Apple sold $1.35 billion of Swiss franc-denominated debt this month, including a 10-year note paying 0.375% interest and a 15-year bond with a 0.75% coupon. That’s a lot of money from a relatively small debt market for a company that has a huge cash hoard and is coming off a bunch of other big debt sales.

Fusions’ Felix Salmon, in a post on Medium, was so surprised they didn’t charge investors for the privilege that he said it proved the existence of the “zero lower bound” for corporate debt. (Bloomberg’s Joe Weisenthal, in a post on Ello, was not convinced).

Either way, the simplest explanation is that Apple’s doing it because it can, but it’s also because Swiss rates are super-low after the Swiss National Bank cut them deep into negative territory.

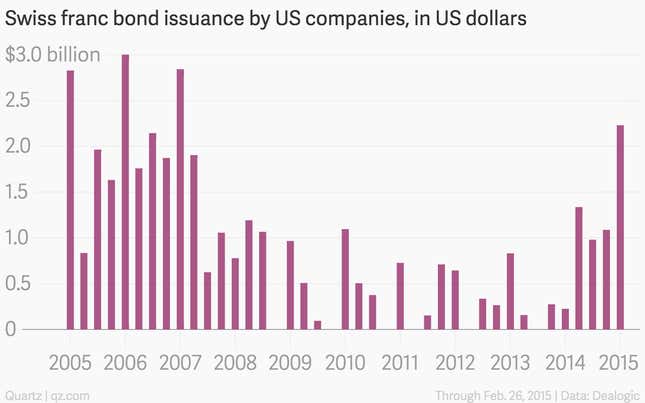

A lot of American companies are now charging into the euro bond game. According to data provider Dealogic, US debt issuers are having their hottest Swiss winter in eight years.