Our vote for the most evocative bit of language to come out of the financial crisis has to be the so-called “shadow banking system.” It conjures up noir-ish images of unsavory, trench-coat-clad bankers ducking into alleys, quickly dropping rubber-banded blocks of crumpled cash into suitcases, and just as quickly slipping into the fog as the click of their hand-crafted Italian shoes on cobblestones slowly fades.

Sounds exciting and vaguely ominous, right? Well good news. You may be involved. That money crumpled block of cash? Some of it may be yours.

The truth is the “shadow banking system” is a basically a catch-all term for a whole host of financial industry players that behave like banks—borrowing short-term cash and lending it for longer periods of time—but aren’t regulated like banks.

It also includes money-market mutual funds, those usually boring accounts where people and companies stuff excess cash in hopes of earning a miniscule bit more interest than in a bank account. They also let you pull out your money, like a bank account. But these funds aren’t bank accounts, which in the US means they don’t have deposit insurance, or at least they didn’t before the crisis.

During the financial crisis, companies and people all of the sudden started paying attention to how money-market funds invest the the money they had deposited. And they realized that a lot of it is tied up in short-term investments to risky financial players. Investors started yanking their money en masse from one of the most established of these funds, the Reserve Primary Fund, when it came to light that it had some $785 million invested in Lehman Brothers, the Wall Street giant that went bankrupt in September 2008. It was the equivalent of a run on a bank. It freaked regulators out and forced them to temporarily extend government guarantees to money-market funds. (The father-and-son team who ran the fund were cleared of fraud a week ago.)

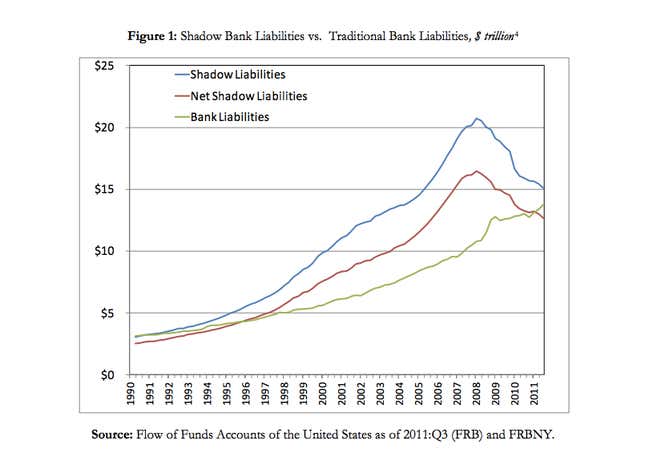

Now a group of international regulators known as the Financial Stability Board (FSB) has reported that the shadow banking system is even bigger than previously estimated: it’s worth around $67 trillion worldwide. The FSB plans to push for tighter oversight (pdf) of the sector, and that includes tougher regulations on money-market funds.

But it’s not going to happen any time soon. For instance, four years after the crisis in the US, regulators are only now seeking comment on their proposed tweaks to regulation of money-market funds. While regulators don’t want act rashly and without input from the industry. The danger here is that the seriousness of the crisis fades into history, while we’ll surely repeat. And your money is involved.