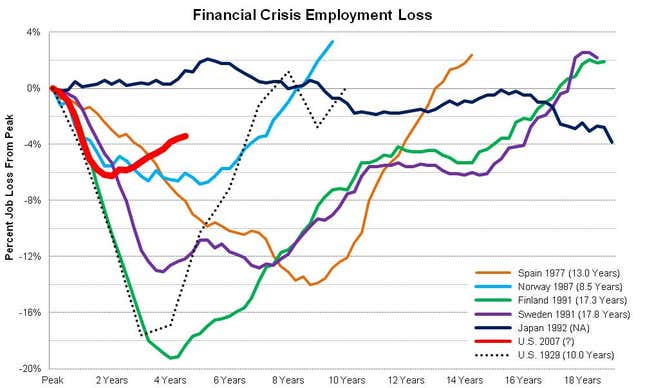

IMF Director Christine LaGarde gave a speech in Washington Sept. 24 with one main point: Policy matters. The above graph, from Josh Lehner, is an example of why: It shows how long jobs took to recover from seven global financial crises. The most recent, the red-line US crisis, shows a fairly big turnaround—largely, in both Lehner and LaGarde’s view, because of coordinated actions taken around the globe by policymakers. Their message? More than anything else, businesses want policymakers to take clear action, fulfill promises and reduce uncertainty.

Here’s what’s on LaGarde’s mind as she prepares for the IMF’s annual summit in Tokyo this October:

Good marks for central bankers. “Initiatives by major central banks—the European Central Bank’s OMT bond-purchasing program, QE3 by the U.S. Federal Reserve, the Bank of Japan’s expanded Asset Purchase Program—are big policy signals in the right direction.”

Euro commitments must be upheld. Besides following through on a unified European banking regulator, LaGarde has these prescriptions (emphasis in the original): ”We have also called consistently for other needed actions: implement the European firewall—notably the European Stability Mechanism; implement the agreed plan for fiscal union; and, at the country level, implement the programs that are essential for growth, jobs and competitiveness.” Shorter LaGarde: Enough talk, more action.

For the United States: Don’t step off the fiscal cliff. “We all hope that political clarity emerges soon, and with it, actions to avoid the fiscal cliff; and, also, a concrete plan to bring down debt gradually over the medium-term. Delivery on this US promise of action is vital for the world.” A 2% contraction in US GDP wouldn’t just be bad here, but bad for the world.

Emerging markets: Stabilize! (We can help.) Though growth is slowing in emerging markets, LaGarde doesn’t have a universal prescription. ”The focus should be on countering vulnerabilities—albeit domestic or external. For some, this may mean putting monetary and fiscal tightening on hold, or even additional stimulus—as was recently announced by China, for example. For others, they must ensure that high credit growth does not compromise financial stability or jeopardize future growth. For all, the key is to prepare for potential spillovers from other parts of the world. The IMF can help: our Flexible Credit Line (FCL) and Precautionary and Liquidity Line (PLL), both recent instruments designed precisely to provide reassurance in times of uncertainty. Colombia, Mexico, Morocco, and Poland have found that to be true.”

And step up economic investment in the Middle East to ease the effects of the Arab Spring. “These transitions also need external support, not only financial, but also by way of FDI, market access, and technical assistance. While some bilateral donors have stepped up, many members of the Deauville Partnership of international donors have yet to deliver on the scale that had been anticipated. Another promise that must be kept.”