Bitcoin’s day of reckoning is here

On the same day that the alleged mastermind of the clandestine Silk Road marketplace was found guilty for a host of crimes that thrust bitcoin into the public spotlight, regulators in New York came a step closer to licensing businesses that deal in the digital currency.

On the same day that the alleged mastermind of the clandestine Silk Road marketplace was found guilty for a host of crimes that thrust bitcoin into the public spotlight, regulators in New York came a step closer to licensing businesses that deal in the digital currency.

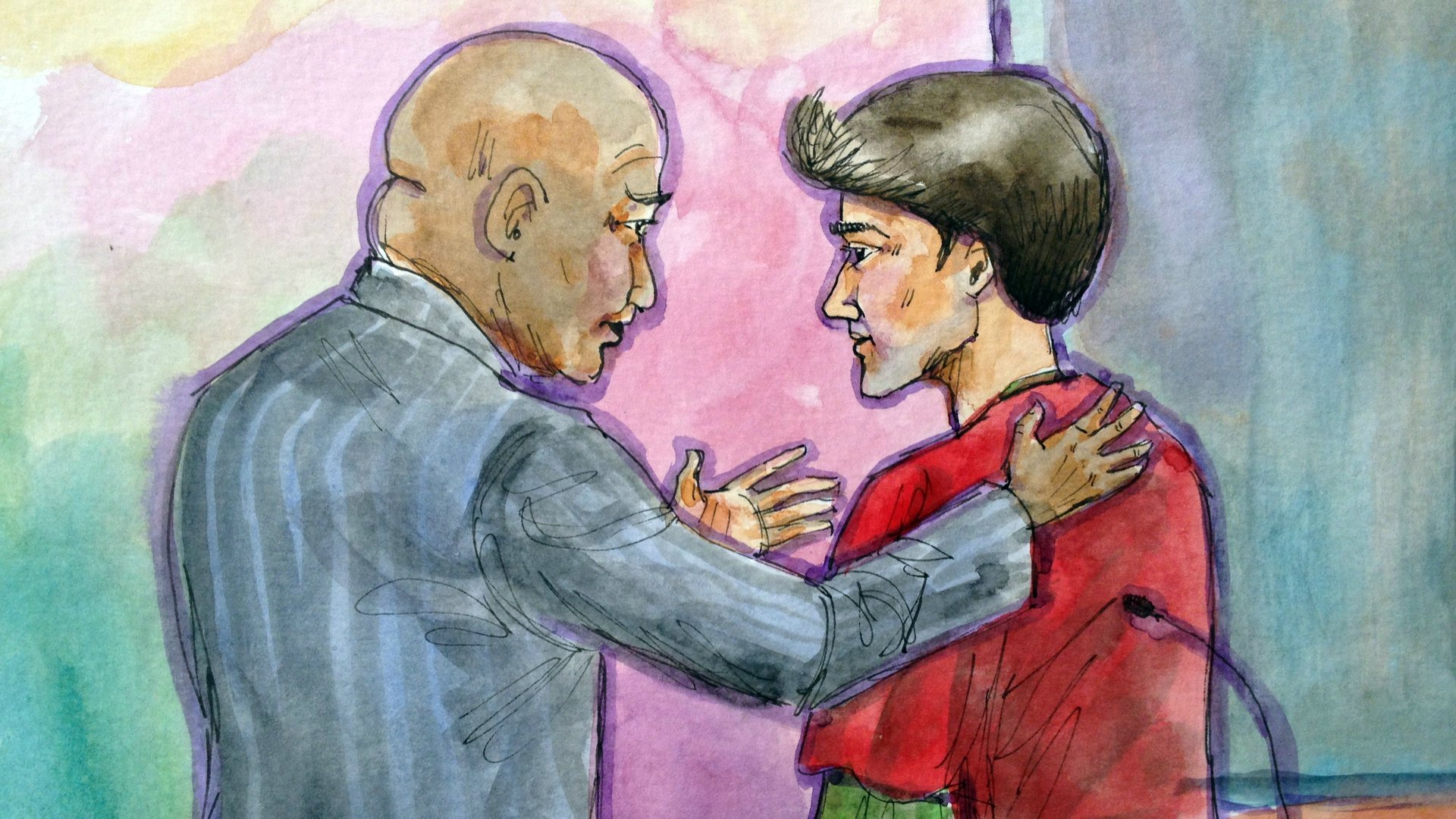

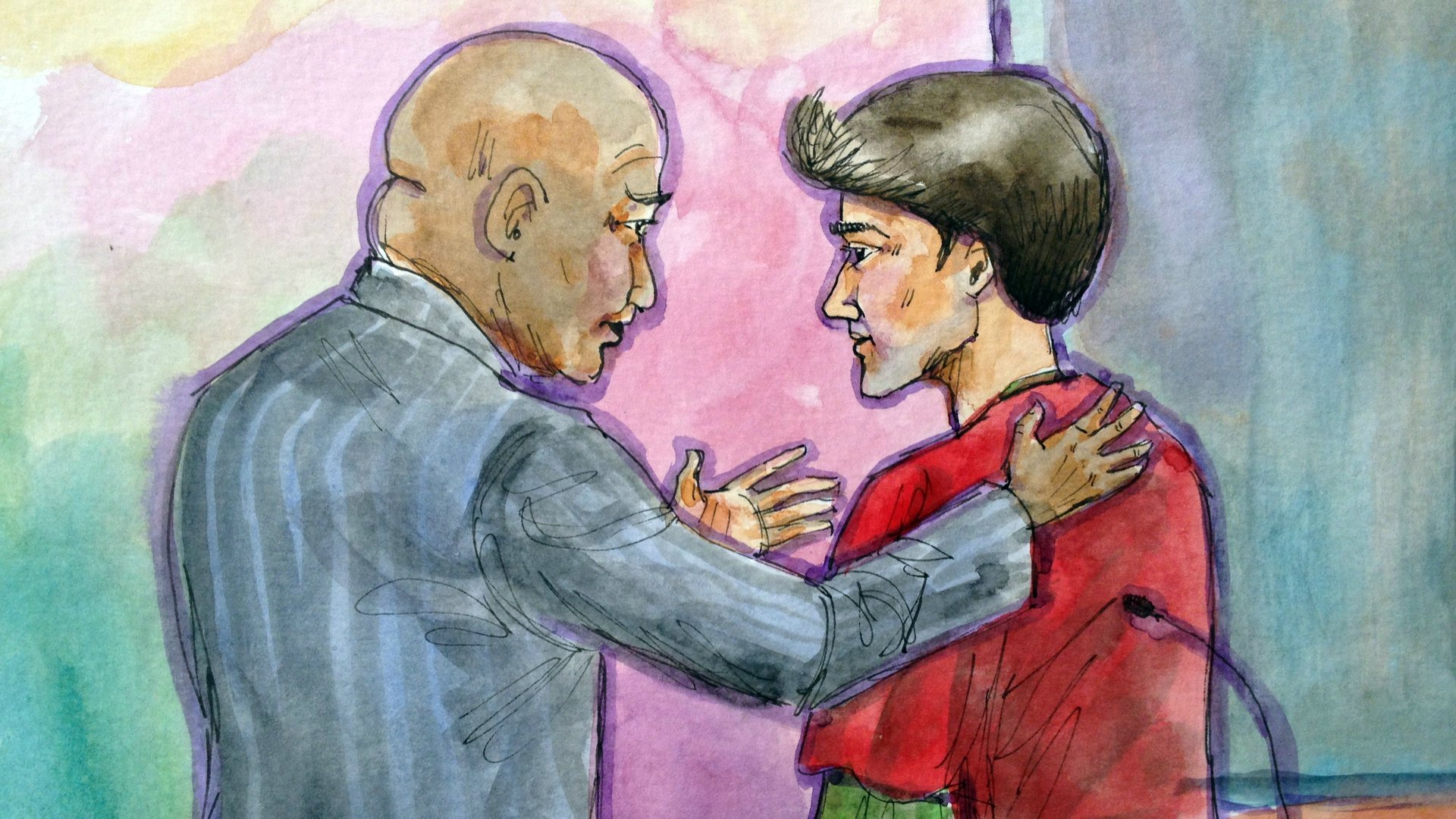

First, the shadowy stuff. Ross Ulbricht, a developer who prosectors said went by the pseudonym ”Dread Pirate Roberts” online and ran a $1.2 billion black market bazaar for illegal goods, was convicted of all seven counts against him, including money laundering and running a criminal enterprise. Bloomberg reported that the jury took just three hours to reach its decision in the case, which was heard in federal court in New York.

While a blow to some of the libertarians and anarcho-capitalists that turned Ulbricht and Silk Road into what Wired describes as “a cause célèbre,” Ulbricht’s conviction also closes a chapter in the sketchier parts of the bitcoin story that highlighted the currency’s alleged use as a conduit for extortion and drug trafficking.

On the same day, New York’s Department of Financial Services came out with a revised set of rules to regulate companies that buy, sell, hold, and transfer bitcoin and other virtual currencies. Businesses that issue gift cards or reward points will be excluded from the rules, following complaints from retailers like Wal-Mart and Amazon over an initial definition of virtual currency they found to be overly broad.

The so-called “bit license” regulations are important because once finalized, they will become the first piece of state regulation to govern what was originally intended to be an unregulated, decentralized currency free from the hand of government.

Of course, that was before bitcoin was tied to criminal activity, and before multiple cases of collapses and theft involving bitcoin exchanges.

New York’s chief financial regulator, Ben Lawsky, has said he wants to “come up with appropriate guardrails that help protect consumers and root out money laundering,” without stifling the benefits of bitcoin and the technology behind virtual currencies.

But it’s not going to be easy.

Companies that run bitcoin exchanges or funds will now have a host of new requirements: They will have to file quarterly financial reports, keep records for at least seven years, and maintain capital reserves (with the amount determined by the superintendent). Plus, any marketing will be required to come with a disclaimer that “virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject” to FDIC and other consumer protections.

It’s a far cry from the libertarian-utopian idea that bitcoin would strip away government control from the free exchange of money. But it all might go a long way toward legitimizing a concept that heretofore has been notable mostly for its less savory side.