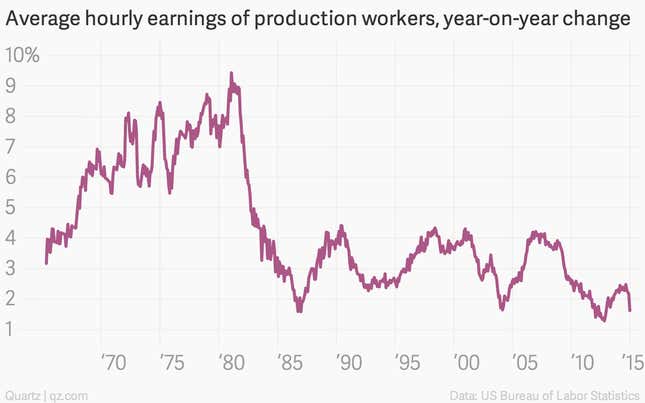

America’s stellar December jobs report came with a serious problem: persistent weakness in American wages. Wages of production workers rose a scant 1.6% in December 2014, compared to the prior year, quite low from a historical perspective. Still, the situation isn’t quite as bad as it looks. Why? Oil.

Though oil field workers might beg to differ, the global collapse of crude prices is a windfall for the US economy, keeping overall inflation in check and propping up real (or inflation-adjusted) wage growth. Inflation-adjusted wages measure the purchasing power of employee paychecks. Here’s a look at year-over-year changes in real wages over the last few years. (You’ll notice what looks like a surge during the worst of the recession, as prices collapsed and the US showed signs of slipping into deflation.)

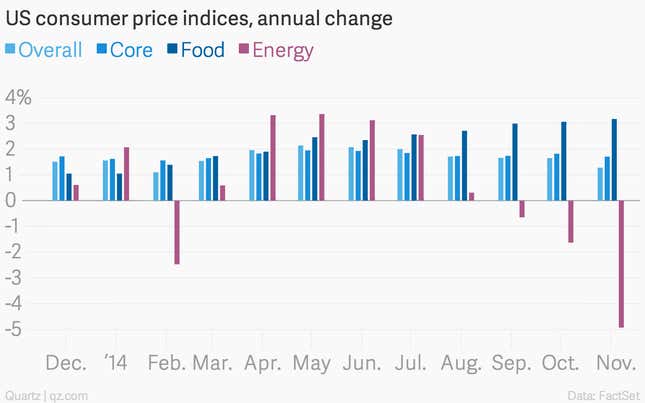

In short, as prices fall, real wages rise. In November, the US consumer price index fell 0.3% compared to the prior month, the largest decline since December 2008. Year-over-year prices are still up. But, as you can see in the chart below, consumer energy prices have collapsed.

This mini-stimulus—perhaps we could call it the Saudi stimulus—of lower energy prices has important economic implications. In a research note earlier this week, Goldman Sachs economic analysts said they expect real income growth to amount to roughly 5% later this year, crediting both lower inflation and a sturdier job market. “The most obvious reason to expect continued strength is the pickup in real income,” they wrote of the US economy.