Changes in frequent flyer policies scare travelers. To the person who has been saving up points for a big trip, a jump in flight prices or a reduction in per-flight “income” can feel devastating.

British Airways just did both, raising the number of Avios—the BA reward currency—needed for many economy tickets and cutting the number of Avios earned by flying on an economy ticket. (Though, as The Guardian points out, Business and First Class flyers actually benefit from the change.)

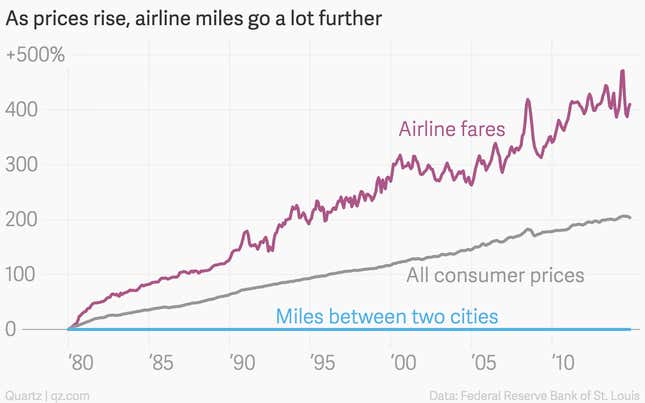

In the short term, moves like BA’s are inflationary: A point buys you a smaller share of a flight today than it did yesterday. But in the long term, when compared to prices, all points programs tend to be the opposite—they’re deflationary.

This is because airline fares—as tracked by the US Bureau of Labor Statistics—have been increasing faster than inflation, but reward ticket prices as measured in points have not. And of course, the distance between two cities—the proxy used for point accrual—remains constant.

Airlines hike their prices much more frequently than they update their rewards programs. Since Jan. 1985, there have only been 13 months in which airfares were cheaper than they had been five years earlier. The number of points needed for award tickets at many US airlines has remained constant or even gone down since the 80s, notes MileCards.com.

As a result, the value of those points effectively grows over time—meaning, the longer flyers wait before cashing in their points, the more money they end up saving. Consider the following scenario:

- A flyer earned 50,000 points in 1980 after spending the 2015 equivalent of $1,000 on four $250 flights (equal to $88 per flight in 1980 dollars).

- In 1980, she could have redeemed those 50,000 points for another $250 flight.

- Today, she can still redeem those 50,000 points for the same flight—even though that flight now costs $340.

This flyer’s 50,000 points used to buy her an inflation-adjusted $250 flight. They now buy her a $340 one.

Sweetening the deal for a long-term frequent-flyer-program member is that the options for redeeming have increased dramatically due to industry consolidation and more permissive deals between operators. According to MileCards.com, “25 years ago you couldn’t fly a [Continental Airlines] award with more than one partner, nor could you even connect within Europe.” Now all of that is possible.