Continuing—and possibly worsening—doldrums in Europe have forced Asian companies to find new trade partners elsewhere. The obvious approach? Upping their focus on the US, which is making progress toward better economic health while Europe appears to be slipping deeper into recession.

In the last few years, a decline in global demand for trade and a simultaneous glut of ships to carry that cargo have pushed shipping rates to the floor. They have been so low, in fact, that in February some shippers offered to pay companies money to charter their goods from out-of-the-way ports to more profitable ones. (The shipper and customer shared the fuel costs, which at the very least defrayed the shipping company’s expense for moving the boats.)

But over the last few months an important evolution has occurred: Firms are scaling back on the number of vessels they run on once highly trafficked routes from Asia to and from Europe and increasingly betting on a rise in Asia-North America trade. A report from Global Port Tracker forecast a 11.9% drop in northern European imports and a 4.9% drop in exports in the next six months, which would prompt a 9.3% drop in container cargo volume—and northern Europe has, to date, been doing far better than its southern European peers.

Faith in the strength of the US economy will probably increase if politicians can do away with lingering uncertainty surrounding the so-called “fiscal cliff,” a package of economic austerity measures that could cost the US about 5% of its GDP. Most economists expect that US politicians will “avert the cliff,” however, by passing a more palatable austerity package and raising the debt ceiling.

”The final development depends on the U.S. Therefore, it is difficult to accurately predict the development of next year, but if the US can solve its economic problems, there is reason to feel optimistic about the Pacific,” says Maersk Line’s Thomas Knudsen (paywall), chief executive of the line’s Asia-Pacific division.

Shippers plan to test this new demand from Asia to and from US ports starting December 15, when major carriers plan to simultaneously raise their rates by $400 per 40-foot-equivalent container unit. Shipping rates generally rise when there’s a higher volume of traffic on a route, so bringing more ships to any given route would bring down the price of moving goods.

But it’s wise to look at these trends beyond the shipping world. As the European crisis drags on, Asian companies are increasingly looking East across the Pacific for productive trade partners, deciding that the US—and not Europe—will play the critical role for the next few years of growth. While US imports of Asian goods have fallen off a cliff recently, they have declined at a far slower pace than those to the EU. And that decline could be temporary; many economists are predicting a resurgence in US consumers’ and business’ demand for goods after they get some certainty from Washington.

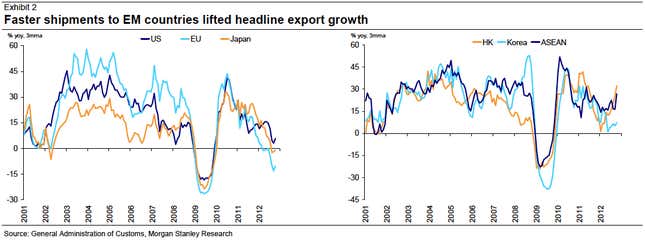

Admittedly, growth in Chinese exports to the US has increased at a far slower pace than has trade with other emerging Asian economies like South Korea and Hong Kong. ”While exports to EU remained lackluster and to Japan softened on the back of the island disputes, the pace of shipping to other Asian countries and the U.S. has picked up notably,” wrote Morgan Stanley analysts in a note on China released December 10.

Regardless, it’s clear that Asian companies are adjusting to a weaker EU and shipping goods elsewhere where there’s more demand. If Knudsen’s predictions are accurate, then this is a trend that will be magnified in the months ahead.