Apple shows a flagrant disregard for the law of large numbers

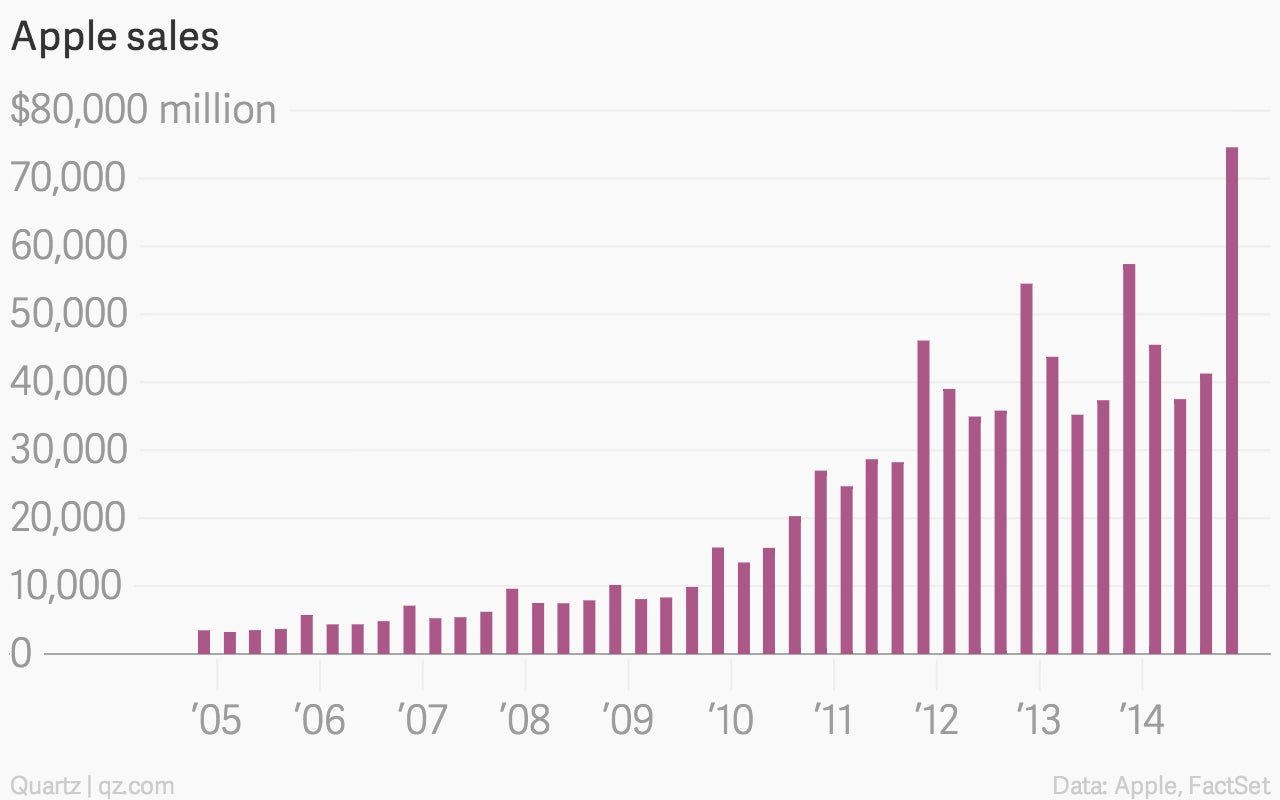

Apple’s fourth-quarter results were truly astounding. Profit jumped 38% to a record $18 billion. But for my money, Apple’s revenue numbers were the most impressive result. The company boosted sales 30% to $74.6 billion.

ByMatt Phillips and Matt Phillips

Apple’s fourth-quarter results were truly astounding. Profit jumped 38% to a record $18 billion. But for my money, Apple’s revenue numbers were the most impressive result. The company boosted sales 30% to $74.6 billion.

Let’s just say that again. From a base of nearly $58 billion, Apple was able to raise revenues by 30%. This is not something that’s supposed to happen when sales are this large. That’s because of something known as the law of large numbers. The short version: As a company’s sales grow it makes it increasingly difficult to generate the large percentage jumps that Wall Street craves. The Times spelled it out clearly in this story from June 2014.

What makes Apple’s challenge particularly daunting is the law of large numbers. Its sales are so big that even another new strong product — unless it’s a gigantic hit on the order of the iPhone — won’t lead to the kind of growth to which some investors have grown accustomed, noted Toni Sacconaghi, a financial analyst who covers Apple for Bernstein Research. He put it this way: If Apple makes an iWatch and sells 10 million units in the first year, it would add a mere 50 cents to its earnings per share, barely a single percentage point.

“Most people would say, if you sell 10 million units of something that would be incredible,” Mr. Sacconaghi said. But not so with Apple. “There are very few things that could move the needle,” he added.

Well, Apple has indeed moved the needle—and then some.