More signs point to a recession in Europe’s strongest economy

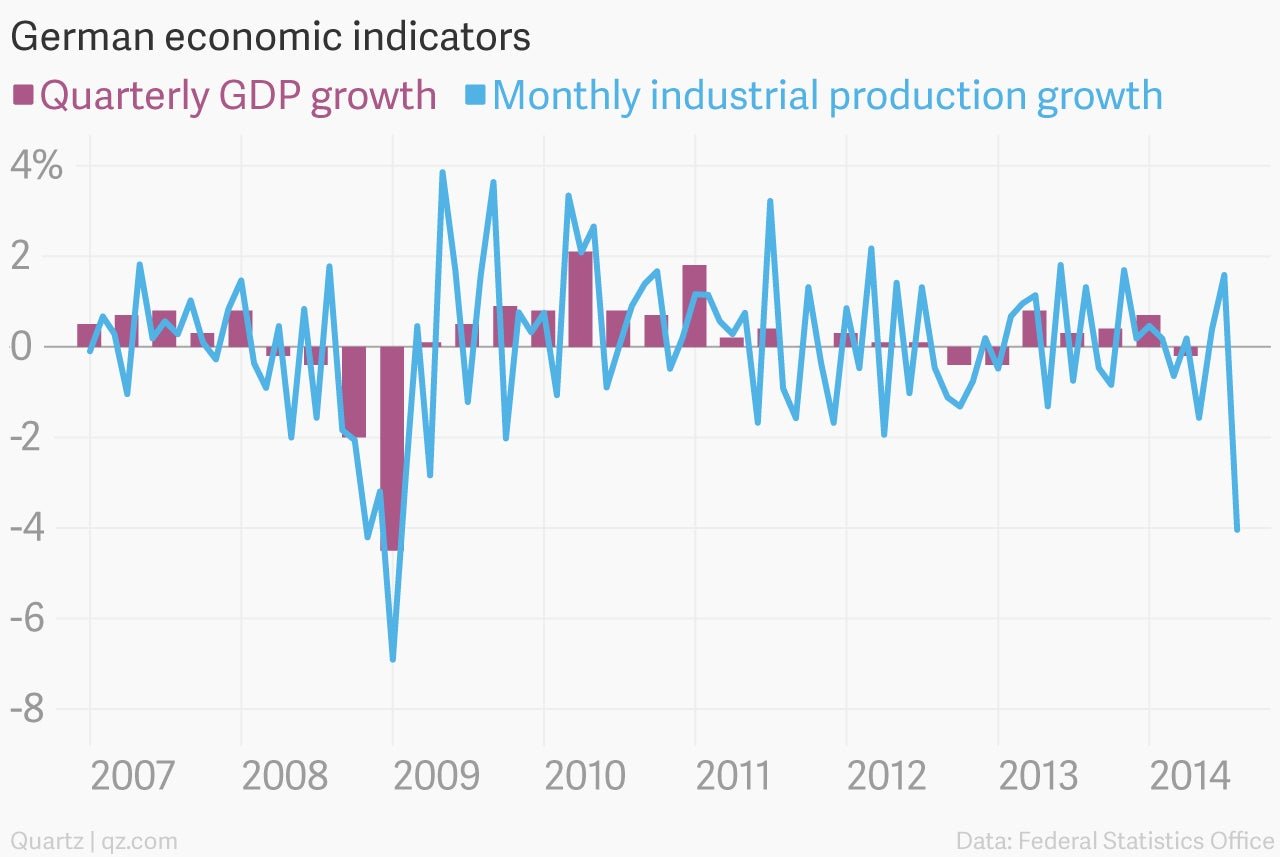

The data coming out of Europe’s largest economy have not made for pleasant reading recently. Germany reported today that industrial production fell by 4% in August from the month before, the biggest decline since early 2009. Earlier this week, factory orders fell by their largest amount in five years as well, with orders from outside the euro zone falling by nearly 10%.

The data coming out of Europe’s largest economy have not made for pleasant reading recently. Germany reported today that industrial production fell by 4% in August from the month before, the biggest decline since early 2009. Earlier this week, factory orders fell by their largest amount in five years as well, with orders from outside the euro zone falling by nearly 10%.

Following a 0.2% drop in GDP in the second quarter, the signs now suggest that Germany’s manufacturing-heavy economy could have slipped back into recession, as defined by two consecutive quarters of falling economic output:

Germany will release its estimate of third-quarter GDP on Nov. 14. Retail sales have been stronger than expected recently, but the drop in manufacturing activity suggests that, at best, growth stalled out in the latest quarter.

Germany’s export-led economy is suffering from the weakness of its neighbors in the euro zone, who continue to reign in spending in the aftermath of the euro debt crisis. And the Chinese economy is also slowing, hurting German equipment exports. On top of that there are the tit-for-tat sanctions between the European Union and Russia, which recently prompted the IMF to lower its growth forecasts for Germany for this year and next.

Add it all up and it’s easy to see why the European Central Bank felt the need to launch a new round of stimulus measures. German opposition to those measures is more difficult to figure. Despite its recent stumble, Germany is better off than most of the euro zone, but its mighty manufacturing machine is hardly firing on all cylinders.