Waaaaaah. It seems like everywhere you look there’s some guy in finance crying about how the Fed ruined his life and there’s nothing good to invest in anymore and his bonuses are getting smaller and soon he’ll have to send his kids to public school. But there were winning bets to be made on Wall Street in 2012. And finding some of them was relatively simple: Just buy the thing that caused—or nearly caused—a major financial meltdown a couple years back.

Here are some of the best trades of the year, from our perspective. We’re sure there’s stuff we missed, so let us know on Twitter. (And by “us,” I mean “me”, @MatthewPhillips)

1. Subprime mortgage bonds

Yeah, sure, they almost tanked the global financial system four years ago. But that was then. And back then, they were supposed to be “AAA” rated pieces of paper. Guess what? They weren’t. They were more like junk bonds. And when the all-seeing, all-knowing market realized that, it adjusted prices. They plummeted, driving the value of all those mortgage bonds the banks were holding down so low the losses began to eat into the capital base of the world’s biggest banks. Voilà! Instant financial crisis.

Now, everybody knows these packages of mortgage bonds aren’t AAA. And that’s a good thing. It means you can buy them for the right price. And if you bought them early enough this year, you made a lot of money. The most widely watched gauge of the prices of these bonds—sort of like the Dow Jones Industrial Average of subprime debt—is the snappily titled ABX.HE.AAA.07-1, and it is up roughly 36% this year.

Why are these things rising? For one thing, the Fed is forcing folks out of their comfort zone to find higher yields, and subprime bonds offer those yields. And as they’re getting more popular, the supply is shrinking. Why? Because banks aren’t making and securitizing subprime loans any more. Rising demand + shrinking supply = higher prices.

Mortgage-focused hedge fund Pine River cottoned on to the trade early, as did others such as former Deutsche Bank star trader Greg Lippmann. He famously bet that the prices of these bonds would collapse and was proven right during the financial crisis. Lippmann’s hedge fund LibreMax showed the mental flexibility to switch sides, and has been raking it in on the trade.

2. US homebuilding stocks

And speaking of housing. Just. Wow. This was the year to own homebuilding stocks. The total return—price gains and dividend payments—from investing in the S&P 500 Homebuilding sub-index was just shy of 90% year-to-date this week. In price terms alone, Pulte Homes is up 160%.

3. Short Chávez

There’s no pleasant way to put it. Financial markets are thrilled that Venezuelan populist president Hugo Chávez looks to be locked in a serious battle with cancer. Prices for Venezuelan bonds have soared, and when added to the interest payments on the debt, the total return on Venezuelan government bonds is flirting with 50% this year—47% through Tuesday, according to Barclays data. Bloomberg succinctly sums up why: “In his 14 years in office, Chávez has seized more than 1,000 companies and imposed currency and price controls as part of what he says is a push to turn South America’s biggest oil producer into a socialist country.”

Chávez’s mismanagement of the country has also meant that even with relatively high oil prices—oil is the most important source of revenue for the country—Venezuela’s debt load seems only to be worsening. The debt-to-GDP ratio jumped sharply last year to an estimated 35%, up from 20% in 2010, according to the CIA World Factbook. That’s why, as unseemly as it seems, the markets are cheering the potential departure of Chavez, one way or another.

4. More than a meal

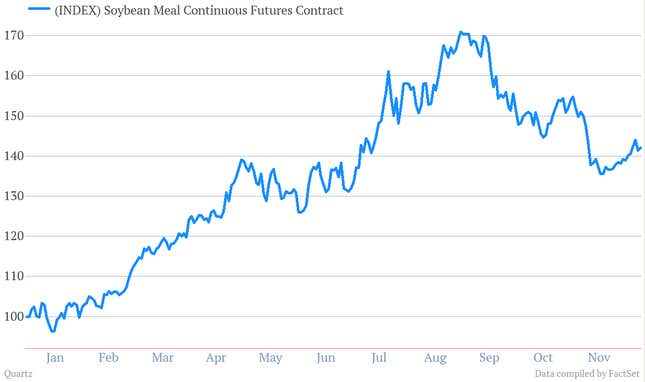

As an animal feed additive, soybean meal might not be the sexiest investment you might have made this year. But with futures prices up around 43% through Wednesday, the returns on this bet weren’t too shabby. The surge in soybean meal prices reflects both the rise in demand from animal processors in Asia as well as the nasty US drought farmers faced this year in the Midwest. Earlier this year, prices were up as high as 70%.

5. Year of the PIIG

Much smaller than Spain and Italy, and without the hard feelings associated with Greece (the Hellenic Republic has had a habit of mis-stating its national statistics) Portuguese debt has quietly rallied away during much of 2012. Portugal’s economy is still shrinking, but with the country at least making the effort to meet the targets set as part of bailout deals, Portuguese banks are finding it easier to fund themselves. According to Barclays data, the total return on Portuguese government debt is up more than 50% since the end of last year. For that matter, the rest of the so-called “PIIGS” countries—the worrisome nations of Portugal, Ireland, Italy, Greece, and Spain—have done pretty well in 2012. Irish government debt returned 26% year-to-date. Greece is the outlier, up more than 74%. Italy is up 18%. Spain looks to be the laggard, returning a mere 4% to investors.