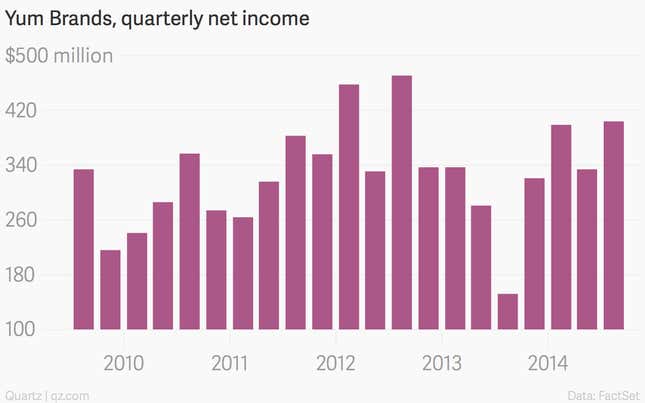

The numbers: The owner of the combination Pizza Hut and Taco Bell – KFC too – posted net income of $404 million for the third quarter, up 21% from the same period a year earlier. Despite the rise, profit levels at Yum have yet to return to their peak prior to a series of food scares in China that have weighed on results over the last couple years.

The takeaway: The company’s earnings update follows its September disclosure that same-store sales for the quarter ending August 31 would drop 13% after a supplier in China was investigated for allegedly altering sell-by dates on food purchased by the company’s KFC and Pizza Hut outposts. That matters because roughly 15% of Yum’s roughly 40,400 restaurants worldwide are located in the country. Though Yum vowed legal action against OSI Group and its Shanghai Husi subsidiary that allegedly supplied the items, the incident arose as Yum labors to rebuild its reputation in China following a similar episode in 2012, when regulators investigated two suppliers to KFC following news reports that the companies furnished chickens that contained excessive levels of antibiotics.

What’s interesting: Besides supply-chain issues, Yum’s business seems to be at a strategic turning point in China, where the company appears bent on making KFC “more upscale and less price-promotion driven,” according to John Ivankoe, a J.P. Morgan analyst. “We believe this not only exposes the company to greater impacts from questions about food quality, but also puts the KFC brand at risk of alienating a core customer focused on value and service,” Ivankoe wrote in a recent research note.