A little over a week ago, the Chinese government finally put a number to its aim of slower, more sustainable growth. It set its 2015 goal for GDP growth at “around 7%,” down from “around 7.5%” in 2014. That’s the biggest drop in China’s government-set GDP target so far this century.

But even that goal might be too optimistic, said Premier Li Keqiang yesterday.

“It is true we have adjusted down somewhat our GDP target, but it will by no means be easy for us to reach this target.” Li told reporters (paywall) at the conclusion of this year’s big government meetings yesterday.

Li was admitting what that data have already made obvious: China’s slowing way faster than expected.

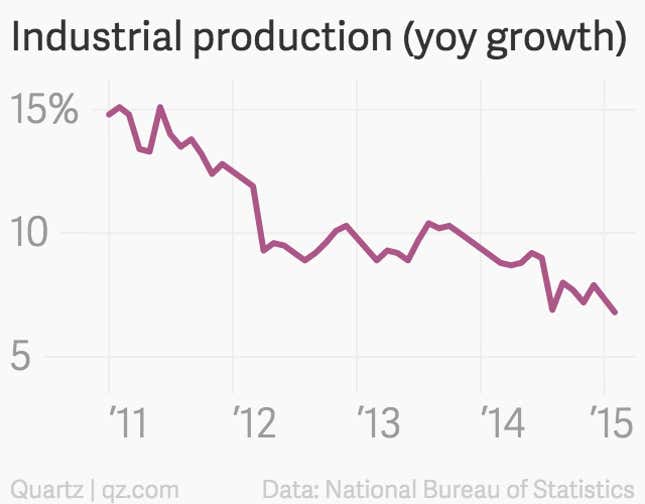

Industrial production slowed to a rate not seen since 2008, at the beginning of the global financial crisis.

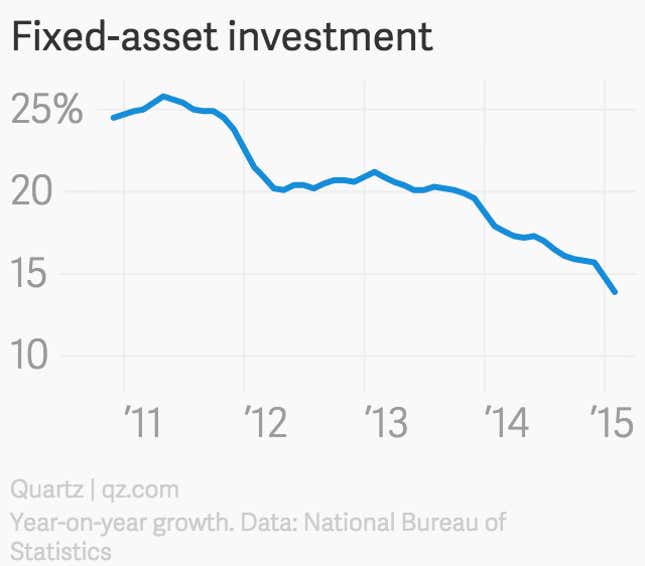

At 13.9% in January/February, investment in fixed assets hasn’t expanded this slowly since 2001. While property investment grew a promising 10.4% in January/February, Société Générale economist Wei Yao says she’s keeping bearish on the sector, noting that recent housing sales “were simply miserable.”

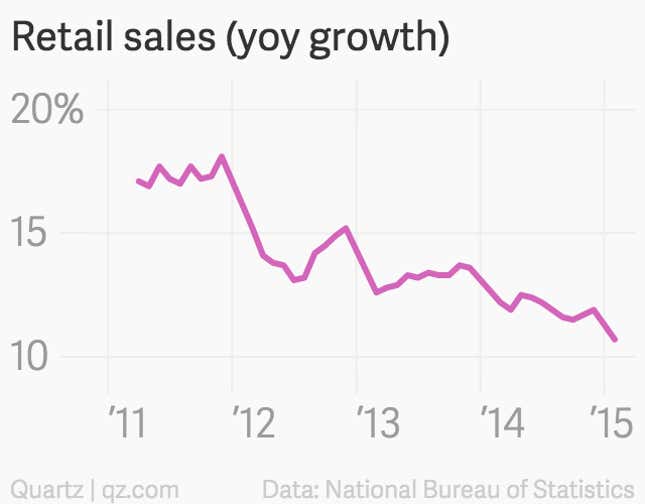

Along those lines, Chinese consumer demand—the force that’s supposed to buoy the economy as it moves away from investment-driven growth—remains concerning.

Sober Look has a thorough rundown of gory charts. Among them is this one by Bloomberg’s Mike McDonough, showing what Premier Li said: that China’s economy’s growing nowhere near 7%.

It should be noted that the country released ”generally dire economic data” in the first two months of 2012, 2013 and 2014, Andrew Batson, economist at GaveKal, points out. But this year’s slump has persisted even after China’s central bank’s recent flurry of moves to free up cash.

So why didn’t more cash in the system stoke investment and overall confidence in the economy? Companies are in worse financial straits and less confident in an economic rebound, says Batson. “The problem with China’s ‘new normal’ is that no one knows what is normal anymore,” he writes,”and uncertainty and financial stress end up having a real impact on activity.”