Given where the US economy has been over the past decade—and the state of the global economy still—it’s pretty amazing how well the world’s largest economy is performing right now. What’s more, all indicators suggest that the momentum has a ways to run yet. Here’s some of the most robust readings on the US economy.

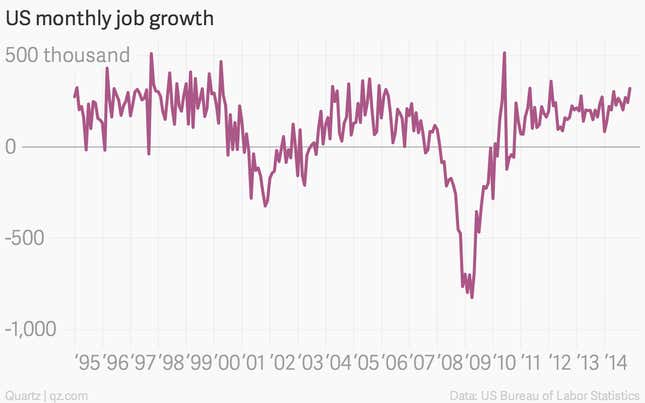

This year has been the best year for job growth since 1999.

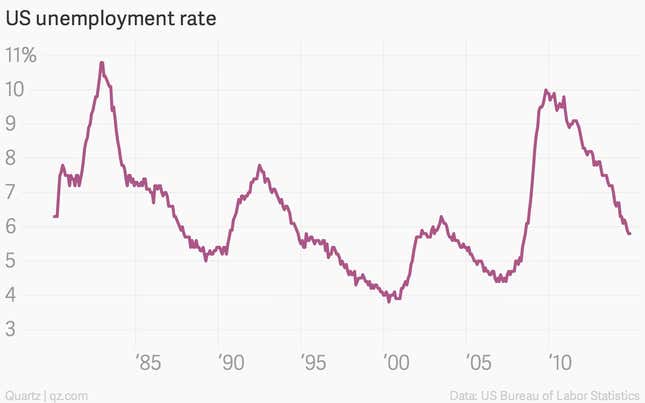

And the jobless rate has fallen sharply to 5.8% in November.

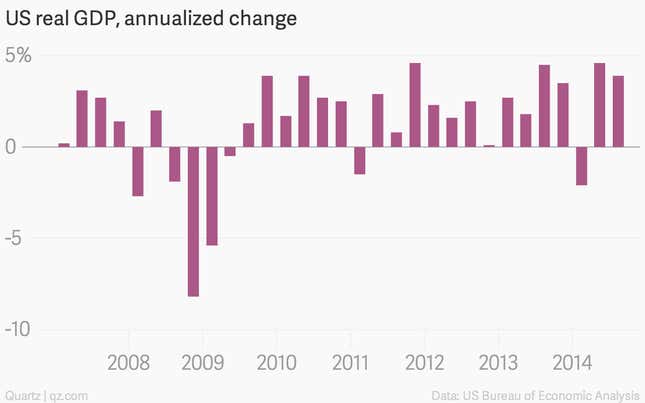

GDP is starting to expand at a faster clip.

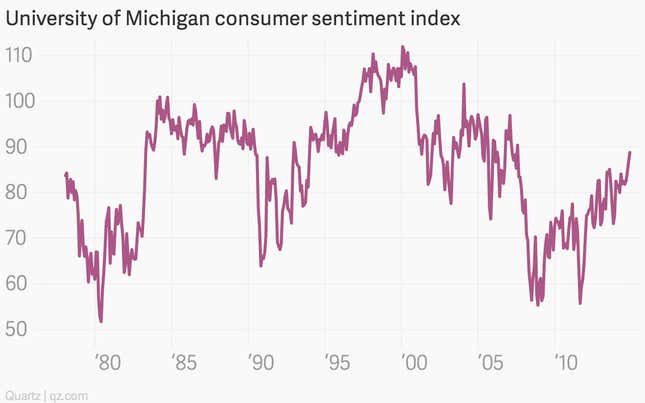

Consumer sentiment is hitting post-crisis peaks.

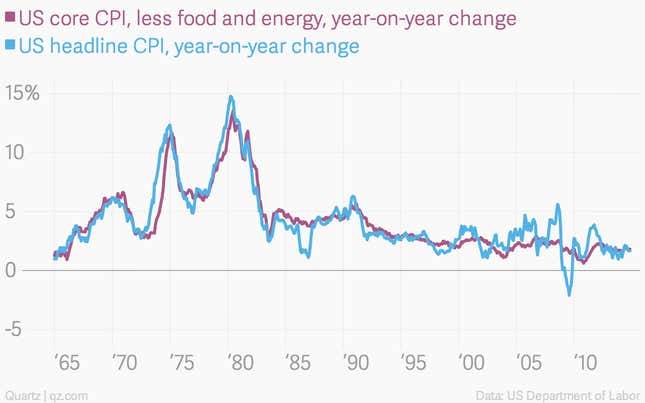

Inflation remains very low.

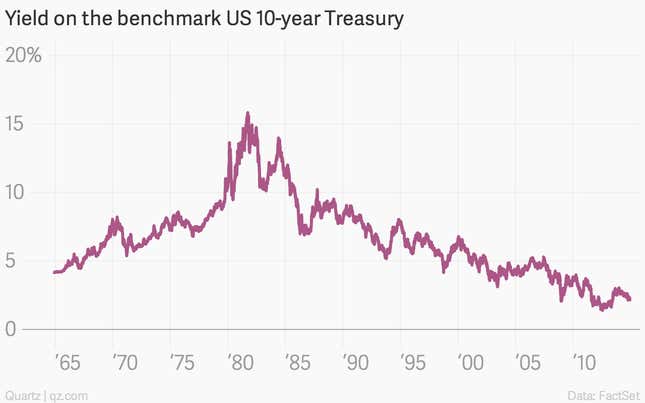

Interest rates are low, too.

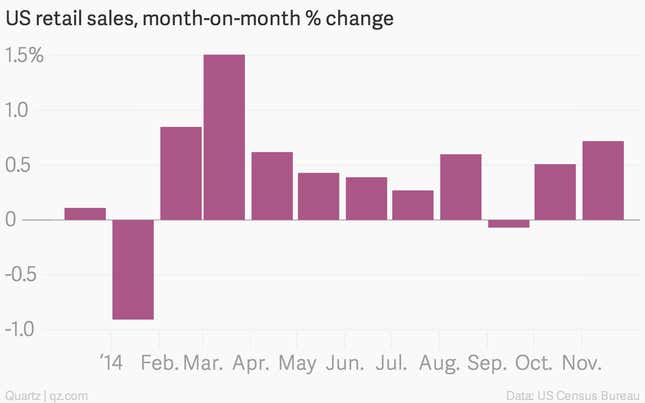

Retail spending is picking up steam.

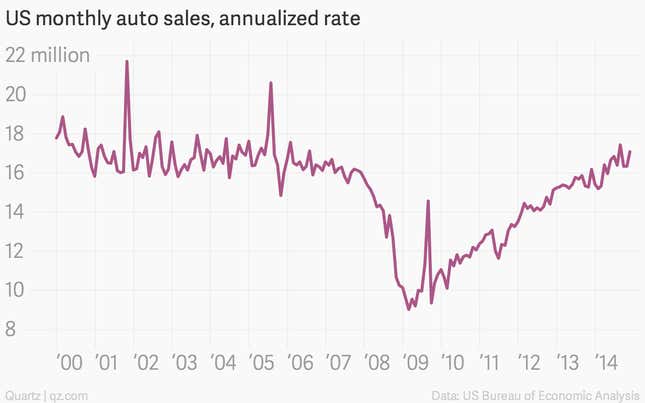

Auto sales are strong

.

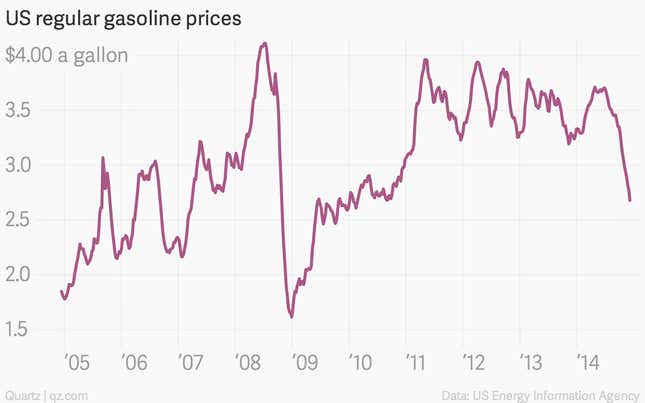

And gasoline prices are tumbling, putting cash in consumers’ pockets.

While they’re nowhere near pre-crisis levels, home sales seem to be gaining traction.

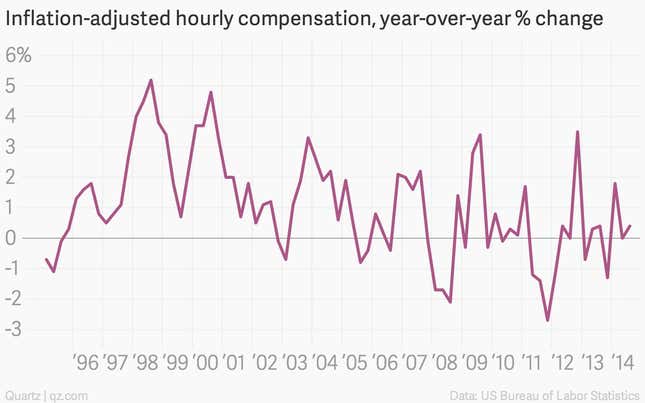

So what’s the problem? In a word: wages.

Any way you slice it, wage growth has been piddling. In November, US private-sector average hourly earnings were up a scant 0.4%, compared to the same period last year. (In the late 1990s, inflation-adjusted wages were regularly logging year-on-year gains of more than 3%.)

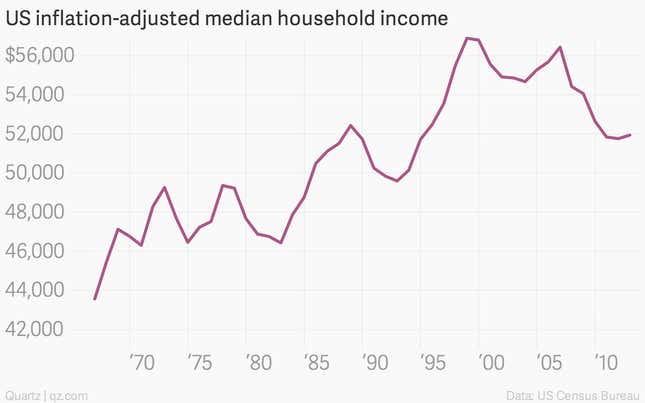

This is part of the reason that typical American families have experienced a lost quarter century of household income growth.

Now the idea is that a long stretch of economic growth would eventually feed through into wage growth. And Federal Reserve Chair Janet Yellen has indicated that she’d like to see real gains for workers, which would suggest she’s willing to let the US economy run a little hot before getting worried about inflation. (It isn’t a problem at all at the moment.)

That’s why this week’s Fed meeting is so important. If the Yellen Fed signals that it’s willing to start raising interest rates shortly—perhaps by removing the “considerable time” language from the Fed’s monetary statement—that would suggest that her commitment to wages growth is softening a bit. And that’d be very disappointing for workers.