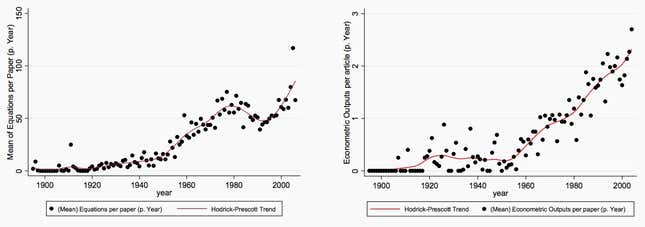

If you spend a lot of time reading economics papers—and who doesn’t?—you’ve probably noticed that there are a lot more equations and charts between the abstract and the conclusion these days.

The Oxford researcher Max Roser tweeted an interesting 2012 working paper Thursday that looked at just that. It examined the number of equations per paper published by top economists—Nobel laureates, winners of other prestigious economics prizes, and a random sampling of professors from well-regarded economics departments.

And yes, the team (Miguel Espinosa of the London School of Economics; Carlos Rondon, then of the International Monetary Fund, now at the University of Notre Dame; and Mauricio Romero of the University of California San Diego) built a mathematical model to do it. Because of course they did.

You guessed it: Papers are getting wonkier.

They also found that more math training is a good look if you’re angling for a Nobel prize one day, though people with oodles of equations in their papers didn’t get awards as often. The ones that did get awards tended to ease up on the algebra afterwards.

The replies to Roser’s tweet included questions about the paper’s methodology:

Concerns about the implications:

And of course a little fun:

If you haven’t had enough, check out this book chapter from the London School of Economics’ Mary Morgan, which offers both a quick history of model usage in economics and a look at its pitfalls:

Economists (just like their astronomer forebears) understand that a model stands in for their economic universe to enable them to explore certain properties of that world represented in the model. But whether they can come to valid conclusions about the behaviour of their actual economic universe is a much more difficult problem, as they know themselves.