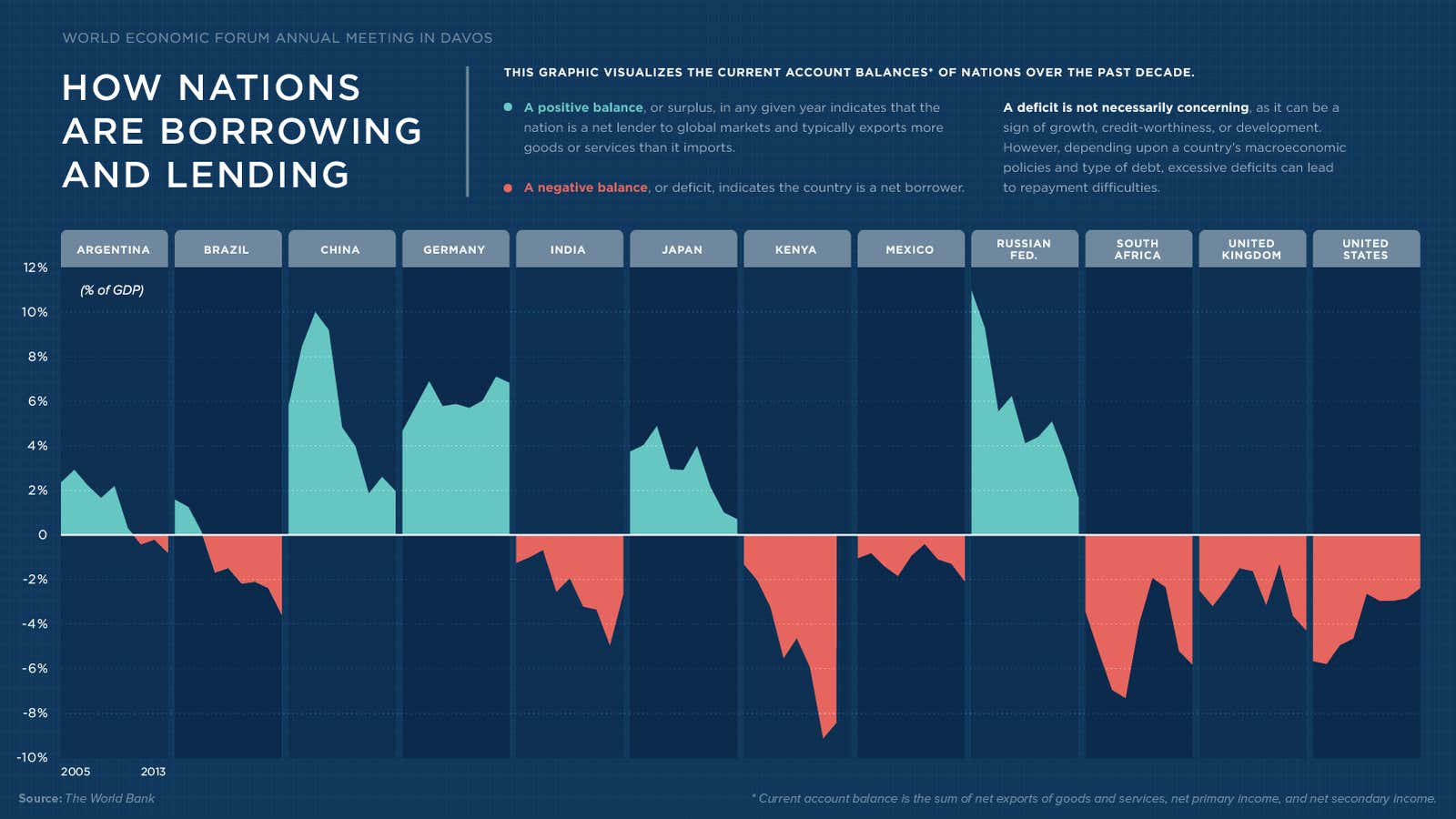

(See the infographic enlarged.)

Davos is not as insular as many critics allege. Despite the conference’s whirlwind occupation of an isolated Swiss ski town, plenty of attendees fixate on far-flung problems and the latest events defining them. Today, just like yesterday, was as much about development globally as the snowy schedule locally.

LET IT QE Programs on Wednesday saw flashy presentations and even raw props, but on Thursday policy was at the forefront. ECB President Mario Draghi announced an ambitious quantitative easing program in the afternoon local time, and multiple morning panels wrestled with the implications of the highly anticipated maneuver that will pump 60 billion euros a month into the euro zone economy until September 2016.

German President Angela Merkel’s address began just before Draghi spoke in Frankfurt, and she seemed intent on leaving the day’s big story there. She noted the ECB’s independence, then focused on other ways for Europe to regain its competitiveness—reforms, a “merger of the real and digital” economies, and private investment. She also called for a hard line against Russia’s “clear and flagrant violation” of post-war European ideals in Crimea.

The “Ending the Experiment” panel turned from a discussion on the end of QE in the US to one on its potential in Europe. “I am all for European QE,” Professor Larry Summers said, capturing panelists’ general sentiment. “The risks of doing too little far outweigh the risks of doing too much.” While IMF head Christine Lagarde argued that US interest rates will soon rise as QE ends, Summers showed more skepticism about whether the Fed will be in a position to cut rates when the next recession comes—noting that they average every seven years, despite our inability to predict them, and we should be prepared to respond with structural reforms and methods outside of “central bank improvisation.”

As Summers also cautioned that QE will not be a “panacea” in Europe’s fragile currency union, and may not approach US successes, Bridgewater founder Ray Dalio contrasted European and US structural potential. He noted that workers “cost” twice as much in Europe, given benefits and productivity numbers, and that Europe’s rate of entrepreneurship is half the US rate, where new technology and low startup costs increase vitality.

European leaders on the “Europe’s Twin Challenges: Growth and Stability” panel seemed quite conscious of these challenges. Netherlands Prime Minister Mark Rutte called Europe vulnerable, imbalanced, and uncompetitive. After German Vice-Chancellor Sigmar Gabriel said it took at least eight years last decade for structural reforms to bear fruit, Rutte cited Ireland, Portugal, and even Greece as countries that have recently made crucial adjustments quickly to shorten painful transitions. Irish leader Enda Kenny said that a weaker euro helps exports and tourism, supporting Lagarde’s claims that QE’s run-up was already making a difference as countries seek to improve their goods’ appeal abroad.

HEALING GLOBAL HEALTH The “Pandemics: Whose Problem?” open forum offered a variety of post-Ebola lessons for the next crisis. Director of the Wellcome Trust Jeremy Farrar, warned that epidemics and global pandemics are not rare events as he called for a global body to handle them. Former UN Secretary Kofi Annan stressed the need to create disease centers around Africa supported by public and private funds. Stanley M. Bergman, CEO of Henry Schein, asked that representatives from the private sector be brought into crisis planning earlier. And Valerie Amos, Under Secretary-General for Humanitarian Affairs and Emergency Relief Coordinator at the UN said that the scale of pandemics requires that risks must be managed by governments, NGOs, and businesses, not just humanitarian agencies.

GROWTH OF CHILDREN A Davos campaign by UNICEF, including the free 140-page report “The Investment Case for Education and Equity,” highlighted the education needs of children and the huge potential yields of a greater resource commitment to young minds.

UNEQUAL SIGNS The Davos “Issue Briefing” on income inequality convened two days after President Obama took on the wealth gap in his State of the Union and a day after billionaire Jeff Greene drew scrutiny for his remarks on the topic after flying his family and nannies on a private jet to Davos. Christopher Pissarides, London School of Economics and Political Science professor, discussed how to approach redistribution of wealth in a free market system through taxes and public programs. He looked to Sweden for an example, where a high trust in government is essential to a jobs program for nannies that also allows both parents to work.

UNDER A TECH As world leaders from Obama to Merkel give serious attention to cybersecurity and data defense issues, some of the web’s biggest names gathered for the “In Tech We Trust” panel. “Users need to be able to own their own data, and even be able to take it to other systems,” Yahoo CEO Marissa Mayer said. The video replay is worth watching for anyone interested in an impressive, direct look at the starpower and brainpower Davos gathers on pressing concerns.

VISUALIZING GLOBAL COMPETITIVENESS While Davos rests, explore this interactive graphic that compares national performance in matters of pay, productivity, and innovation.

We’ll be back here tomorrow to wrap up the most powerful powwows you might have missed.

This article was produced on behalf of Bank of America by the Quartz marketing team and not by the Quartz editorial staff.