University students who take out loans are essentially betting that the education they’re financing with debt will help them get a decent job—and that the job, in turn, will help them repay the loan.

Defaulting on student loans, then, means something went terribly wrong.

Alas, such a turn of events is far from uncommon. Last month, the US Department of Education released its latest batch of data on student loan defaults. Broadly, the news was good. Overall default rates fell to 13.7% from 14.7% the prior year.

But the there’s plenty of variation under the top-line numbers. The schools with the highest rates mostly were for-profit colleges (which have such notoriously bad track records on this that they have attracted regulatory scrutiny in recent years) and community colleges (where having to take out a student loan to pay for the relatively affordable tuition might be indicative of more serious financial straits.) Student loan default rates were also surprisingly high at a number of well-known, four-year institutions.

So should you be upset if your alma mater is on one of these lists? Not necessarily. It’s hard to know the complete story of why one school might have a higher rate than another because there are so many factors at play. Still, Moody’s analysts recently noted that default rates are correlated with factors such as high student retention and graduation rates, which are, in turn, associated with student ability to repay loans. Moody’s analysts also note that schools with greater financial resources have greater capacity to support students through both financial aid and student services.

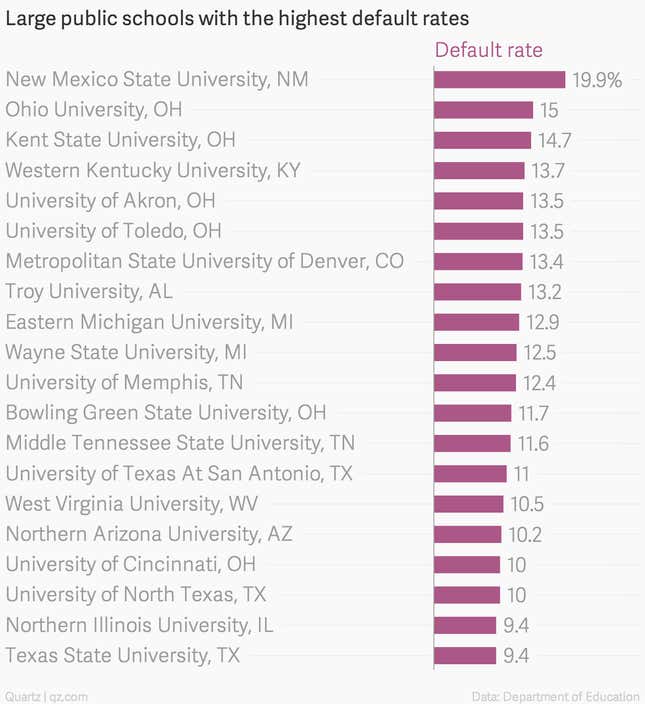

Here are the big public schools with the highest three-year default rates. This list is limited to schools that had at least 5,000 students go into repayment mode in fiscal 2011—mostly schools on the large side.

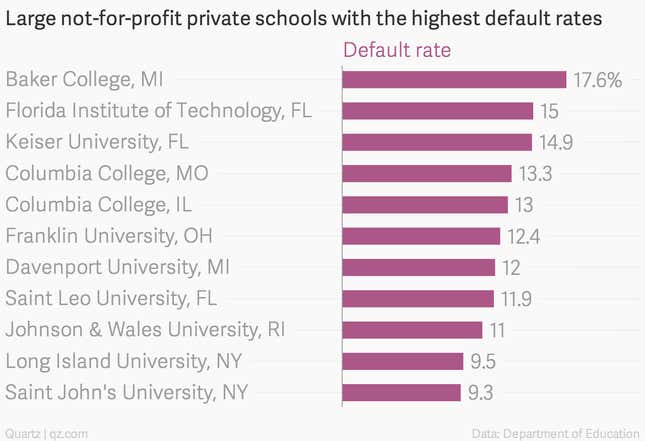

Here are the four-year, non-profit private schools with the highest rates, limited to schools that had 3,000 or more people due to begin repayments in 2011.

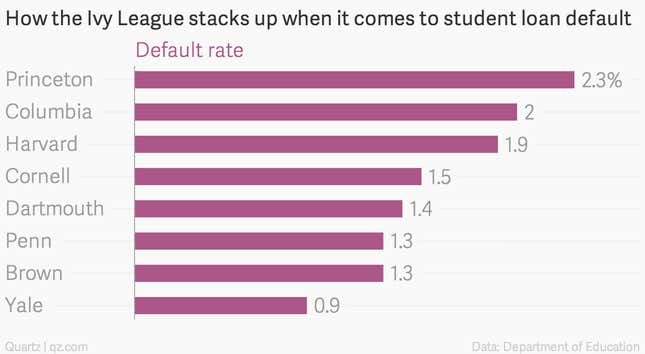

For comparison, here’s the Ivy League. Things are looking pretty good. All eight universities fell well below the average default rate of 7% for four-year, non-profit private schools.

The data here represent the 2011 three-year default rates for all accredited American colleges. That number measures, by school, the percentage of federal student loans that were supposed to get repaid beginning in fiscal 2011 but went into default—meaning the debtor went 270 days without payment—some time in the next three years. This number doesn’t capture those who are teetering on the verge of default or who have entered deference or forbearance programs, which let debtors temporarily halt payments without defaulting. It also doesn’t account for the fact that some schools attract more low-income students who are vulnerable to default, or the fact that some schools just happen to be in economically depressed areas.