India’s Tata Motors, struggling to sell its passenger cars in the subcontinent, is scaling up its business to sell its more profitable commercial vehicles (CVs) into high-growth Southeast Asian countries.

That’s an unknown territory for most Indian carmakers. Tata Motors’ push to the east will also mean that it will now go head-to-head against Japanese and Korean automobile giants in the 10-member Association of Southeast Asian Nations (ASEAN) region, including Indonesia, Vietnam and Malaysia.

“We have made some significant progress in our plans for ASEAN,” a Tata Motors spokesperson told Quartz, “while Russia and Latin America is work in progress.”

Of course, the Mumbai-headquartered company has a grand history of global expansion. In 2008, it bought Jaguar Land Rover (JLR) for $2.3 billion and has transformed the British marquee brand into a serious money-spinner.

But even JLR is now under pressure as sales in China have slowed down amidst a sluggish economy. Between September and December 2014, JLR’s profit after tax fell by 4% to Rs5,605 crore ($903 million) against Rs5,851 crore ($942 million) during the same quarter in 2013.

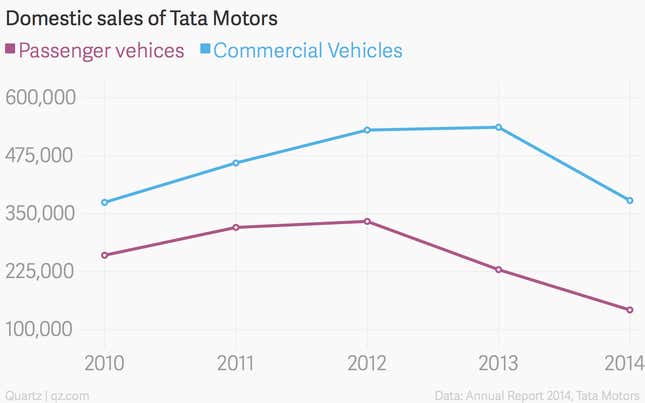

At home, the going has been even more difficult for debt-ridden Tata Motors as sales of its passenger vehicles have trailed others quarter-after-quarter. In 2014, the company’s market share in the passenger vehicle segment fell to 5.8% from 9% the year before.

For the September-December quarter, Tata Motors’ profit after tax fell by 26% to Rs3,581 crore ($576 million) compared to Rs4,805 crore ($774 million) in the corresponding period the year before.

On Jan 27. the company said that it plans to sell additional shares to its shareholders to raise Rs7,500 crore ($1.25 billion) to reduce its debt and expand its operations.

The ASEAN trip

“We have consciously taken the strategic decision to have a globally diversified business to better manage the cyclicity in the auto business, especially the CV market,” the spokesperson said in an emailed reply.

That includes pushing deeper into ASEAN, including high growth countries like Indonesia, Vietnam and Malaysia, where a burgeoning middle class is spending more.

Tata Motors has been building a presence in the region for some time now.

In 2006, the company partnered with Thailand’s Thonburi Automotive Assembly Plant to create a hub to manufacture and distribute their vehicles to other ASEAN countries.

In 2013, Tata Motors launched its Indonesia operations and a year later, in April 2014, it also announced its entry into the Philippines market.

“The company is also exploring options for setting up a manufacturing base in Indonesia to serve the country and the ASEAN region,” the spokesperson said.

“Also, as announced during our Q1 results (August 2014), Malaysia and Vietnam markets were in the pipeline, out of which we launched the Tata Motors brand in Malaysia in January 2015. We will be opening up Vietnam in the coming year.”

With large Asian carmakers—including Toyota, Nissan Isuzu and Honda—already deeply entrenched and fighting for market share, it’s unlikely to be an easy ride for Tata Motors.

For instance, in Indonesia—now the largest automobile market in Southeast Asia—Toyota currently has 36% market share in the passenger vehicle market followed by Daihatsu and Mitsubishi.

It’s an opportunity, nonetheless, as ASEAN grows to become the world’s fifth largest automotive market by 2019.

“The region has high growth potential,” Deepesh Rathore, director at Emerging Markets Automotive Advisors told Quartz. “It’s not impossible to capture the market.”