Morgan Stanley has a fascinating deep dive this week into the world of online advertising. Analysts at the bank looked at Facebook, Google, and Twitter to get a sense of how online advertising, and by extension the business model of the web, is developing in the forthcoming years.

In short, this is a good time to be Facebook.

Google, as Larry Page (and, ahem, Quartz) has said, is reaching maturity. Revenue growth from search is slowing in its biggest markets—the US and Britain. And the bulk of people in emerging markets are mostly getting online using mobile phones, which Google has yet to master (it has tremendous market share with the Android operating system, but it is much harder to show lots of ads, which is where over 90% of Google’s revenue comes from, on a small screen).

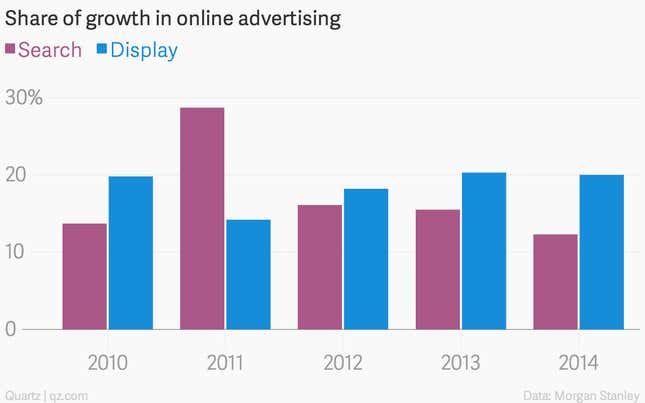

By contrast, Facebook has figured out mobile as well as display advertising—the former dominant in users coming online, the latter in dollars spent by advertisers. The big difference between Facebook and Google is that while search ads are “performance advertising,” in that they can be directly measured, Facebook focuses more on display ads, which aim to influence people’s impression of a company the way magazine or television ads do. Display advertising has accounted for more growth in online advertising than search since 2012, and the gap is only widening.

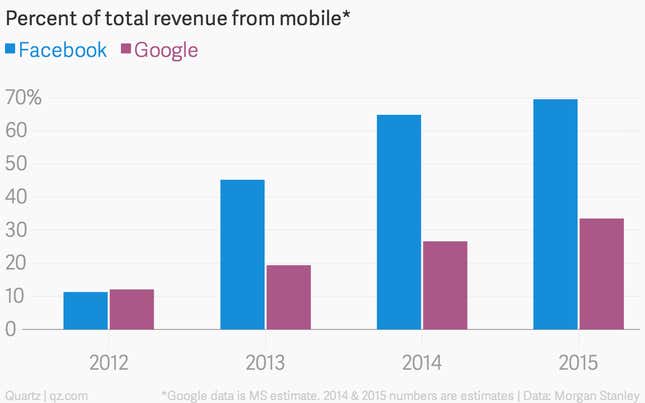

Moreover, Facebook now makes nearly 70% of its revenue from mobile, up from 11% in 2012. Google makes a third of its income from mobile, up from 12% in 2012. And these are still “very early days in mobile advertising,” writes Morgan Stanley analysts, suggesting plenty of room for growth.

And Facebook has a long way to go. It is ramping up video ads, and recently launched an ad platform, Atlas, to challenge the dominance of Google’s YouTube and Doubleclick. Neither will necessarily beat Google’s properties, but they represent significant opportunity for Facebook.

Google is in no danger of shrivelling away. Indeed, it will continue to make vast amounts of money from search and will continue to see impressive revenue growth. But Google is finding new streams of revenue hard to come by, whereas Facebook has managed the impressive feats both of charging more for mobile than desktop ads (“unique among its competitive set,” says Morgan Stanley) as well as reducing the number of ads while being able to increase the price of those ads. Facebook may not yet come close to raking in the massive revenue Google does, but it is better poised to take advantage of the changing nature of online advertising.