Tesco’s Value Destruct-o-Meter: $21 billion and counting

The numbers: Grim. Really grim. Gruesome, even. When a 92% drop in profit is not the worst thing in a results announcement, you know you’re in trouble. Tesco’s delayed half-year earnings report revealed that the £250 million ($400 million) profit overstatement it flagged last month was in fact worth £263 million; what’s more, the aggressive accounting practices that goosed the numbers had been going on for at least two years, much longer than previously suggested. Tesco chairman Sir Richard Broadbent expressed “profound regret” and announced his resignation.

The numbers: Grim. Really grim. Gruesome, even. When a 92% drop in profit is not the worst thing in a results announcement, you know you’re in trouble. Tesco’s delayed half-year earnings report revealed that the £250 million ($400 million) profit overstatement it flagged last month was in fact worth £263 million; what’s more, the aggressive accounting practices that goosed the numbers had been going on for at least two years, much longer than previously suggested. Tesco chairman Sir Richard Broadbent expressed “profound regret” and announced his resignation.

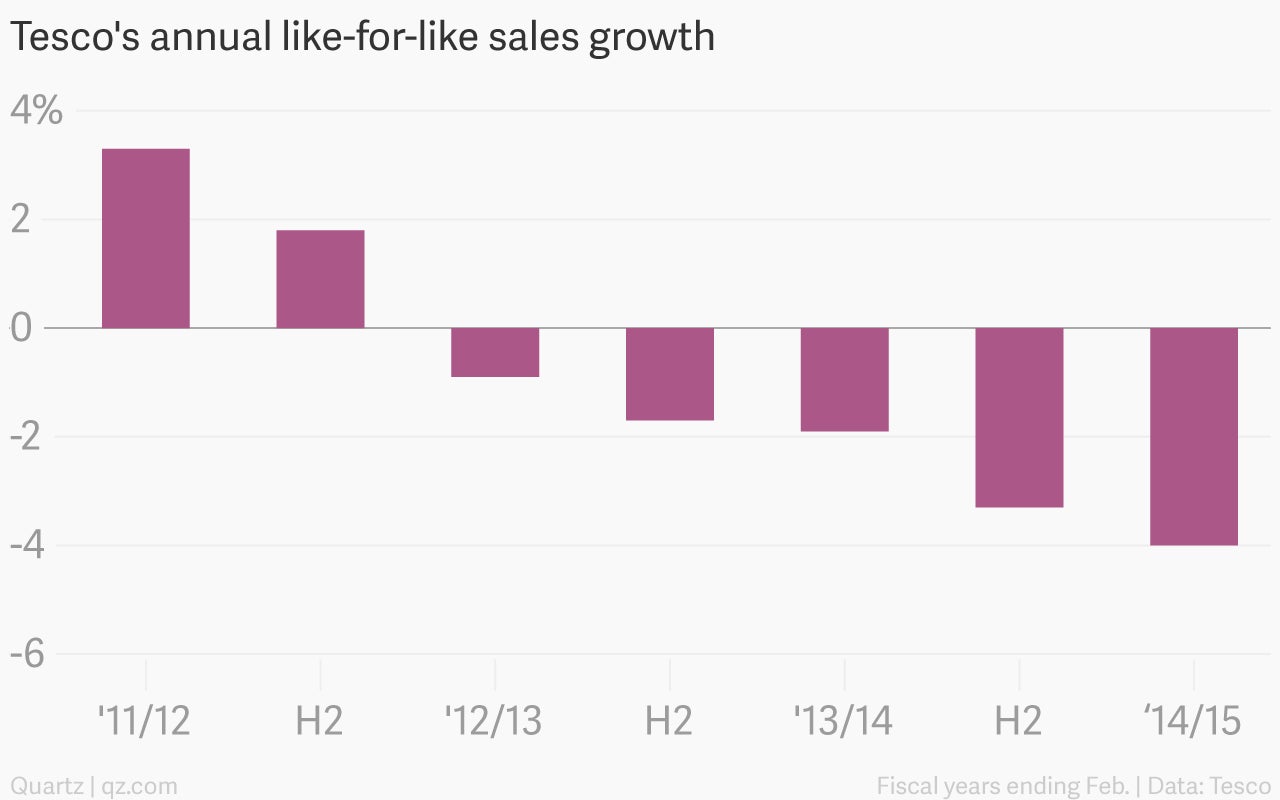

The takeaway: Newish chief executive Dave Lewis was already warning about the waning health of Tesco’s core business before the accounting snafu came to light. Same-store sales continue to fall (see chart above), as the company steadily loses ground to upstart discounters from Deutschland. The company is rumored to be considering the sale of foreign units to raise funds and sharpen its focus on regaining competitiveness at home.

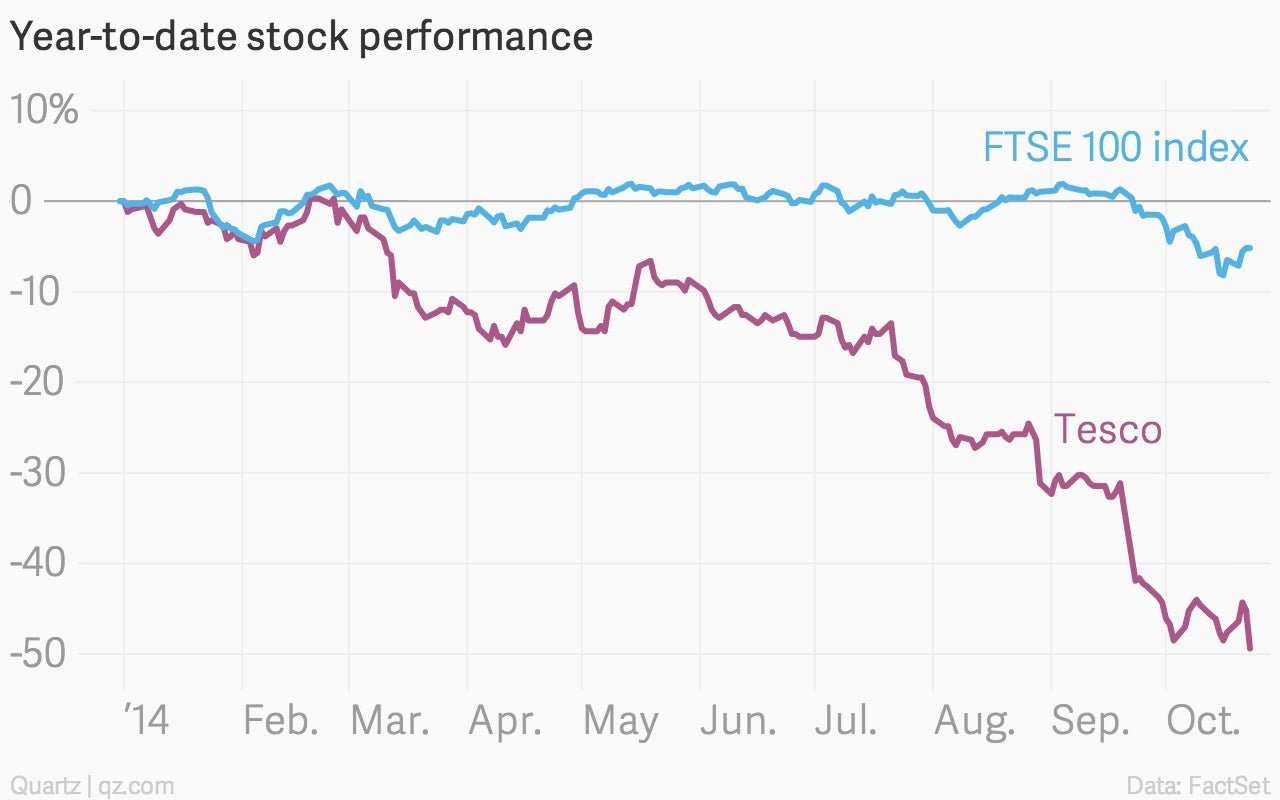

What’s interesting: Tesco is one of the UK’s largest and most widely-held stocks. (Some pretty shrewd investors outside of Britain are also major holders.) Unfortunately for shareholders, the retailer has destroyed some £13 billion, or around $21 billion, in value so far this year. Tesco’s shares fell as much as 9% today, even though investors were already primed to expect bad news. How will Lewis reverse the decline? He won’t say. When asked for his vision for the next six months (pdf), he said, “Well let’s start with 6 days’ time shall we?”