The US economy isn’t having a ’90s flashback, it’s having an ’80s flashback…and it’s totally rad

In its recent, year-end spectacular, the Economist argued that the ghost of the late 1990s is hovering ominously over the global economy.

In its recent, year-end spectacular, the Economist argued that the ghost of the late 1990s is hovering ominously over the global economy.

We see the point. There’s a surfeit of San Francisco hubris amid sky-high technology valuations. The ruble is plummeting and there’s talk of a replay of Russia’s 1998 default. All the while, equity markets seem to be trotting ever higher.

But we’d argue that, at least for the US economy, the flashback is not to the late 1990s, but rather the 1980s.

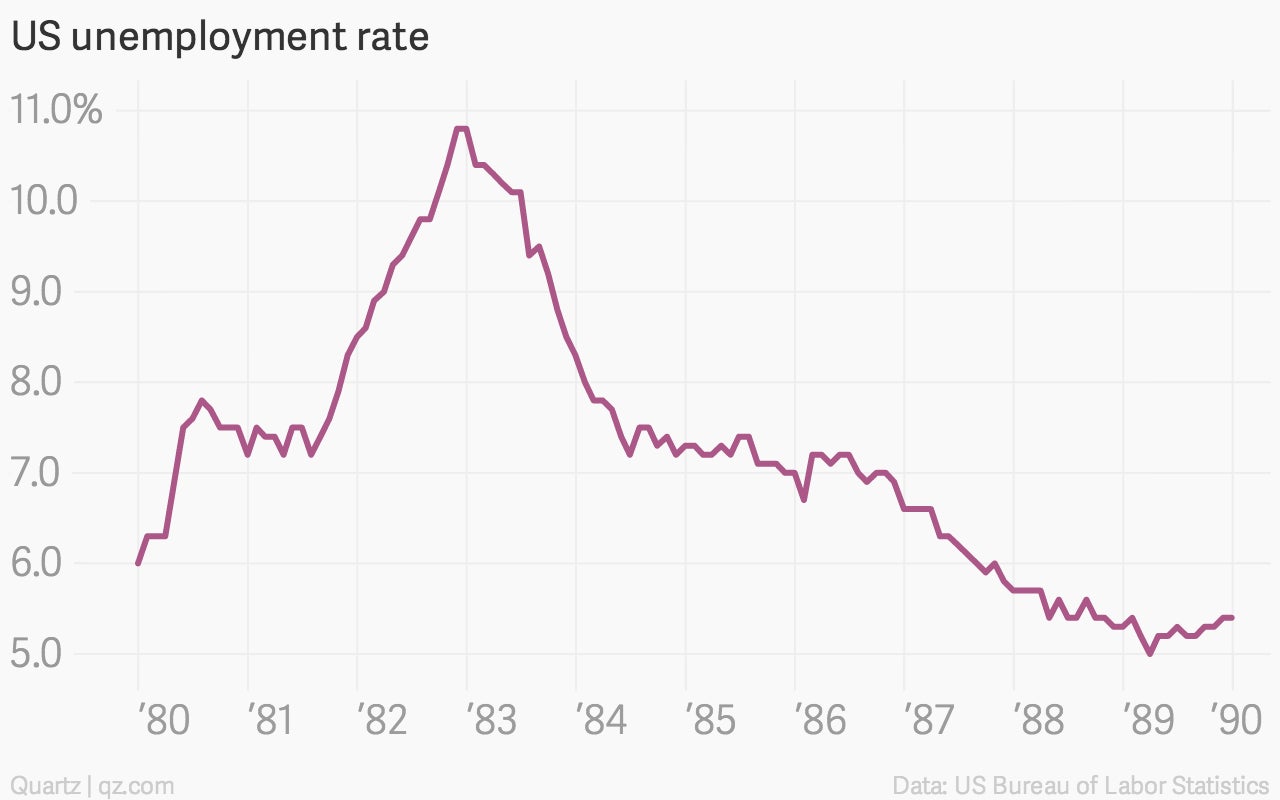

Think about it. While the 1980s is often remembered as a relentlessly robust period for the US economy, that’s just because it ended that way. The early 1980s actually were pretty miserable. Unemployment topped 10%, the highest since the Great Depression, after the Federal Reserve inflicted a recession on the economy in an effort to crush inflation. In fact, the recession of the early 1980s was the worst in recent memory—until the Great Recession geared up in 2007.

Eventually the Fed of the 1980s took its foot off the economy’s oxygen line by letting interest rates fall. And the economy snapped back to life remarkably, with a steep decline in unemployment in 1983. The jobless rate stayed pretty much stable in 1984 and 1985.

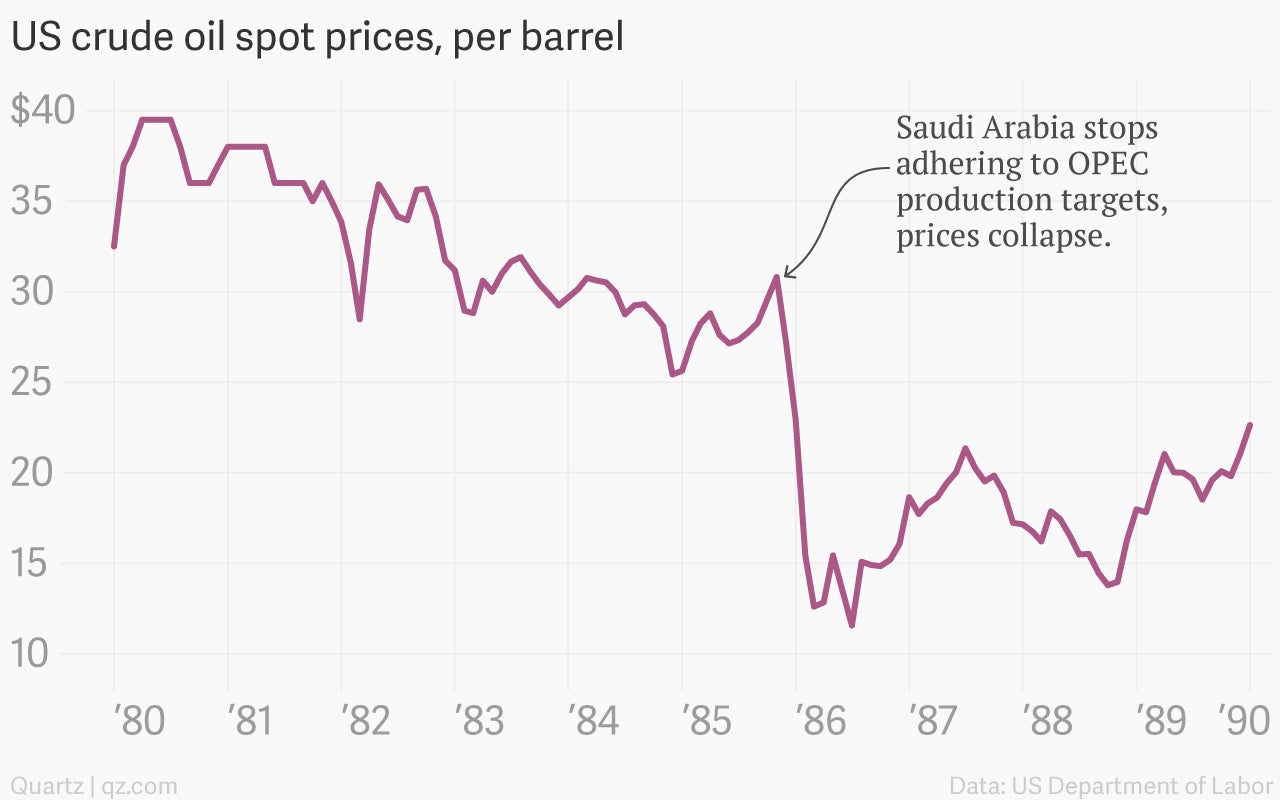

Then, in late 1985, something totally unexpected happened. Saudi Arabia became embroiled in a price war in the oil markets. Crude oil prices collapsed, followed by gasoline prices. The decline in oil prices seemed to send the US economy into higher gear, as unemployment tumbled to 15-year lows of roughly 5% in the late 1980s.

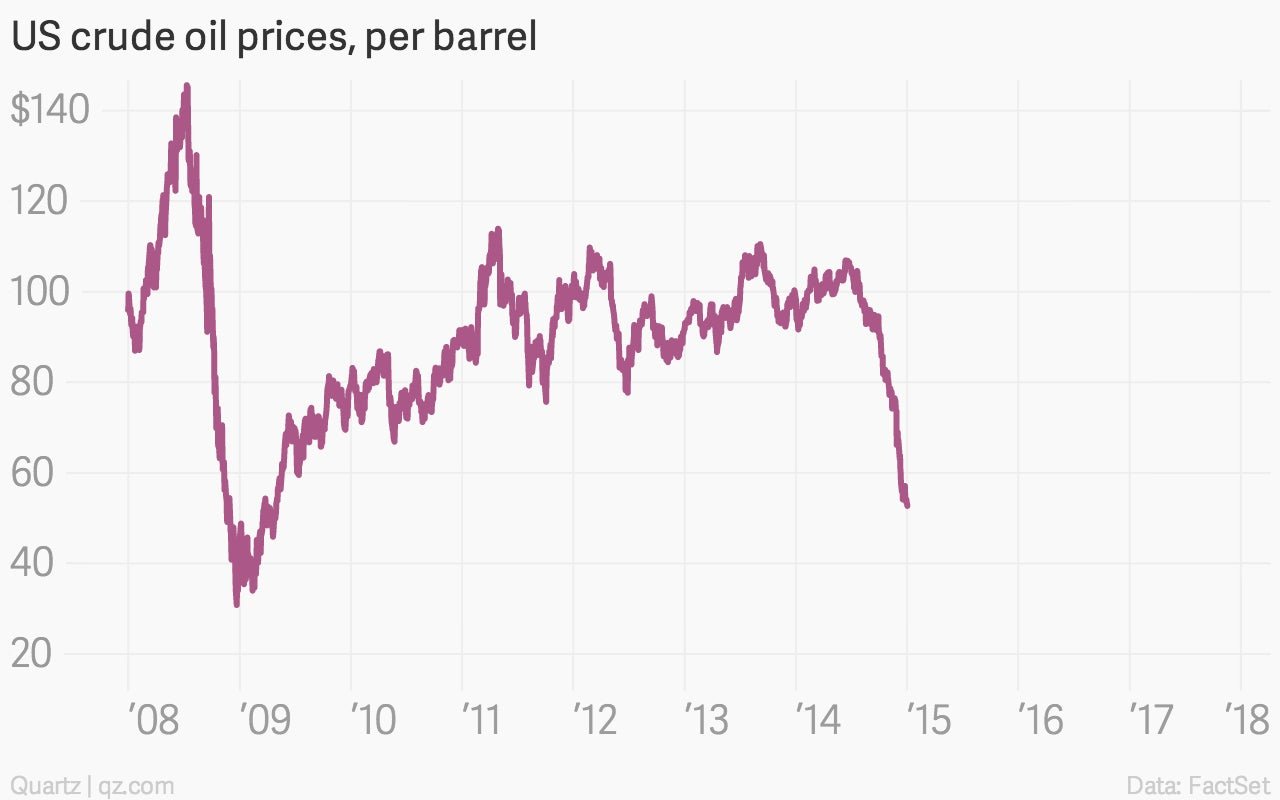

The US economy of today is different from the US economy of the 1980s. It’s much more energy efficient, for example. Nonetheless, it’s hard to overstate the importance of the recent collapse in oil and gasoline prices. (Crude oil is down more than 50% in the last six months.) In an economy that is as consumption-driven as the US, it’s really worth paying attention to.

Will the final years of the Obama era be like the final years of the Reagan era, with low gas prices and relatively low interest rates helping to drive down unemployment?

Time will tell.

But remember, just because the economy stands to gain strength in coming months, this doesn’t guarantee investors will have a smooth ride. Remember, both the late 1990s and the late 1980s experienced spectacular stock market crashes after several good years of economic growth.