Uber has been heavily criticized for its practice of implementing “surge pricing” during times of high demand, perhaps never more so than earlier this week when prices for rides in Sydney increased dramatically amid a hostage crisis.

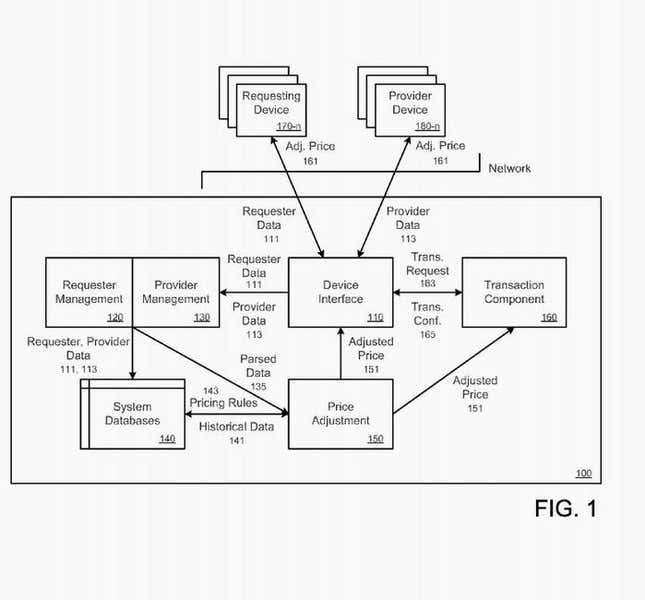

But it’s clear the app-enabled car service sees surge pricing, which boosts its bottom line, as a key piece of intellectual property for its business. As Bloomberg reported, it took out a patent on its surge pricing platform last year. Here is a taste of what it looks like:

The company consistently uses basic economics to defend surge pricing, and has long argued that the system is simply intended to increase the supply of drivers at times of high demand. The patents confirm it’s a bit more complicated that that.

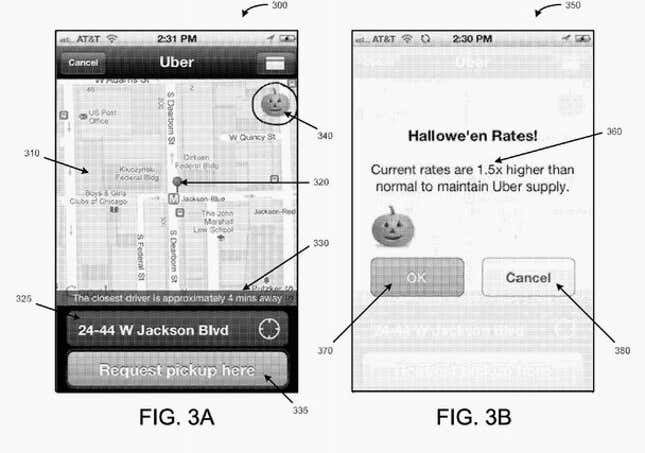

The system parses historical data to set prices more accurately. Here’s how that might work on a holiday. (We’ve added parentheses around the numbers corresponding to the figure above, for easier reading.)

[T]he price adjustment (150) can use historical data (141) that is comparable to previous Halloweens (e.g., data from Halloween for the last three years, or the last five years) that were provided by requesting devices (170) and provider devices (180) around the same time (e.g., night). The price adjustment (150) can also use historical data (141) that in a more specific manner, for example, by using historical data (141) that corresponds to data received at 9pm every night for the past month.

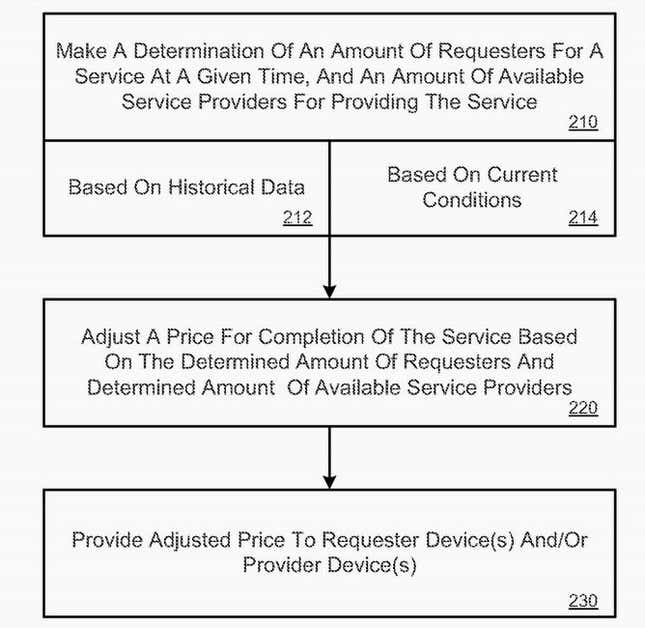

It can also take outside data sources into account. Here, the emphasis on emergencies is ours.

Other examples of outside sources or other stored data (current and/or historic) include weather conditions, news information (e.g., fires, emergency situations), social information (via social networking websites), traffic conditions, flight information from airports and/or airlines, etc., or other information that can assist in determining supply and/or demand for the service.

Uber has filed a stack of patents, a practice many privately held tech companies do before they go public. The problem is, as Bloomberg points out, many of them have been rejected—apparently because some of the applications, Bloomberg reported, “are for basic business concepts that have been around for a long time. Uber officials have not responded to Quartz’s request for a comment.

Dynamic pricing is common in other industries, most notably airlines, car rentals, and hotels. Bill Gurley, a partner at Benchmark Capital (which is an investor in Uber) has eloquently argued that Uber’s model is different: unlike rental cars and hotel rooms, the supply of Uber drivers is not fixed and can expand as prices increase.

Whether the US Patent and Trademark Office agrees remains to be seen.