S&P 500 companies get more than a third of their revenue outside the United States, and it’s often the growing part of their business. Yet a tiny fraction of of people governing boards have worked abroad for a significant amount of time, and even fewer are non-US nationals, according to a new report from executive search firm Egon Zehnder.

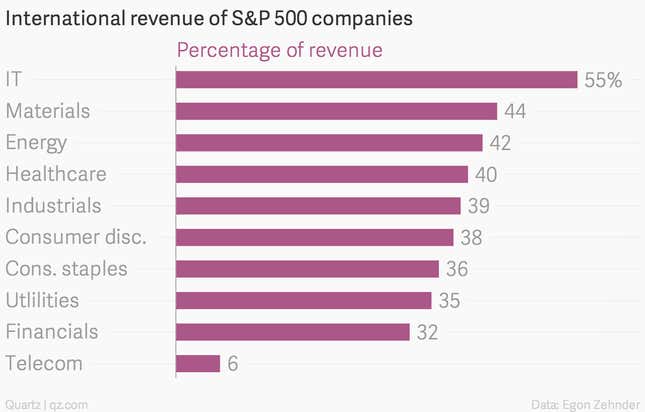

Here’s the proportion of international revenue by industry in the S&P 500, which is up 37% as a portion of total revenue since 2008:

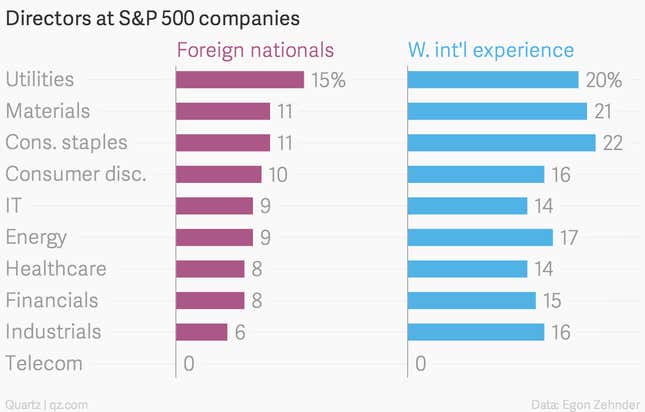

And here’s the percentage of board members who are foreign nationals, or have meaningful international work experience:

These numbers restrict the sample to the subset of companies that report international revenue. When you consider that the average board size in these companies is a bit over 10, it means that many have just one foreign national, and maybe two who have spent significant time abroad.

You have a bunch of nominally global companies who constantly talk about operating in a “globalized” economy, who have nearly all Americans at the top.

It’s not the only area they lack diversity. Only 18.3% of board members at these companies are women.

The ideal function of a board is to extend the capabilities of the CEO, to provide expertise he doesn’t have, different points of view, and critical, rigorous oversight. Diversity of experience helps. But when companies are doing so much business abroad, having people who have spent real time there is important.

Since 2008, the share of directors with international experience has jumped 6.1%. But the share who are foreign nationals is up only 0.6%.

Some of the biggest corporate scandals of recent years have come from large American companies operating abroad. Citigroup and Walmart’s troubles in Mexico are just two recent examples.

It’s impossible to draw a line from board composition to those scandals, but when there’s too heavy a US focus at the top, there is less informed oversight.