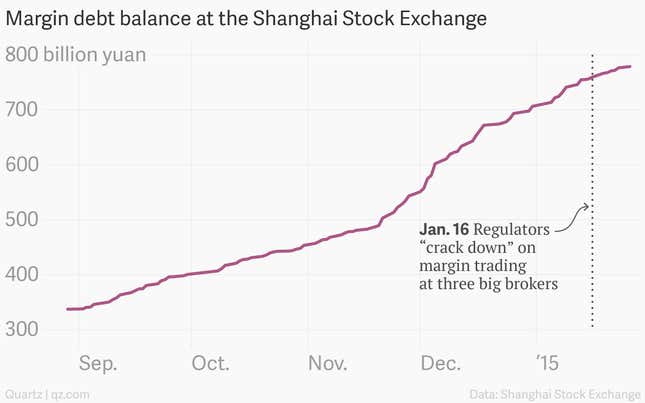

About that “crackdown.” On Jan. 16, Chinese authorities barred three big brokers from opening new margin-trading accounts for three months. The brokers had lax controls on lending to investors, so investors could buy more stock, regulators said. Shares plunged on the day, but borrowing took only the briefest of pauses before setting a series of daily records (see chart above).

Amid slowing economic growth, China’s stock markets have soared on the back of aggressive borrowing by the retail investors that dominate trading in Shanghai and Shenzen. And they show no signs of slowing down—the Shanghai Composite Index is now more or less back to where it was before the brokers were punished.

Now, Reuters reports that a new investigation into margin trading is in the works. More curbs on excessive borrowing to bet on stocks might stoke further volatility in China’s markets.