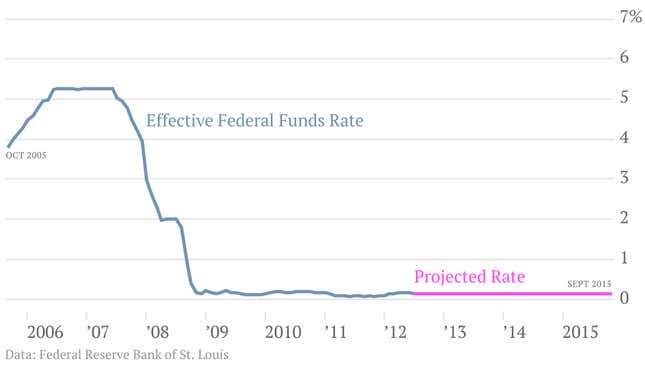

The US Federal Open Market Committee indicated September 13 that it would keep the federal funds rate “exceptionally low” through at least the middle of 2015. The rate, which determines how much banks pay to lend each other money overnight, has hovered between 0 and 0.25% since December 2008.

If interest rates remain “exceptionally low” for another three years, as the Fed has signalled, this is what the decade will have looked like:

Seven out of 10 years will have seen near-zero interest rates with an average rate 1.36%, assuming current trends continue.

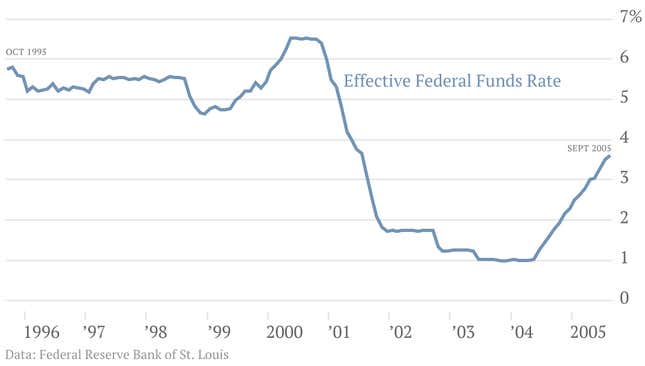

Now consider how this compares to interest rates during the previous ten years, 1995-2005:

From October 1995 to September 2005, the federal funds rate fell below 1.0% only once, in December 2003. The average rate was 3.9%.