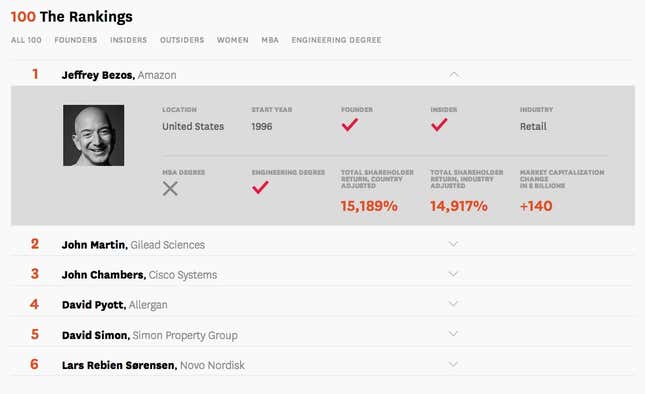

The Harvard Business Review just bestowed the title of best-performing CEO in the world on Amazon.com CEO Jeff Bezos, who last year tied with late Steve Jobs for the honor.

Now, given that Jobs had been deceased for nearly a year when Harvard Business Review gave him the title, there’s room to be skeptical of methodology for such lists. After all, usually most lists of top CEOs would begin meeting the basic criteria of being A.) alive and B.) an actual CEO.

But such details aside, let’s take a look at the core criterion that HBR spotlights in its methodology: Shareholder returns. It’s clear that Amazon.com performance in the equity markets looks fairly outstanding over the long-term. According to FactSet, the company’s total return—that’s share price gains and dividends, which Amazon has never paid—since going public in May 1997 is more than 15,000%, trouncing the return of the S&P 500 over the same period, which was a bit more than 200%.

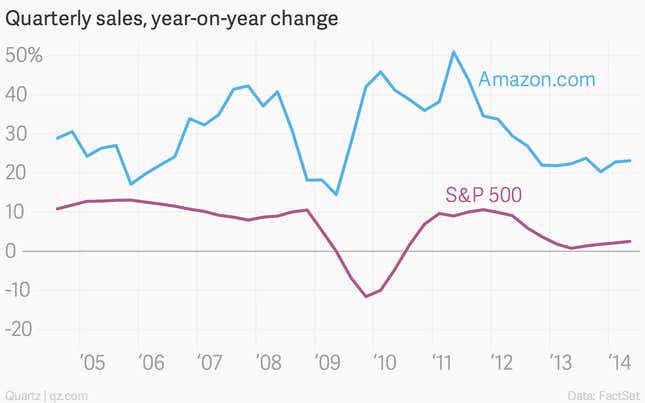

Of course, picking beginnings and endings for this type of analysis is always important. Amazon lagged the S&P 500 for most of the decade between the tech stock bust of 2000 and 2010. And over the past three years Amazon.com has also lagged the broader index.

Even so, Amazon’s high-altitude share price is fairly amazing, and perhaps even justified if you look at the tremendous sales growth that the online shopping behemoth continues to notch up, quarter-over-quarter.

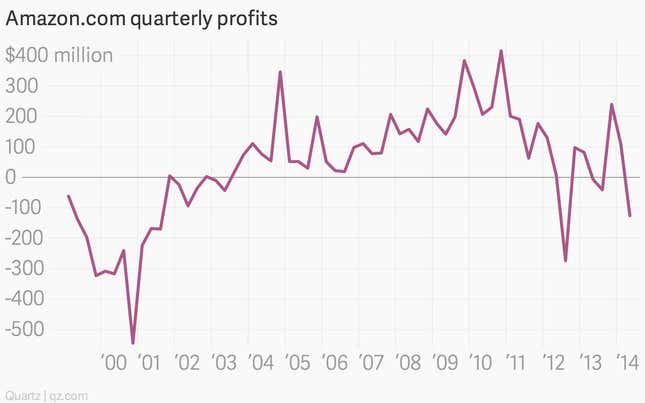

But the bottom line, for CEOs, is the bottom line. In other words, profit. And this is Amazon’s weak point. Profit growth has been a problem as the company has consistently lagged for much of the past five years, including a really ugly tumble during the second quarter of 2014. The plain fact is that Amazon’s profits have been quite soft.

So is Bezos the best or not? It may be a silly question.

It’s incredibly difficult to identify the impact that individual CEOs have on their companies. As the founder, CEO, and guiding spirit of Amazon, Bezos obviously has a lot to do with the company’s development.

But who’s to say that there’s not someone out there who could run a better, more disciplined Amazon, who transforms its tremendous sales into solid quarter-on-quarter profit growth? We’ll never know. Economics isn’t a controlled experiment that you can re-run to prove a statistically significant point.

In the backdrop of all efforts to quantify CEO performance is what Thomas Piketty calls the “illusion of marginal productivity.” The influential French economist argues that in large corporations, it’s essentially impossible to connect the performance of a single manager with the company as a whole. Also lurking behind that argument is that age-old bugbear: CEO pay. After all, if you can’t quantify the performance of a CEO, how can you justify his or her pay?

The obvious answer is, you often can’t.