There’s really no other way to say it.

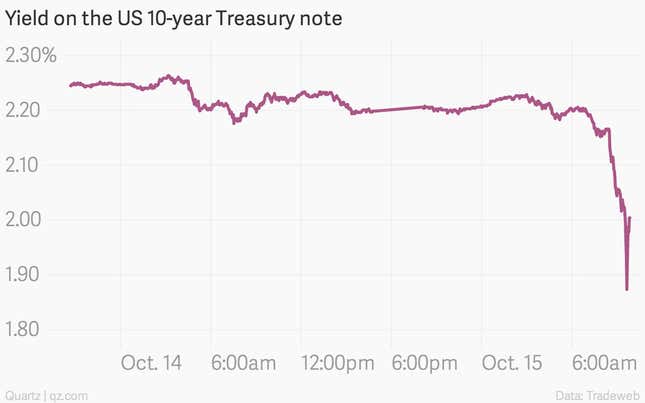

Across Asia, Europe, and the US, there’s a mad dash for the world’s safest bonds right now. That’s pushing yields—which move inversely to prices—down to some of their lowest levels since the scariest moments of the European debt crisis.

The yield on the benchmark US 10-year Treasury note has plummeted this morning. Yields collapsed below 2% briefly, before rebounding.

Basically, that means the bond markets are back to where they were before the so-called “taper tantrum” pushed interest rates sharply higher in 2013.

The same rush to safety is happening in Europe. Yields on Germany’s 10-year government bond, a key destination for money in search of safety, are also collapsing.

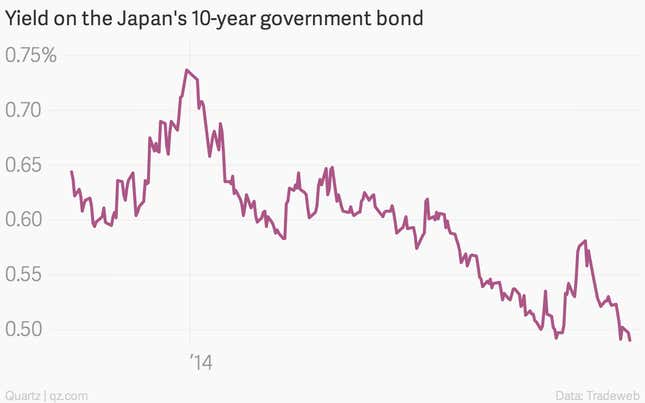

Yields on Japanese government debt are also near some of their lows in recent memory today.

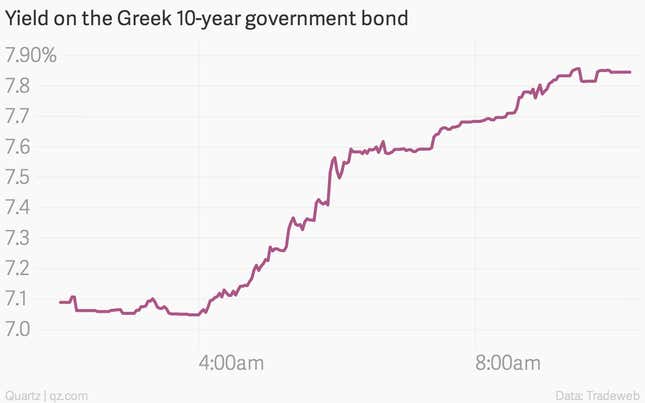

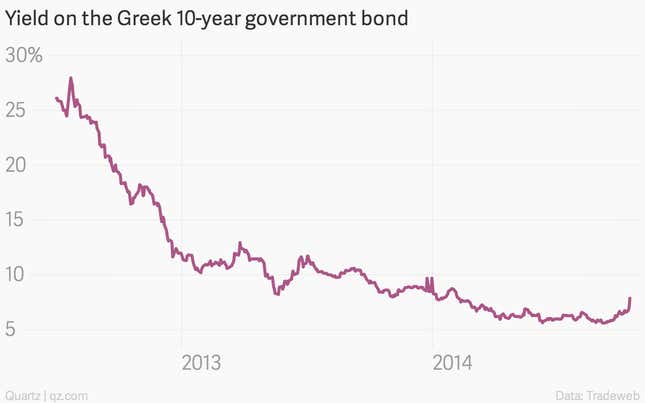

And investors are dumping riskier investments, such as the peripheral European government bonds that have been a favorite of financial markets in recent years. Yields on Greek government bonds, for example, have moved sharply higher today, hitting their highest level in two years.

Of course, a bit of context is needed. Yields are still nowhere near as high as they were when ECB President Mario Draghi vowed to do “whatever it takes” to save the euro in July 2012. But still, the sharp selloff is worth watching.

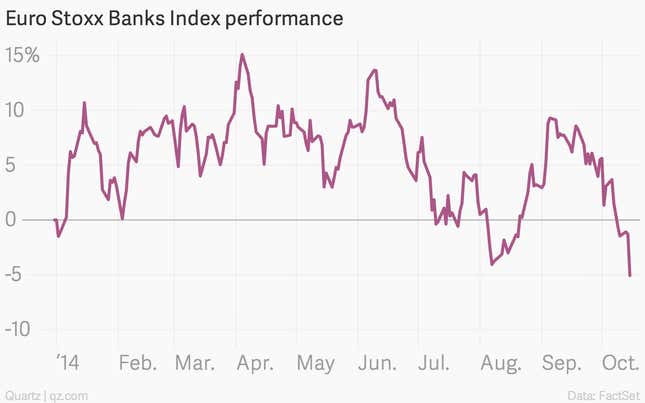

Speaking of a sharp selloff, European stocks have been hit the hardest:

And whenever investors are seeking safety, they are probably selling euro zone bank shares. Greek and Italian banks led the declines, thanks to fears about their countries’ fiscal health and economic prospects dimming their prospects. A benchmark index of big euro zone banks just touched a year-to-date low in trading today.

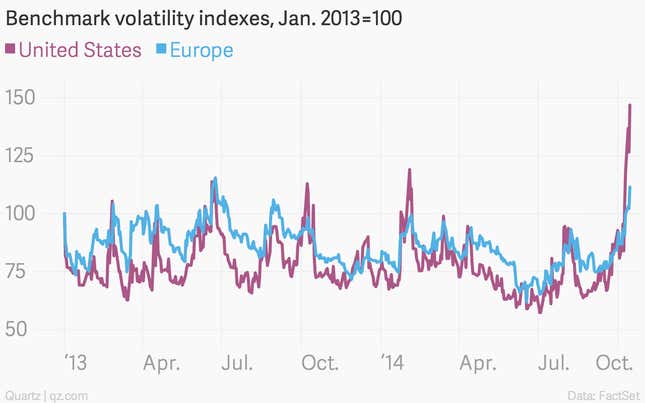

Unsurprisingly, equity volatility indexes—considered a gauge of investor fear—have been setting multi-year highs.