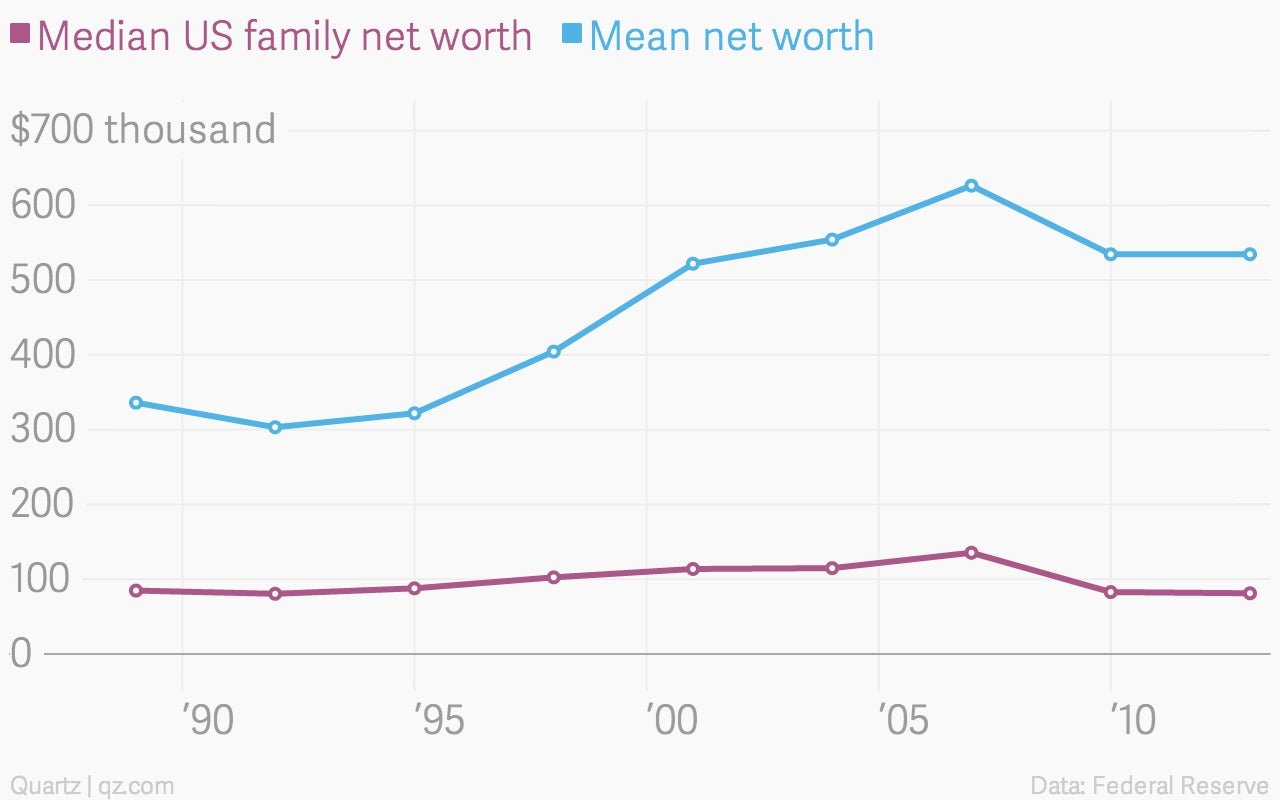

The vast majority of corporate equities in the US are owned by relatively few affluent shareholders. So the surge in US stock prices has important distributive effects. In other words, even though overall US net worth has been bouncing back, the net worth of the most affluent households has been bouncing back far faster. The most recent iteration of the Federal Reserve’s triennial survey of consumer finances showed that pretty conclusively.

According to those numbers, average net worth among those in the top 10% of the wealth distribution saw their net worth rise 2%, to more than $3.3 million, between the surveys conducted in 2010 and 2013. The other 90% of the wealth distribution saw their average net worth decline in that time frame. For a better sense of how a typical family did between 2010 and 2013, look at the median family net worth numbers, which show that net worth fell 2% to $81,200.