The bond market is acting like the taper tantrum never happened

This article has been corrected.

This article has been corrected.

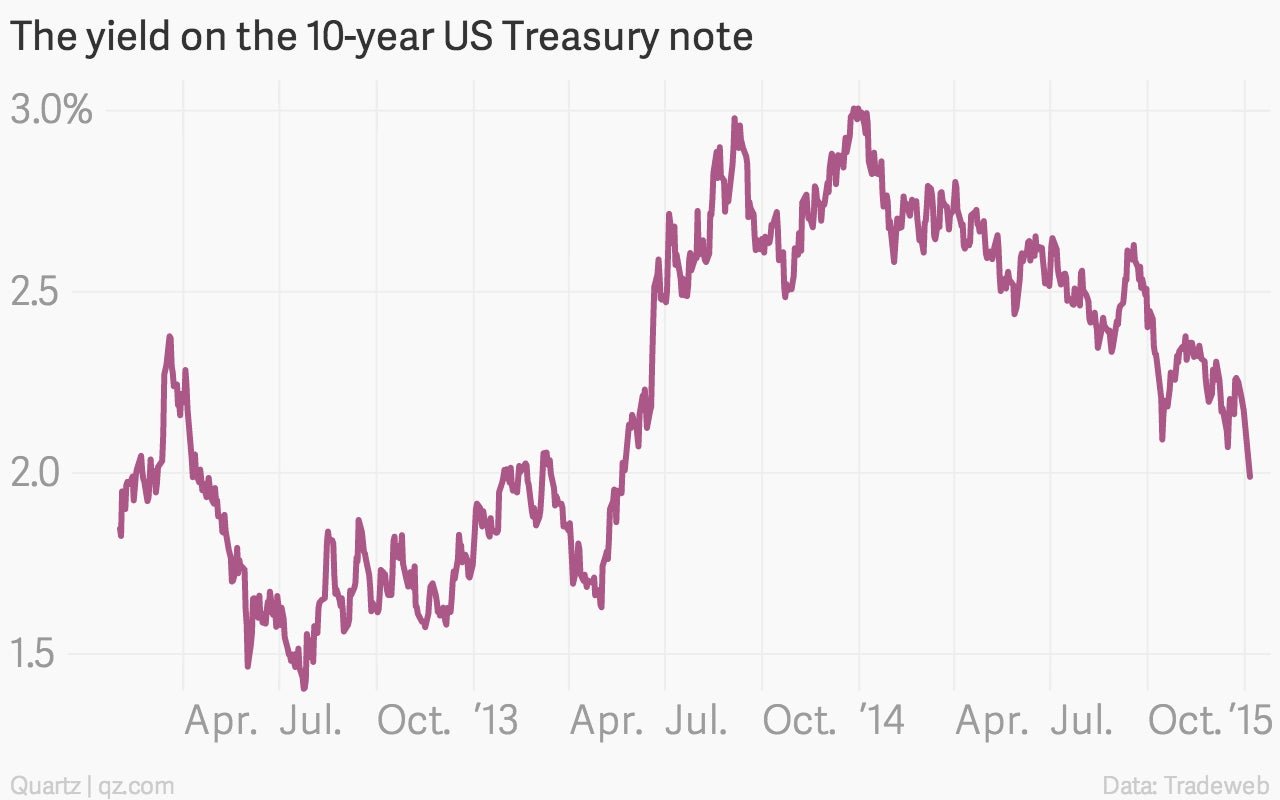

In May 2013, Ben Bernanke spooked the bond market by suggesting that the Federal Reserve might begin slowing down its bond-buying program aimed at stimulating the US economy. The Fed’s done buying bonds and the US economy is on surer footing, but the benchmark 10-year treasury note just closed* to the lower side of the 2% line for the first time since that fateful press conference.

Why? It’s not so much that US investors are getting worried again, but that many of the rest of the world’s major economic engines have slowed, and foreign markets have been in turmoil. That’s why a lot of world’s money is flowing to Treasury debt. And it’s still has a better yield than other flight-to-safety staples like German bunds.

*Correction: A previous version of this article said 10-year Treasury note had not yielded less than 2% since Ben Bernanke’s “taper” press conference. In fact, the yield did fall below that level before, including Oct. 15, 2014 and Oct. 16, 2014.