The euro crisis has hit Spain hard. The country saw the construction of 675,00 homes per year from 1997 to 2006—more than France, Germany, and the UK combined, which together have over four times Spain’s population. The resultant housing bubble is shaping up to be far worse than the one that popped in the US in 2006. At the market’s worst in March 2012, US home prices had fallen 35% from their 2006 peak. Spanish homes are worth 27% less than they were back in 2007, but Spain’s recession just began this year, and a protracted euro-area recession looks like it’s just beginning.

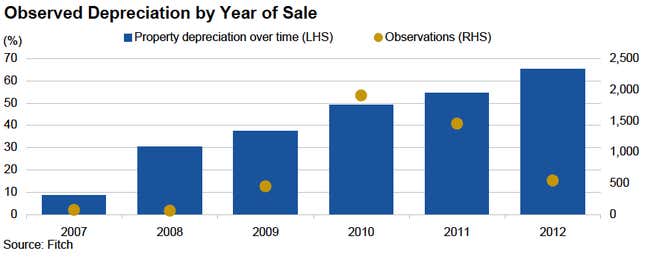

Some 10.7% of Spanish banks’ loans are now “non-performing.” New capital rules and forced deleveraging have pushed Spanish banks to get as many bad loans as they can off their books. But they’re only succeeding at selling distressed homes if they can do so cheaply. In a survey of 4,488 homes, Fitch Ratings found that homes were, on average, selling for 50% of the price initially paid for them, and considerably worse for properties bought in the boom years of 2005-2007.

Fitch analysts Carlos Masip and Juan David García suggest that the fire-sale is just beginning:

There are currently approximately one million newly built homes for sale, in addition to over 200,000 repossessed properties; furthermore, there are an unknown number of exchanges of debt for property agreements in place, as used by financial institutions. It will take many years to absorb the stock of properties, even if sales volumes return to 2003/4 levels of 250,000/300,000 units a year.