Sorry, Obama doesn’t get the credit for the US economy

Like bond markets, politics has a well-defined credit cycle.

Like bond markets, politics has a well-defined credit cycle.

But instead of following the boom-bust pattern of finance, political credit markets swing between the spotlight-hogging that takes place during good times and the blame-gamesmanship when things go wrong. That’s important to keep in mind now, as the momentum of the US economy becomes more difficult to dismiss.

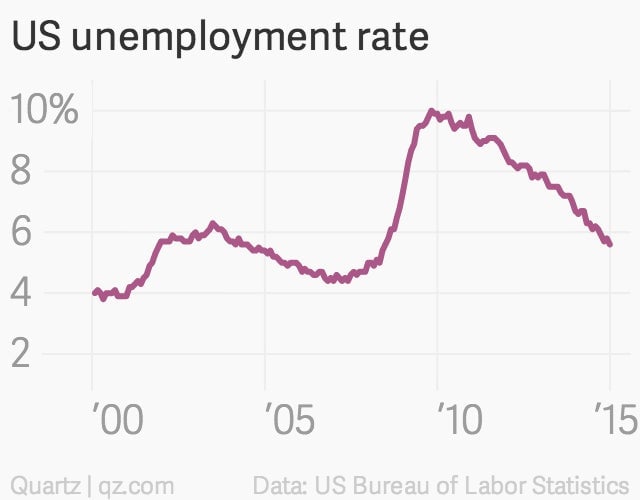

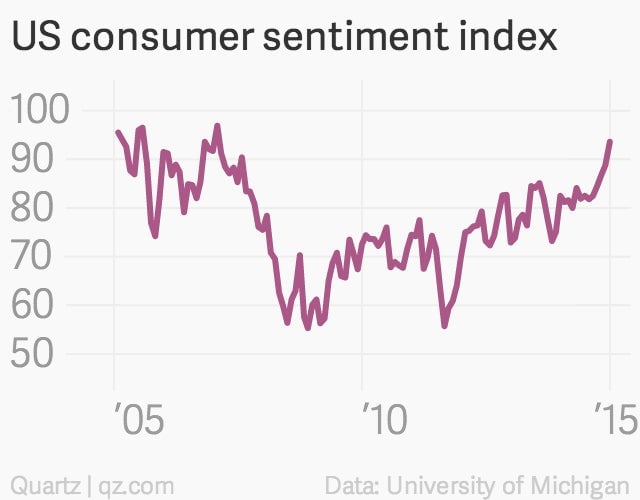

Six years into the recovery, Americans are finally beginning to feel the benefits. The December jobs report, for example, marked the 58th consecutive month of job growth and capped the best year of payroll expansion since 1999. Unemployment has tumbled sharply. Consumer confidence is hitting highs not seen since well before the financial crisis. (Of course, some of us have been banging the drum on the significant momentum in the US economy for months, if not years.)

Who will get the credit for the recent improvements? It certainly won’t be Obama. With Congressional Republicans effectively railroading him since their capture of the House in 2010, the president has been largely stifled in his efforts to push through measures that would drive domestic economic growth.

So should we be thanking the Republicans? Well, that’s certainly what Senate majority leader Mitch McConnell, a Kentucky Republican, would have you believe.

“After so many years of sluggish growth, we’re finally starting to see some economic data that can provide a glimmer of hope,” he said in a statement last week. “The uptick appears to coincide with the biggest political change of the Obama Administration’s long tenure in Washington: the expectation of a new Republican Congress.”

But this was a shameless grab for unearned credit, and it deservedly got an outright “false” rating from nonpartisan fact-checking website Politifact.

You see, the Republicans spent the first six years of the Obama administration trying to disrupt any sensible effort to jumpstart the economy. And in the past few years, they’ve been hugely successful at it.

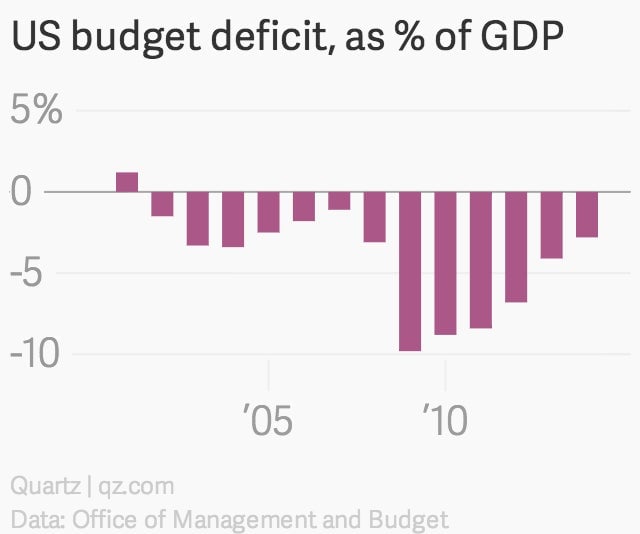

The proof is in the pudding. And like the British, when we say “pudding” we mean something besides “pudding.” In this case, we mean federal budget deficits.

Conventional economic thinking, first defined by Keynes, calls for “expansionary fiscal policy” during economic downturns. The idea is that with households and companies both retrenching, government is the only entity left with the wherewithal to borrow and spend. And since it can, it should. And early in the recession, it did.

US deficits exploded to roughly 10% of GDP in 2009 as the US borrowed big to keep the Great Recession from becoming another Great Depression. Much of that wasn’t Obama’s doing. (For instance, a large part of it was needed to pay for the $700 billion TARP financial bailouts program that came out of George W. Bush’s White House.) But a lot of it was, like the $787 billion American Recovery and Reinvestment Act, which Obama signed into law in early 2009.

Large deficits—coupled with activist monetary policy—were precisely the economic medicine that was called for. In early 2009, the US economy was losing an almost unthinkable 800,000 jobs a month. Financial markets were frozen. Companies and consumers were hoarding cash. Only a government action kept US from being sucked into an economic black hole.

But after the Republicans took control of the House in the 2010 election, deficits shrank sharply as the Obama administration agreed to a series of poorly thought-out spending cuts in order to appease a Republican Congress that, at times, looked ready to default on the US debt. (See the Budget Control Act of 2011.)

Let’s be clear. This was a bad thing. It meant that US fiscal policy was actually working against a US recovery over the last few years. And it’s one of the reasons that the recovery has been so sluggish. The result is that the government has been a giant drag on growth until very recently. (And more recently improvement in government spending has been pretty closely correlated to US economic pep.)

And that’s where things become difficult for Obama. The Republicans’ success in forcing him to run stingier budgets severely undercuts his own ability to take credit for the buoyancy now seen in the US economy. Some argue that things would have been far worse without the stimulus program he put in place back in 2009. True. Also true: the Obama administration made a good call in pushing the US auto bailout. (The auto industry has been a bright spot for the economy in recent years.) But for the US populace, these important programs are distant memories.

In any case, “it’s not as bad as it could have been” is never the strongest political message to send. In recent years, there just haven’t been enough high-profile economic programs that would allow the president to take a victory lap on the latest job numbers. The public’s view is clear. Despite the economic improvement in recent months, less than 50% approve of his handling of the economy.

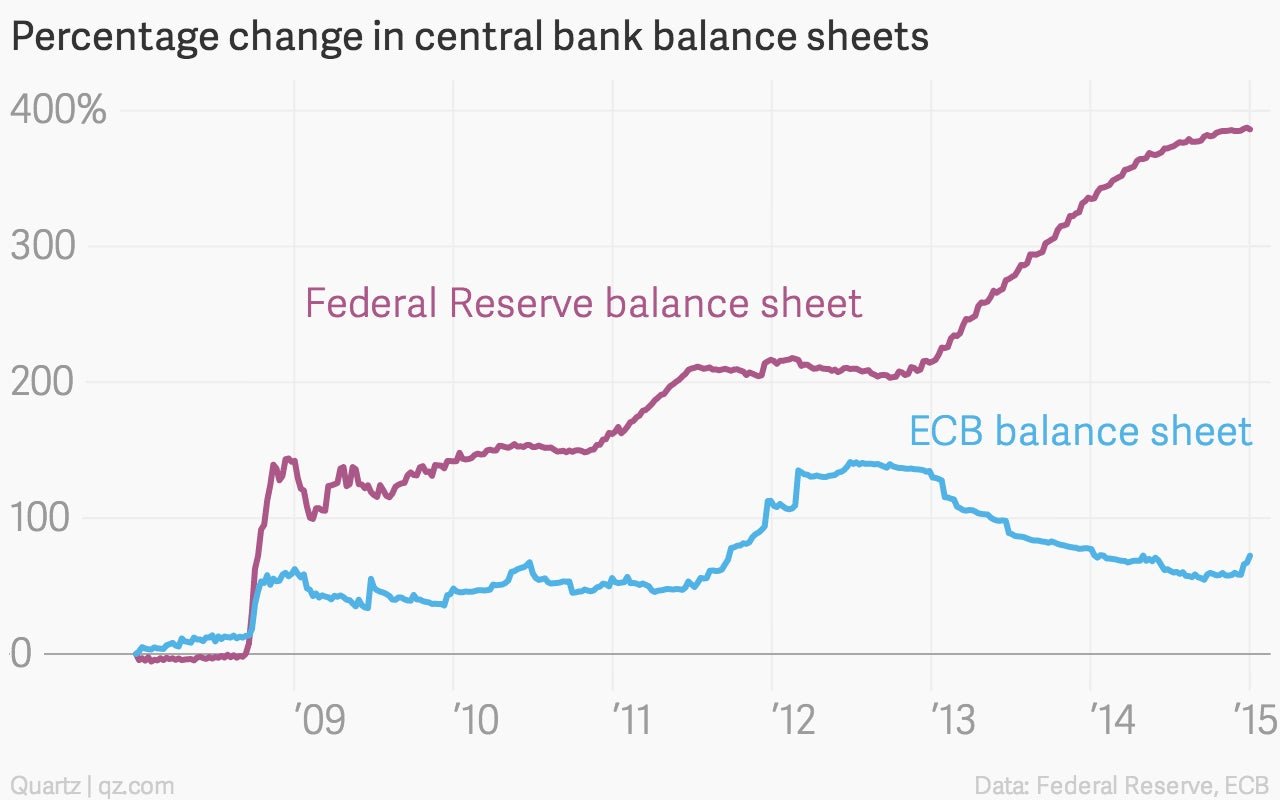

For the record, there is actually one institution that deserves a ton of credit for the US economic rebound: the Federal Reserve.

The US central bank, first under Ben Bernanke and now under chair Janet Yellen, relentlessly administered the economic medicine that historians and economists know is needed in the aftermath of a giant banking crisis and deep, deep recession: Massive money printing.

Disagree that this was the right prescription? It’s true the US economy isn’t fully cured just yet. Wages are weak. Labor force participation is low. But the US unemployment rate is down to 5.6%. The euro zone’s is 11.6%. And that, in a nutshell, explains why the European Central Bank is expected to launch a giant, Fed-style, bond-buying program of its own very soon.

The Fed took considerable political risk by enacting unconventional monetary policies that, especially in the context of the preceding 20 years, seemed downright radical. And it is the Fed, more than anyone in the White House or Congress, that deserves the recognition for the recovery that is well underway now.