The Reserve Bank of Australia trimmed interest rates by another quarter percentage point on Dec. 3, down to 3.00%, in a bid to help the Antipodean giant (no offense meant, New Zealand) smooth the transition from being a completely export-driven entity reliant on Chinese demand to a more balanced economy that can count on domestic consumer spending. As the Bloomberg report in that link points out, some 90% of Australian mortgages are floating-rate loans, which means that cutting interest rates translates directly into lower monthly housing payments for millions of consumers. Theoretically that money could be spent elsewhere in the Australian economy.

And in normal times, a lower interest rate would also weaken the national currency. One way to think about central bank interest rates is as the return investors can expect on holding investments denominated in that currency. So, just like the deposit rate potential bank customers consider before depositing their cash in different savings banks, a lower rate—all else being equal–should make that bank, or currency, a less attractive place for capital.

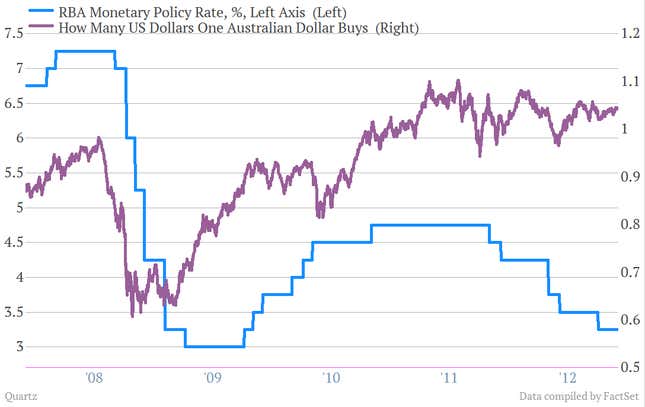

But of course, all things never really are equal. And the Australian dollar has stayed remarkably strong in recent months even as the Reserve Bank has chopped rates six times in the last 14 months. Even today, after the rate cut the Aussie is up 0.5% against the US dollar. Why is that? Here’s a look at the Aussie versus the Reserve Bank’s target rate. You can see that the recent round of cuts hasn’t done much to weaken the currency. (FYI, the most recent rate cut isn’t reflected in this chart, which still shows the policy rate at 3.25%.)

Likely it reflects the fact that AAA-rated Australia is really coming into its own as something like a little brother to the United States, the place where global investors have long stashed their cash for safekeeping. That should keep Australian interest rates low—as investors are willing to accept low returns on their money in exchange for peace of mind. And while it limits the ability of the central bank to stimulate growth by weakening the currency to boost exports, those low interest rates make it easier and cheaper for the government itself to engage in fiscal spending to help the economy.