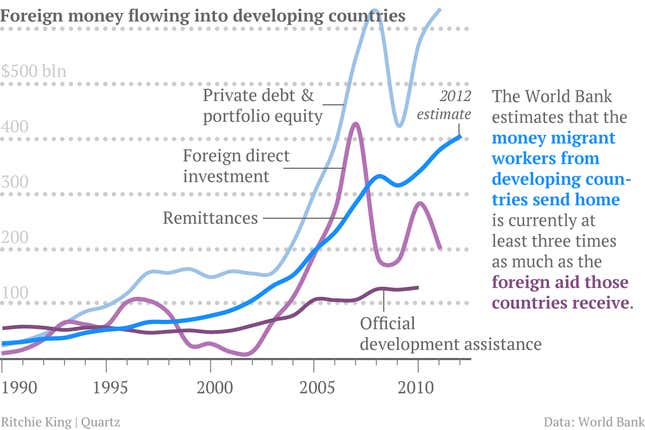

Migrant workers abroad will send $406 billion back to their home countries this year, the highest level in over a decade, according to a new report by the World Bank. This money, also known as remittances, typically goes from developed to developing countries. It’s an important, and as it turns out, possibly more reliable source of foreign funding for poorer nations than other sources.

In the face of external economic shocks, remittance money is more stable than flows of foreign money like foreign direct investment (FDI) or money transferred into the country by individuals from business or investments abroad. In 2009, the worst moment of the financial crisis, global remittances fell 5.5% from 2008 while FDI and private debt and portfolio equity dropped off dramatically and suddenly, according to a 2011 report from the UNDP. Remittances can even rise during financial crises and natural disasters because migrants living abroad send more money home to help their families.

In contrast to foreign aid, usually channeled through organizations, remittances go straight from a migrant worker to his or her family and friends and can be better tailored to people’s needs. Official foreign aid provided by governments, sometimes seen as an extension of a country’s foreign policy, is often vulnerable to diplomatic ups and downs as well.

The chart below looks at remittances that have been officially counted. The true amount is likely much higher because of how much money is sent through informal channels. The World Bank estimated in 2010 that true remittance flows could be as much as 50% more than the official figure.

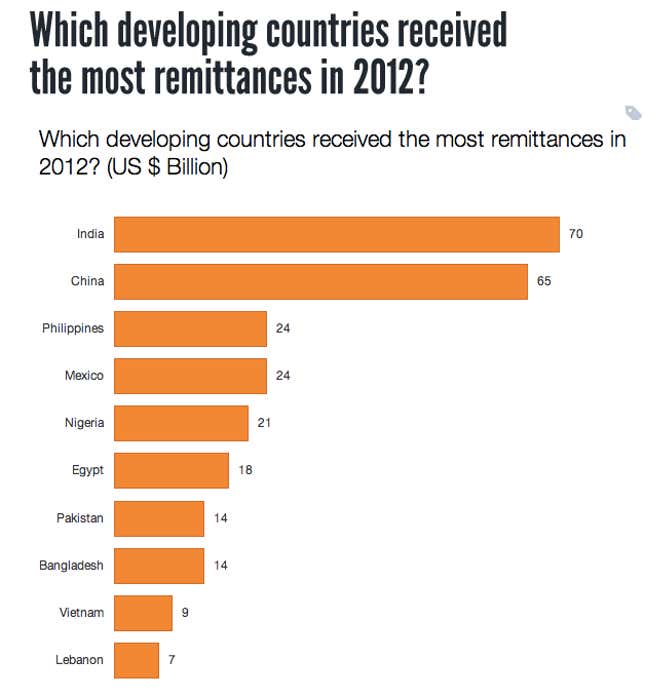

Remittance flows aren’t rising everywhere. High unemployment in Europe has meant weaker remittances flows (unemployment among migrants tends to be higher than that of native workers.) This was offset by increases elsewhere. More money from Russia, an energy exporter that has benefitted from higher oil prices, is flowing to Armenia, Georgia, Kyrgyz Republic, Moldova, and Tajikistan. Gulf Cooperation Council countries on the Saudi Arabian peninsula also saw increases in remittance outflows while flows into South Asia increased. The top recipients in 2012 are India and China.