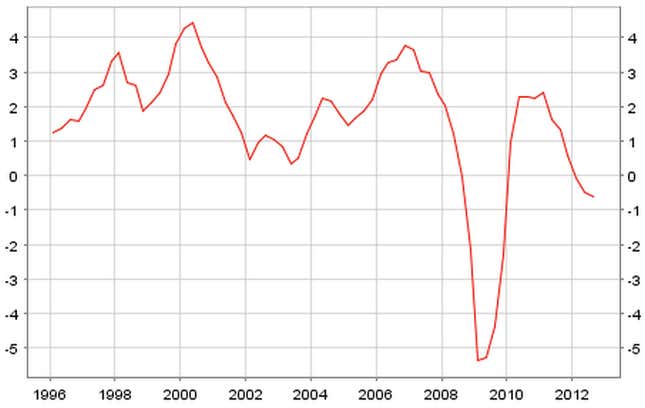

European Central Bank (ECB) President Mario Draghi sent the value of the euro reeling this morning when he announced downward revisions to the central bank’s growth projections through 2014. The bank now believes that the 17-nation euro area’s total GDP will grow at a rate between -0.6% and -0.4% for 2012, between -0.9% and 0.3% for 2013 and between 0.2% and 2.2% for 2014. He also decided—contrary to some analyst expectations—to leave the bank’s target interest rate on hold at 0.75%.

We’ve been expecting this trend. Banks have scaled back their lending, companies have cut down production and laid off their workers, and people have less money to spend. This is likely to carry on as European governments continue to bicker about how to bail out struggling countries and about the EU’s future more generally.

Although the ECB now expects the euro area economy to recover at the middle of next year, it now seems too late to avert the underlying problems that caused the recession in the first place. Banks are being held to ever-stricter standards and cutting off investments. Meanwhile foreign money-lenders like private equity shops and investment management companies have been reluctant to invest in anything but the safest assets, buying up distressed debt in Germany and the Netherlands but passing on similar investments in southern Europe.

Though it may be able to pour money into European banks and buy up bonds of struggling countries to keep them afloat, there’s little the central bank can do to help the region avoid recession. “ECB President Draghi stressed on several occasions that the ECB’s policy stance is accommodative and that the ECB has already taken far-reaching measures,” writes Morgan Stanley Chief European Economist Elga Bartsch. Although there’s more space to loosen credit and lending standards by pushing down interest rates further, “We need to acknowledge the risk that the ECB might simply stay put going forward.”