Negative inflation is a sign something big is about to happen in Europe’s economy

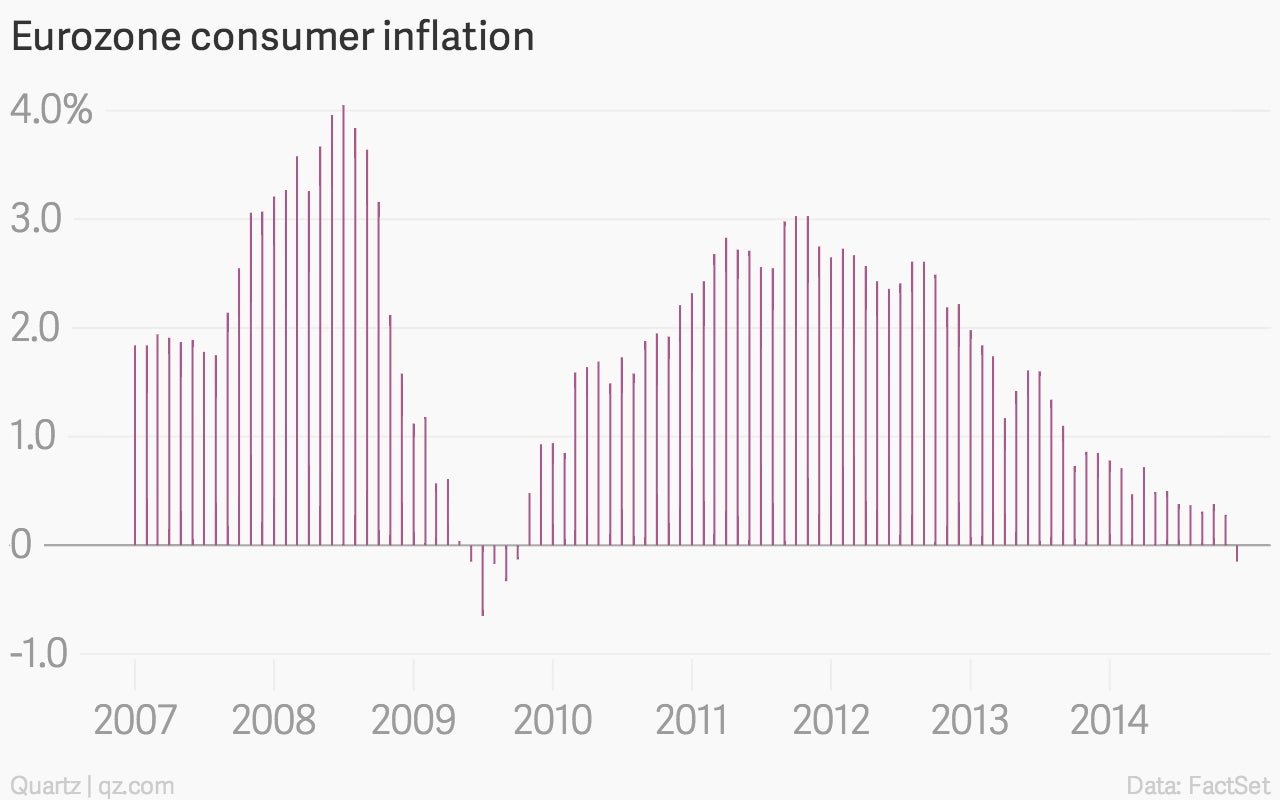

Europe’s prospects for deflation haven’t been this bad since the financial crisis. Overall, prices went negative in the December for first time in a while.

Europe’s prospects for deflation haven’t been this bad since the financial crisis. Overall, prices went negative in the December for first time in a while.

But that’s thanks to plummeting energy prices, a result of cheap oil. The core inflation number is still positive—though just barely—and actually rose a little last month.

The European Central Bank, which many investors are counting on to unveil further stimulus that might help boost the continent’s economies, defines deflation in its monthly bulletins as “a significant and persistent decline in the prices of a very broad set of consumer goods and services that becomes entrenched in expectations,” which likely will take a few more months to come to fruition if things indeed are trending that way. But that’s not stopping folks in the market from thinking falling prices will force the ECB to act.

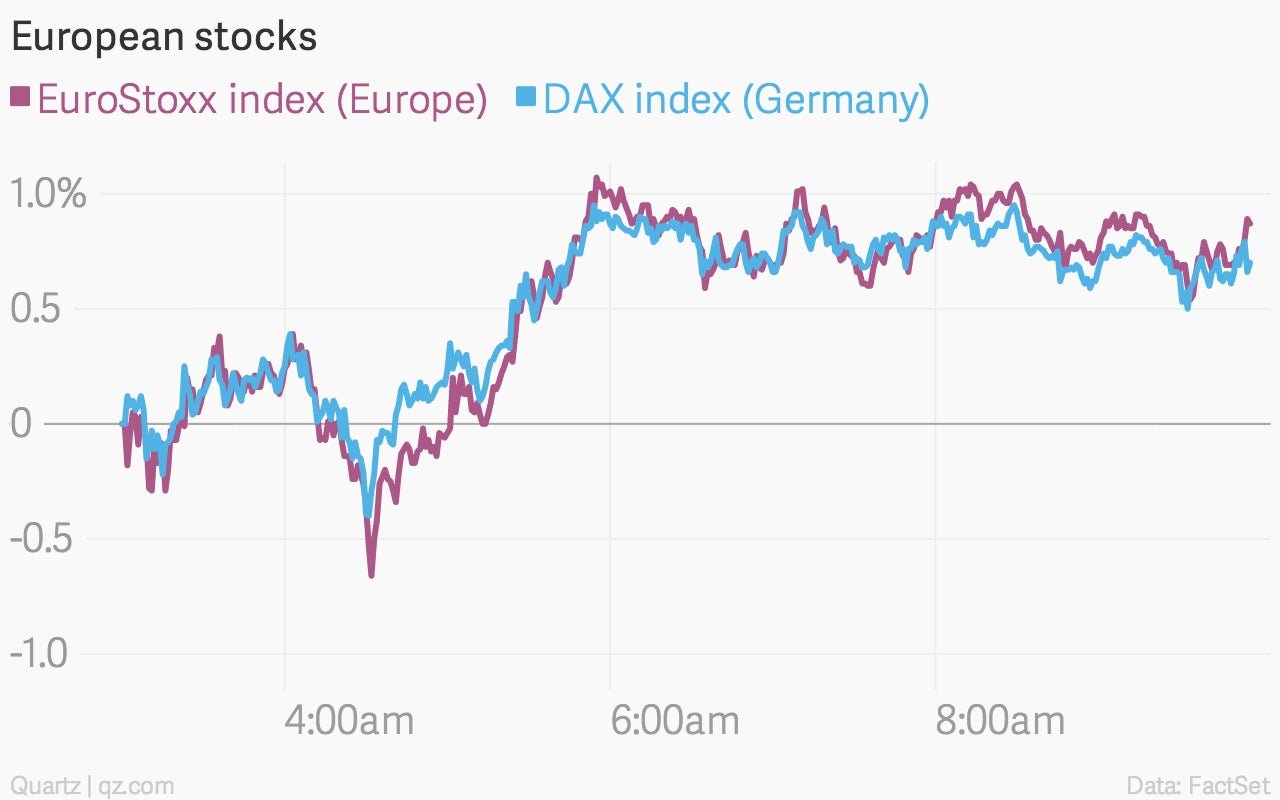

European stocks are going gangbusters.

And Germany sold a two-year bond with a record-low (paywall) negative interest rate. Europe’s economy has been slowing down for a while, and there are a lot of noisy signals out there (take the diverging German and Italian unemployment rates, for example). But a negative inflation rate is a big, honking symbol that something’s about to come to a head.