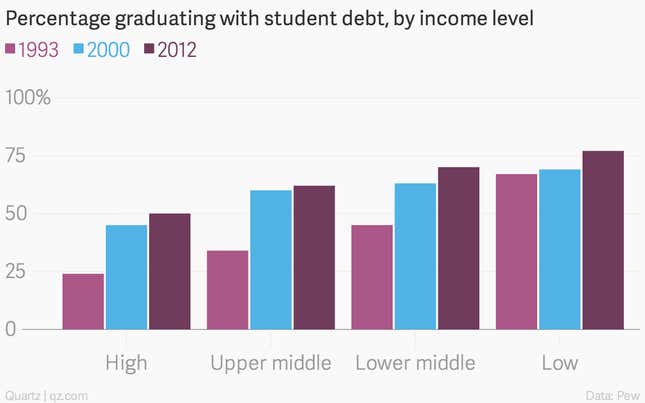

The easy assumption about student debt is that it’s mainly a result of kids from low-income families trying to finance their education. But the fastest growing cohorts of borrowers are those from more affluent households, according to a new Pew Research Report.

The number of borrowers from high-income families has doubled since 1993, while borrowing by those in upper-middle income brackets has increased nearly 30%.

A greater percentage of low-income students leave school with debt. But in the ’90s, it was only the low-income quartile that had a majority of students graduate with debt. Now, each quartile, even the most affluent one, sees half or more of its students graduating with debt. Overall, 69% of students finish school with loans to pay off:

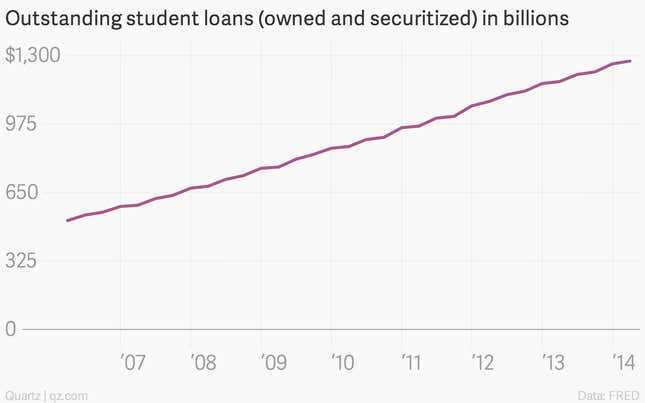

It’s an important component of the ongoing increase in overall student loan debt, which has substantially passed the $1 trillion mark:

Average student loan debt for individual borrowers has jumped from $12,434 in 1993 to $26,885 in 2012.

The specific reasons are hard to track down, although rising tuition certainly is a factor, even with the offsets of grants, tax credits, and financial aid. Students rarely pay the full sticker price, but since those from households in higher income brackets are more likely to do so, tuition increases might prompt more borrowing at the top. Higher-income students also are much more likely to apply to more selective, and more expensive, private institutions.

For-profit schools cost more out of pocket, have become enormously popular, and contribute a great deal to the overall increase in student loans, but they tend to attract students from lower-income and less-educated families, and are unlikely explanation for the increase in borrowing among the more affluent.