Robert Shiller on crypto-politics, Piketty, and why efficient market theory is a “half-truth”

The first two editions of Irrational Exuberance, Robert Shiller’s best-selling study of financial markets, both presciently called the top on asset bubbles of historic proportions.

The first two editions of Irrational Exuberance, Robert Shiller’s best-selling study of financial markets, both presciently called the top on asset bubbles of historic proportions.

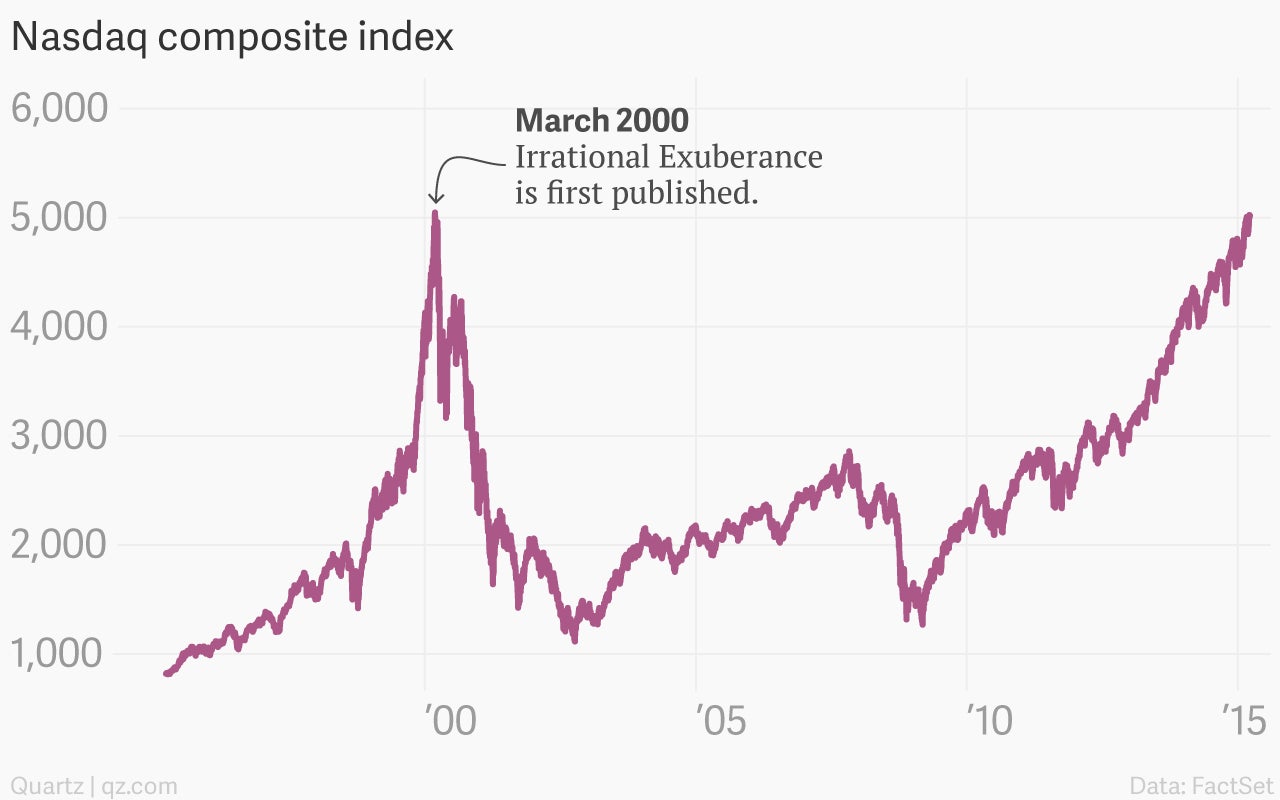

The first edition, published in March 2000, warned of the risk of a collapse of the US stock market just as a market rollover—which eventually became the dot-com bust—was beginning.

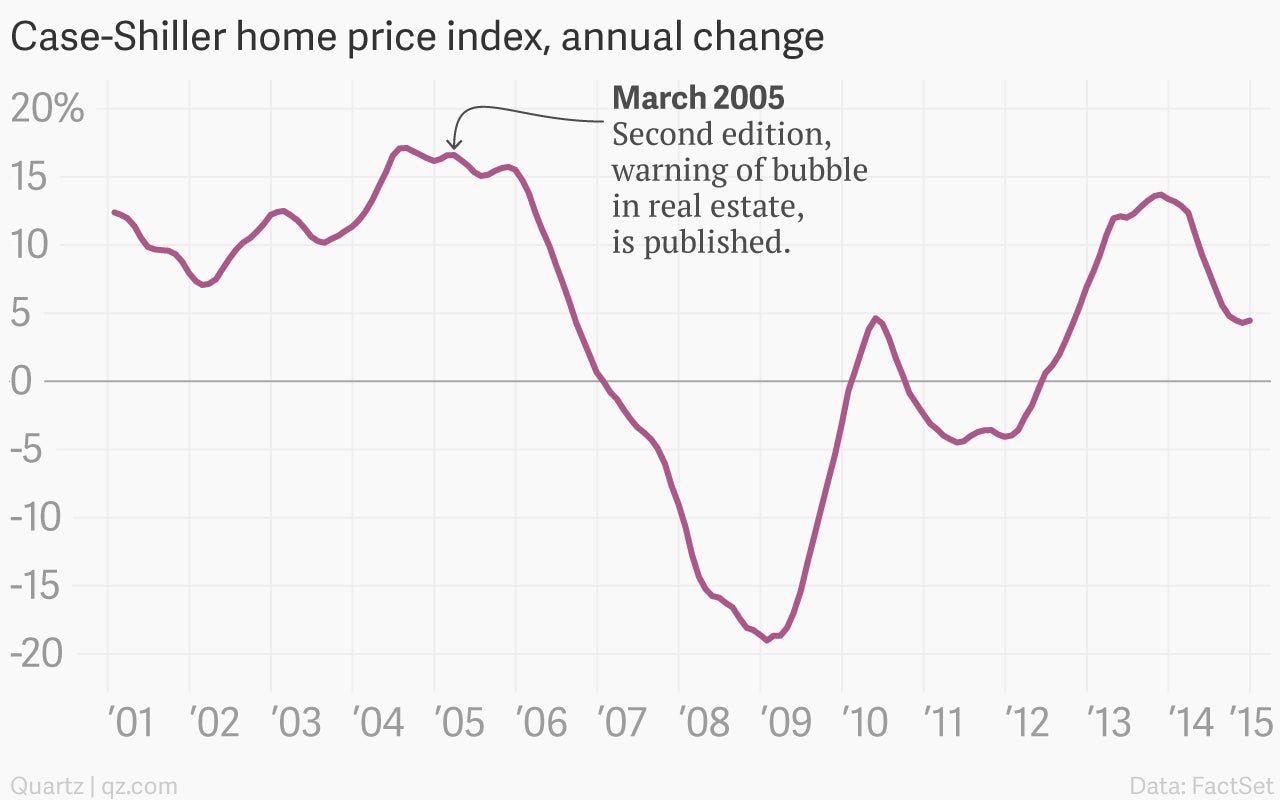

The 2005 edition warned about overheating in the US housing market, which began to turn south soon after.

The third edition came out last month. But it contains no prophecies of doom this time, and Shiller—affable and boyish at 68 years old—makes no claims to special predictive powers. In a visit to Quartz’s New York offices, the Yale University economist and recipient of the 2013 Nobel prize—which he won for his work challenging the “efficient markets hypothesis,” the theory that investors always act rationally—underscored that his success stems from a combination of luck and detailed attention to decades’-worth of often overlooked data. Here’s our chat, edited for clarity and concision.

On making predictions

Quartz: Most people probably know you—to the extent most people know any economist—as the person who correctly called a few bubbles at the top. So as punishment for those two correct calls, you are forever asked to call the next one. Does that make your life a living hell, basically? How do you handle these kinds of questions?

Shiller: First of all I think I was lucky. Secondly, I take it as some confirmation of thinking independently. There’s a conventional wisdom that goes around. That was a term that John Kenneth Galbraith coined. I think it’s a very good term [that means] that this is a “safe story.” “Safe” because everyone else seems to be saying it. And so you jump onto the same bandwagon. So, I thought I would write a book that just said it the way I thought it. It was lucky. I think it’s very hard to predict these turning points. I’m not predicting a turning point at this point—or a sharp turning point. The current edition doesn’t have that.

I think you’ve used the term “social epidemic” to describe bubbles in financial assets, which may explain why people always ask you to tell them where the next one is. Deep down, do people just want someone who can tell the future? Someone who can tell them where things are going?

People do want that. I wish I could provide that. The problem is we’re talking about big, rare historic events that only come along at long intervals. And there’s always somebody who forecasts them. You know, World War II was forecast. There was, I think, a 1934 book by Johannes Steel entitled World War II [the actual title was The Second World War—eds] and he predicted it. Actually I read the book—obviously not in 1934. And it was pretty good. He was right. I think after the fact people look at the reasons given and they get some sense if [the prediction] was completely fortuitous.

On his education and upbringing

Switching gears a bit to economic theory, you started out almost as an efficient markets guy, right?

Yes. I wrote a dissertation called Rational Expectations and the Term Structure of Interest Rates. That presented a rational expectations model, which was the fashion at the time. And then I didn’t really believe my own work. And I finally corrected myself… You know when you’re writing a doctoral dissertation you have to get it done. You have to get a job. I didn’t have as much time to reflect. I don’t think it was worthless. I think it was a useful exercise. But I don’t believe the model I presented there.

I’ve been following you for a long time. And I don’t know much about you. Like, what’s your hometown?

By the way, there’s a whole autobiography on the Nobel web site. It’s one of our chores to write that. I’m from Detroit.

How did your parents make their living? What kind of background would you say you came from, was it middle class? Upper-middle class? Lower class?

My grandparents were Lithuanian immigrants. So now after the Nobel prize I’m suddenly Lithuanian again. I had sort of forgotten about that. My grandparents all came between 1904 and 1911.

And why’d they settle in Detroit?

Oh, because of Henry Ford offering five dollars a day. In 1915, it was a big thing. That’s the reason.

So they were auto workers?

Yeah.

And your father, is that what he did?

He became an engineer. He went to college. And he got a patent on industrial ovens.

Industrial ovens?

To bake enamel on car bodies. I got sort of an entrepreneurial spirit from him.

And your mother, did she work?

She was a stay-at-home mother. She was a great mother. We had an intellectual atmosphere in the house. We talked about books.

Did you think your upbringing influenced your economic thinking very much?

I didn’t necessarily believe what my parents told me. But I did get some sort of skepticism from them about conventional thinking.

On the importance of data

One things of the things we’re really interested in here is data and the interconnection of data and how data can form feedback loops. You talk a lot about feedback loops. How unpredictable is data in its interactions with the world? And should we be humble about data?

One thing that really affected my life was in the 1980s my colleague Karl Case found that we could get a Univac tape with millions of [records] on sales of houses.

Univac tape?

Like a reel-to-reel kind of thing?

You don’t even know about that.

I think I saw one in an old Superman movie.

It had data on sales, sales with dates and information on building permits. We had real information that we could process by computer that was a new thing at the time. A lot of big things were happening. You know my co-Nobel prize winner Eugene Fama, he emerged at the University of Chicago as a graduate student right after the Ford Foundation gave them a grant to collect data on stock transactions. The CRSP tape. The Center for Research in Securities Pricing. So he had a new data set too that he exploited a lot. That’s when the efficient markets theory first reached prominence. He coined the term, I believe. And he had millions of observations to back it up, which impressed a lot of people.

On the politicization of economic theory

That brings me to your Nobel prize, which you won in 2013, the same year as Eugene Fama, of University of Chicago fame, won. To me this was a little bit like Luke Skywalker and Darth Vader were both given a medal at the end of Star Wars. I mean, both of you can’t be right. You’re talking about how irrational markets can be. He’s talking about inherently rational they are.

I think it’s mostly a matter of rhetoric. It also reflects a right-wing or libertarian philosophy. They like to say the government is stupid and the public is smart.

Or the market is smart.

Or the market is smart, right.

There’s so much economics that just comes off as crypto-politics to me. And I’m wondering if that’s just the nature of it. It’s a social science. It’s not a hard science. Do your politics inform your economics, do you think? Is it possible to separate them?

Well I’m human. But I don’t consider myself particularly political.

What is your politics? Can I ask? Are you a Democrat? Republican?

Well, I’m registered as a Democrat. But I don’t know if that means I’m a rank-and-file Democrat. You know, I write books about expanding free markets. I consider Eugene Fama’s efficient markets theory an important idea. A half-truth, I call it. It has important elements of truth to it.

In the book you say, “Whether or not we ultimately agree with it, we must at least take the efficient market theory seriously.” That’s so hard for me to do. It just seems like the world’s most successful bit of circular reasoning.

It’s true in some obvious senses. That if you want to get rich quickly, by trading the market you will find it difficult. There’s a lot of other people playing that game.

On inequality

Speaking of other economists, what did you think of [Thomas] Piketty’s work?

More generally, his work with Emmanuel Saez was an important chronicle of what was happening with inequality. And they made an important discovery that has changed people’s thinking ever since. And that is, much of the [rise in] inequality that has taken place is in the top 1% or the top one-tenth of the top 1%. Which was just not researched before them. And they went and did it. So to me it’s a testimonial to the importance of unglamorous—from an economic theory standpoint—data work, which they did.

And then in Piketty’s book, Capital in the Twenty-First Century, it’s a very nice thought piece on inequality, where it’s been going for the last 100 years and whatever has been done to combat it, and what effects it’s had on our society. It even goes into literary analysis. As for his particular theory on inequality, I understand it’s been criticized. I tend to emphasize that inequality might get worse in the future, but we don’t know. Whereas [Piketty] wants to give a confident forecast—or it sounds fairly confident to me—that it’s going to get worse based on things that I wouldn’t want to emphasize, namely capital accumulation.

What are you reading right now?

Well, I’m actually writing another book with George Akerlof, and that dictates a lot of what I read.

What’s it about?

The title of our book is Phishing for Fools. And then the subtitle is The Economics of Manipulation and Deception. It’s about the amount of deception in our society and about regulators and their importance.